J. Hugh Liedtke Professor of Marketing

When Self-Identity Sways the Deal

People who see themselves as independent are less likely to go for friends-and-family promotions.

Based on research by Vikas Mittal (Rice Business), Karen Page Winterich (Penn State), and Vanitha Swaminathan (Pittsburgh)

Key takeaways:

- Our responses to sales promotions are influenced by our self-identity — either as interdependent members of a community or individuals who want to stand out.

- While a consumer’s decision to take advantage of a sales promotion is mainly a function of whether they see it as a good deal, self-identity also comes into play.

- Friends-and-family promotions work well for people who see themselves as interdependent. But promotions that play up exclusivity are equally successful regardless of how customers identify themselves.

Maybe you have a friends-and-family plan on your phone. Or perhaps you like to take advantage of your birthday discount at Benihana.

Companies want to offer you a promotional deal you can’t resist. But discounts for special customers or friends and family don’t always work. That’s because our buying decisions depend not only on rational cost-benefit analysis, but on our concept of self.

Self-concepts can be interdependent — people who consider themselves deeply connected to a particular social network, such as family, co-workers, or friends. Or it can be independent — people who want to stand out as individuals by focusing on themselves.

Some promotions tempt interdependent people. Others appeal to independent consumers. When it comes to designing promotional deals, these nuances of identity can be the difference between a sale and disinterest.

We all have a bit of both identity types. But three studies involving hundreds of university students by Rice Business marketing professor Vikas Mittal suggest that, regardless of economic incentive, people whose self-concept is more independent are less likely to go for friends-and-family plans, regardless of the savings.

A related set of studies, meanwhile, show that the appeal of feeling special is universal. Mittal and co-researchers Karen Page Winterich at Penn State and Vanitha Swaminathan of the University of Pittsburgh found that promotions based on exclusivity tended to work equally well regardless of whether consumers saw themselves as part of an interdependent tribe or as lone wolves who need to stand out from the pack.

The lesson for consumers? Brands will do all they can to understand the social relationships of consumers they want to reach. So while it make sense for Verizon to have a friends and family plan, in all likelihood, it won’t work for Rolls Royce or Chanel, whose consumers want to stand out.

To be sure, it’s not enough to simply push a product: most people can do the math to determine whether a promotional price is worth it, or sniff out a shoddy product they don’t really want. But self-concept can alter our perceptions of whether or not a deal is good or bad overall.

How should companies evaluate these deals? Some managers argue that promotional rates provide discounts for customers who will flee as soon as the price goes back to normal. Mittal’s research suggests the opposite. When self-identity is part of the consumer’s decision to take advantage of a promotion, he writes, the transaction becomes an opportunity for company and customer to bond – and for the company to cultivate ongoing loyalty.

In the long run, the promotional funds spent on friends-and-family discounts or “you’re special” customer rewards pay off symbolically and monetarily: with warm, exclusive bonds between consumers and the brand that makes them feel understood.

Mittal, et al (2014). “Friends and Family: How In-Group Focused Promotions Can Increase Purchase,” Customer Needs and Solutions.

J. Hugh Liedtke Professor of Marketing

Never Miss A Story

You May Also Like

Keep Exploring

Protect Me

How detaining children hurts the American workers who guard them

By Claudia Kolker

How Detaining Children Hurts The American Workers Who Guard Them

This article originally appeared in the Houston Chronicle as "When we hurt migrants, we hurt Americans"

I was standing in a trailer in South Texas, anxiously sipping from a Styrofoam coffee cup, when the lawyer rushed in. “Can you help?” she said. “There’s a 9-year-old who will not stop crying.”

It was a relief to face a problem I might be able to fix. I had spent that whole week in mid-July in this temporary building, interpreting for detained asylum seekers who had just been reunited with their children.

I’d volunteered there precisely to stop feeling helpless. Under the zero-tolerance immigration policy launched in April, all people who crossed the border without documents — even asylum seekers — were now treated as criminals. When parents went to court, their children were taken from them and placed in shelters.

Five months later, the family separation policy has been suspended, but thousands of children who have crossed the border are still held for long periods in detention centers and tent cities across the country. Though my understanding of asylum law was limited, I knew I wanted to help those kids. Most of all, I wanted to see what was going on for myself.

What I saw at the border was far worse than I imagined, not only because of what these families experienced, but because of what had happened to the American workers guarding them.

I was hardly alone in wanting to help detained kids. The volunteers I worked with that week included Republicans, Democrats and independents; Baptists, Evangelicals, Catholics and Jews; mothers, nuns and young men. Laura, the corporate lawyer for whom I translated, had grabbed a flight from Kansas City. I drove from Houston.

The 60 or so women we met that week had been reunited with their children only days before. All were following the legal procedure to seek asylum, after crossing over from Guatemala, Honduras and El Salvador. For some, our job was preparing them for “credible fear” interviews, the first step in filing an asylum case. A negative outcome from one of these interviews can lead to deportation.

For others — women who had already failed this interview, women without legal counsel and distraught over their missing children — we helped document why they were afraid to go home, with the hope they would get another chance at a hearing.

My first surprise that week, however, was not what our clients were fleeing. It was the brutality in their everyday lives. Every woman I talked to, and every one that my colleagues interviewed, had endured some form of sexual or physical violence at home.

Domestic violence, though, is no longer cause for asylum in most cases. What potentially is: persecution by criminals or government, lack of protection from police, forced labor, oppression for race or political belief. For a woman whose whole village or neighborhood has been strangled by gangs and poverty, though, it can be hard to explain to Americans how these all entwine. In the first interview I did, a Honduran mother tried to explain why she knew police wouldn’t protect her from a violent stalker. It took her awhile to find an example that showed us: Her neighbor in their remote village was murdered along with her children in her house by a gang. The police never showed up to investigate.

It was stories like this that kept me returning to the break room to gulp caffeine. Other interpreters and lawyers were there for the same reason, silently swallowing coffee or chips. It helped to glance up at the wall, covered with crayoned pictures of mermaids and superheroes drawn by detained kids. They reminded me of the sketches with which I used to amuse my own daughters. So when the lawyer came in for help, I thought I know what to do.

But the girl would not stop crying.

Inside a cubicle, her mother sat quietly. This interview was her one chance for help: most detainees get no counsel and have no clue what U.S. asylum criteria might be. But the interview couldn’t start because her daughter leaned face down on the desk, shaking with sobs.

I obviously couldn’t carry out my original plan for distraction: a princess-y portrait of the girl herself. So I decided to sketch the person she loved most in the world, her mother. Sure enough, never once showing her face, the girl slowly began pointing which colors I should use. The lawyer started asking questions.

But when I looked up to draw in the mother’s long hair, she was hiding her face as well. Staring downward, cheeks drenched with tears, she never stopped whispering her answers to the lawyer’s questions.

What if the child resumed crying, now that I had nothing to draw? I started making things up. Around the mom’s half-finished portrait, I drew vines, bluebirds, green trees bursting with roses and grapes. Still facing downward, the girl joined in. “I love you Mami,” she wrote neatly in Spanish. Then, almost miraculously, she began to color. By the time Laura tapped to signal a new case, the girl was sitting up, drawing and smiling intently.

The next interview made my stomach churn all over again. All that week Laura and I had worked with a Salvadoran mother who had seen authorities in her town beat someone nearly to death. This time, she told us what she experienced herself. At the hands of Americans.

Shivering and exhausted after crossing the Rio Grande River, the woman and her small daughter encountered U.S. border agents almost immediately. The officials drove them to the Port Isabel detention center in Brownsville — and the hielera. The icebox. A routine, and controversial, part of the border control process, the hielera is an ice-cold cell with concrete floors where newly apprehended migrants are jammed often for days. Forbidden to huddle for warmth, with no protection except Mylar sheets, the women in the hielera begged border control agents for sweaters.

“They laughed,” the mother told us. “A group of them fanned themselves and said, ‘Whew, it’s hot in here! Let’s turn up the air conditioning.’”

From the hielera, officers transferred the woman to the perrera, the dog kennel. Here, in a cell crammed with dozens of other women, trays of disgusting food such as still-frozen bologna were kicked across the cell floor. She told us that once, after a day with no food at all, a guard opened the door at 3 a.m. and hurled in packs of crackers, as if to animals.

But the mother we were interviewing was too traumatized to eat at all. Within hours of arriving, officials had taken her daughter. “They took me out to go sign papers,” she told us. “They said she’d be there when I got back.” But when she returned to the perrera, her daughter was gone.

That was May 23. The girl would not see her mother until the third week of July, just days before I met them.

Migrating to the United States is a known risk. One in six Latin American women who make the journey are raped. This threat in mind, some mothers even give their girls birth control injections before starting out. But the Salvadoran woman and her daughter had been threatened with murder and had no choice. Other migrants have been driven by poverty so intense that 70 percent of their communities suffer from malnutrition. Most never heard - or imagined - that the United States might separate them from their children.

When the Salvadoran mother was finally reunited with her skinny, soft-spoken daughter, whose favorite recollection of home was going to school, the girl was altered. “Why did you sign me away?” were her first words to her mother. “Why did you give me to a shelter?” U.S. border officials had told her that her mother abandoned her. For two months she had no choice but to believe them.

At late-night dinners all that week, my co-workers described similar stories. One talked to a small boy who said he was told by guards to sign a paper he couldn’t read or have his fingers chopped off. Another interviewed an 8-year-old who watched guards kicking a teenager over and over in the ice box room. Child welfare workers and lawyers have documented thousands of similar reports.

“Why did they treat us like we were not human?” the Salvadoran mother asked. Some guards, she added, were Latino. “Why did they do this to their own people?”

When the interview ended, I ran into the lawyer who asked for help with the crying girl. “Thanks for the help,” the lawyer said tersely. Then she summarized what the girl’s mother had whispered to her. What both had survived, for years, in the house of a gang member before they fled.

“That’s not why the girl was crying,” the lawyer added. “She won’t talk about that even with her mother. She was crying because they were separated when they got here, and she didn’t see her mother again for 52 days. She has been crying nonstop since they were reunited.”

I had fixed precisely nothing, in other words. My absurd attempt at American mom magic merely showed how little I understood what was in front of me.

Leaving for South Texas five days earlier, I had wanted to support due process, and to act on the same empathy that millions of others have felt for children snared in the zero-tolerance policy. What I hadn’t grasped was how many regular Americans were no longer just executing that policy. They were purposely sharpening its cruelty.

It hit me that the faint nausea I’d felt that week had nothing to do with all the junk food I ate. I was unable to digest what I was learning.

I have lived in Texas for more than 20 years. I’ve spent lots of time in small communities where the local prison is the best employer. And like many Texans, I have friends from border towns who grew up alongside people who became officers for Immigration and Customs Enforcement and border control. My own family circle includes good men and women who have worked as corrections officers in places like the South Texas town where I was volunteering.

What had happened to so many of these working dads and moms, that they could see a girl freezing in a concrete room and laugh? How could these regular Americans tell a boy his fingers would be severed if he disobeyed? The zero-tolerance detention policy was designed with full knowledge of how it would damage children. But its most far-reaching effect may be the way it has distorted American men and women who enforce it.

Border control agents don’t differ much from millions of other hard-working Americans with blue-collar jobs, families to support and the luck to find secure work in places with limited options. Typically, they view themselves as good guys, defending Americans’ safety like firefighters or policemen.

Even in good times such jobs take a toll: ICE ranks near last of all government agencies in employee satisfaction, and corrections officers overall endure PTSD rates equal to those of war veterans. Now, though, the border agents’ adversaries are children. And the number in custody is soaring.

While unauthorized crossings overall dropped sharply in the past 20 years, the number of migrant children in U.S. custody has skyrocketed to the highest levels ever, from an average of 4,000 two years ago to more than 14,000 today. Extreme vetting rules mean far fewer of these children are being released to family and friends. And the government has now proposed new rules allowing detention of migrant children indefinitely, in facilities free of state supervision.

“These officers are under untenable pressure,” a researcher on corrections officers told me. Of the border agents who purposely torment migrant children, “there’s a lot of in-group pressure, possibly led by a few strong personalities,” she said. Like military and police culture, she said, immigration officers have a “culture of toughness and unity. If you’re not with them you’re against them.”

The repercussions for soldiers and other people who engage in such brutality, however, are often lifelong, crippling levels of guilt and shame.

But our southern border isn’t a war zone. It’s not Vietnam or post-9/11 Abu Ghraib. We’re not living through World War II, when Americans of Japanese descent were imprisoned on our own soil. More than a century has passed since slavery made tearing children from parents a business model. We’re at peace, in a boom economy, and many Americans are deep in the work of trying to comprehend those past crimes and their lingering effect on our culture.

Given the right circumstances, most humans have it in us to hurt those with less power. It’s surprisingly easy to induce a sense of disgust in a lab, and after that’s achieved, normal people will steal and cheat others. Wearing a uniform can hold particular power, making us do things we might not otherwise — sometimes even making us better at performing those actions.

Under normal conditions, though, we’re socialized to nurture, not torture. It was the familiar call to nurture that catapulted Laura, the Kansas lawyer, from her church pew to this dusty outpost in Texas. Haunted by reports from the border, she had mulled volunteering before deciding she was too busy. Then, one Sunday morning at church, she told me, the gospel was John 21:15-19, in which Jesus asked Simon Peter three times in quick succession: “Do you love me?” Three times he responds, “Yes, you know I love you.” To which Jesus replies: “Feed my lambs.” “Tend my sheep.” “Feed my sheep.” And finally: “Follow me.”

“I couldn’t ignore the message,” Laura said, and signed up to volunteer.

Months later I’m back at home, and whenever I dissolve into sleep I often see something familiar as well: a girl who looks a lot like my daughters, intently coloring a picture. Just as often, I see darkness and feel sick. I have the sensation that I’ve been in a place where something was wrong, something infectious. It was cruelty, spreading from person to person, among ordinary Americans not any different from me.

Claudia Kolker is the associate director of intellectual capital at Rice Business and author of “The Immigrant Advantage: What We Can Learn From Newcomers To America About Health, Happiness, and Hope."

Never Miss A Story

You May Also Like

Keep Exploring

Rice mourns trustee emeritus Robert McNair

Longtime Houston philanthropist and Rice trustee emeritus Robert McNair died Nov. 23. He was 81 years old. McNair was a prominent figure in business, sports and philanthropy. He was the founder, senior chair and chief executive officer of the Houston Texans and founded Cogen Technologies, one of the world’s largest energy cogeneration companies.

Longtime Houston philanthropist and Rice trustee emeritus Robert McNair died Nov. 23. He was 81 years old.

McNair was a prominent figure in business, sports and philanthropy. He was the founder, senior chair and chief executive officer of the Houston Texans and founded Cogen Technologies, one of the world’s largest energy cogeneration companies.

McNair was also generous to Rice.

In 2005 he and his wife Janice made a gift to Rice’s Jones Graduate School of Business; the school’s building, Robert and Janice McNair Hall, bears their names. The Robert and Janice McNair Foundation funds the McNair Scholars program, which each year awards one student a fully funded, two-year tuition package to Rice Business.

“Together they have been champions of philanthropy for over 50 years, giving generously to many deserving causes,” said Rice Business Dean Peter Rodriguez.

The McNairs also established one of Rice’s Baker Institute for Public Policy’s first endowments — the Janice and Robert McNair Chair in Public Policy, held by Baker Institute Director Edward Djerejian. They endowed the McNair Center for Entrepreneurship and Economic Growth in 2015, and Robert McNair was honored for his professional achievements and dedication to public service with the Baker Prize for Excellence in Leadership in 2009.

“It is difficult to overstate Bob McNair’s importance to the Baker Institute,” Djerejian said. “He was truly instrumental in shaping the institute into what it is today.”

Boiler Room

What you absolutely need to know about microcap stock scams.

Based on research by Brian Rountree, Karen Nelson and Richard Price

What You Absolutely Need To Know About Microcap Stock Scams

- “Pump and dump” scams lure potential investors to a stock with fake news. When the investor buys at an artificially inflated price, the scam artists then sell.

- The more effective scams bundle unrealistic stock projections with seemingly credible information, including a company press release.

- Though these scams constitute fraud, the chances of an SEC investigation decrease when the spams involve a press release.

It’s called “pump and dump,” and it’s fraud. Con artists lure potential investors by deluging them with fake online news to get them to buy a particular stock. When the marks start buying at what amounts to an artificially inflated price, the scam artists sell, leaving the dupes with micro-cap stocks or cryptocurrencies whose value has collapsed.

Earlier this decade, Rice Business professor Brian Rountree joined then-Rice Business professors Karen Nelson, now at Texas Christian University, and Richard Price, now at the University of Oklahoma, in probing this type of fraud and the investors who fall for it. While the schemes vary, the researchers found that they work best when the fake news is bundled with seemingly reputable information issued by the company itself. Wildly optimistic stock price projections seem much more plausible when accompanied by a company press release.

In several respects, such cons offer a natural setting to examine what gets the attention of unsophisticated investors. To better understand this dynamic, Rountree’s team analyzed 639 unique spam events from internet archives of spam messages between January 1999 and May 2006.

Sophisticated pump and dumps generally work on two levels. First, there is the internet equivalent of boiler room con artists, people who buy a micro-cap stock, spam fake news about its prospects, then reap the rewards.

To make any kind of return on their scam, though, these grifters have to actually buy the stock in massive quantities, exposing themselves to significant risk of investigation by the Securities and Exchange Commission. They’re further hindered by a lack of access to corporate information. Hence, these kinds of spammers will more often than not generate flattering material about a stock, but aren’t likely to include corporate press release information.

The second type of scammers have some kind of relationship with corporate management. They already hold or receive shares as compensation, allowing them to profit from a rise in liquidity even if the stock price does not rise much.

In this scenario, company executives may be participants in the scam. These schemes are similar to paid advertising, to raise awareness about a company’s stock. Nevertheless, the odds of the overly optimistic projections actually coming true are equivalent to the odds of picking winning lottery numbers.

But since these messages include full disclosure of a relationship with a company, and the analysis is accompanied by caveats indicating there is no guarantee of a return, the SEC has a difficult time prosecuting such cases.

Both types of con artist usually favor attention-grabbing micro-cap stocks (those in the news and with high past returns) with relatively low transaction costs. But, the researchers found, when potential investors got spam messages conveying vague puffery attached to nothing that might be considered factual, they were less likely to buy. The lack of anything official-looking inspired at least a minimum level of discernment.

Investors were far more vulnerable to the second type of scam. When spam messages also contained actual press release information, buying increased significantly — even if the press release information was old. The presence of a press release gave the spam message an official tone that induced more people to at least consider the message, which in turn translated to more investors actually buying the stock.

Since pump and dump scams are fraud, they are a crime to be investigated by the SEC. But the researchers discovered a troubling corollary to their findings: The SEC is less likely to investigate schemes that involve press release information and the inclusion of a disclaimer, which are exactly the schemes most likely to attract investor attention.

So buyer beware. The more professional-looking the offer of free money, the more professional the scam itself.

Brian Rountree is an associate professor of accounting at Jones Graduate School of Business at Rice University.

To learn more, please see: Nelson, K. K., Price, R. A. & Rountree, B. R. (2013). Are individual investors influenced by the optimism and credibility of stock spam recommendations? Journal of Business Finance & Accounting, 40(9-10), 1155–1183.

Never Miss A Story

You May Also Like

Keep Exploring

Every Company Runs on Competing Stories

Organizations sustain multiple, clashing narratives at once. Leaders who track the unofficial versions, instead of suppressing them, can spot risk earlier and find clearer paths to real change.

Based on research by Scott Sonenshein (Rice Business), Eero Vaara (Aalto University School of Business), and David Boje (New Mexico State)

Key takeaways:

- Companies, like people, give themselves narratives that provide them with meaning.

- Every company exists within a web of narratives, which are often contradictory.

- Narratives provide both individuals and companies what they need to compete, to accept failure and to grow.

A string of workers gets hurt on the job at a major energy firm. Though the company insists it’s dedicated to improving safety, many employees believe that it’s all talk and no action. Meanwhile, management is convinced that morale has never been better. It’s a tug-of-reality, and such simultaneous, contradictory narratives could apply to any number of big firms around the world.

The urge to tell stories that justify our attitudes and behavior is part of what it means to be human. Big companies are agglomerations of humans, so they become a kind of universe of narratives. And like individuals, companies make sense of their behavior by using mere fragments of stories.

In a recent literature survey, Rice Business professor Scott Sonenshein and colleagues Eero Vaara of Aalto University School of Business and David Boje of New Mexico State University looked closely at the ways corporations tell and perpetuate their stories. Analyzing a series of company narratives as a literary critic might study a novel, Sonenshein’s team noted that different companies, like individuals, explain their behavior with distinct narratives. Often, these narratives bang up against each other.

Such contradictions can be a form of warfare, with high stakes attached. Imagine two companies at loggerheads, with one attempting a hostile takeover of the other. Naturally, the aggressor firm will spin a story about why the takeover will be good for the market, the firm and probably society at large. The target firm will likely cry foul, protesting that the move saps the economic and even cultural well-being of its workers, stakeholders and consumers in general.

This plurality of narratives can also exist within the universe of a single firm. In fact, an individual employee may authentically believe different storylines about the same workplace, depending on whom he or she is talking to. The nature of office politics guarantees different storylines for different audiences. These narratives can often be complex and ambiguous.

In one experiment cited by Sonenshein and his colleagues, managers were told to write a note to themselves about the usefulness of a company product. They were then told to write an email to a superior about the same product. The result: Managers typically used moral language when writing about the product to themselves, and economic language when writing about the product to their superior.

Similarly, entrepreneurs often use an array of narratives to explain their success or failure. Sonenshein groups these narratives into general types familiar from myths and literature. In each type, the story hinges on something different. There’s “catharsis,” where the story hinges on one person’s responsibility or revelation; in “hubris,” it’s venture-wide responsibility; “zeitgeist,” industry-wide responsibility; “betrayal,” one responsible agent inside the venture; “nemesis,” a responsible external agent; “mechanistic,” an uncontrollable non-human element within the venture; and, simply, “fate.”

These stories, Sonenshein notes, are more than just excuses. They’re mechanisms that help entrepreneurs cope with events.

At the same time, when there’s a crisis, some groups within an institution form narratives that blame others for corporate shortcomings. Organizational change unfolds with multiple narratives offered by different parties, each with their own agenda.

For companies and individuals alike, narratives can provide a way to deal with setbacks and trauma. That’s because stories allow us to understand our identities even as they shift. In today’s fluid employment environment, the stories we tell ourselves can mean the difference between moving forward and giving up altogether.

There is still much that remains to be understood about how storytelling shapes organizational narratives. While corporate origin stories can influence the lives of individual workers, an individual’s story can also powerfully impact an organization. The narrative of Steve Jobs, for example, shaped the vision of Apple as a company.

Similarly, companies need to better understand the voices that resist an accepted storyline. A 2013 Twitter Q&A by J.P. Morgan turned into a public relations meltdown when a discussion on the firm’s career opportunities launched a backlash of more than 18,000 comments from Twitter users still angry about the 2008 recession. One writer demanded, “Does the sleaze wash off with a regular shower, or do you have to use something special like babies tears? #AskJPM.”

These counter narratives can be irksome. But listening to them can form the basis for essential change.

Counter narratives also abound within firms. At Microsoft, for example, more than 100 employees recently protested the company’s work with U.S. Immigration and Customs Enforcement (ICE), arguing that the agency’s policy of incarcerating child immigrants was immoral.

Between the current political polarization, and the many ways dissident voices can be heard via social media, companies will find it harder than ever to silence unofficial narratives. Sonenshein offers an alternative: Rather than stamping them out, follow these alternative storylines carefully, and embrace them as possible roadmaps to success.

Sonenshein, et al (2017). “Narratives as Sources of Stability and Change in Organizations,” Academy of Management Annals.

Henry Gardiner Symonds Professor of Management – Organizational Behavior

Never Miss A Story

You May Also Like

Keep Exploring

Quiet Riot

How can introverts make noise without raising their voices?

By Tracy L. Barnett

How Can Introverts Make Noise Without Raising Their Voices?

The morning after the 2016 election, Sophia Dembling woke up feeling shocked, appalled and terrified at what lay ahead. “And I still am,” she confessed.

She’d been planning to attend Hillary Clinton’s inauguration, so as she stewed over the headlines, one jumped out at her. She decided to go to Washington, D.C., anyway — and join the Women’s March. But marching, and bunking with 11 strangers, was not an appealing prospect.

Dembling, author of “The Introvert's Way: Living a Quiet Life in a Noisy World,” is an introvert. She’d never ventured into political activism, but thought the stakes were so high that she needed to get involved. The decision has provided endless fodder for The Introvert’s Corner, her blog on Psychology Today.

This election cycle, a growing number of organizers are working to increase civic engagement among the long-overlooked one-third to one-half of the population who identify as introverted. In part, this shift is due to an explosion in technologies that provide less intrusive ways to participate. In part it’s due to rising awareness of the needs of this quiet, but sizeable, minority.

For many, the epiphany was unleashed with Susan Cain’s 2012 book “Quiet: The Power of Introverts in a World That Can’t Stop Talking.” Cain’s book argues that Western civilization has exalted an extroverted ideal, undervaluing and underutilizing the skills of introverts.

“The thing about extroverts is that they are loud and proud, so we are more likely to hear what they are doing than we are to hear about introverts' contributions,” said Dembling. “So it can be easy to imagine that only extroverts need apply. But this is not the case. All of our skills and contributions matter.”

While extroverts are energized by social stimulation and contact, introverts find it draining. That means they’re often alienated by traditional types of activism: door-knocking, cold-calling, marching with bullhorns and the like.

“Introverts are by no means apolitical, they just find the world a little more difficult to navigate,” said Rice University political science professor Robert Stein. A University of Nebraska study found that even the act of voting in a traditional voting booth raises cortisone levels — a physiological indicator of stress. The study showed that people who voted at home had significantly lower cortisone levels. Those findings underscore the need to make absentee ballots universally available, Stein said — and they apply to political participation as well.

“If you’re an introvert and you don’t want to go out and march in the streets, or go to a political rally, it doesn’t mean you lack efficacy. You can still vote, you can still express your opinion in Facebook posts, on blogs, in newspaper articles; you can make campaign contributions,” he said.

Kerryn Rodriguez, a Cleveland, Texas, schoolteacher, tried to do traditional activism but found the stress levels impossible to navigate. First it was calls to a phone bank; then it was door-to-door canvassing. “Just the idea of going up to someone’s door had my heart racing a little bit, and my palms sweating,” she says.

Fortunately for people like Rodriguez, introverts and their needs are now on organizers’ radar, and there are more ways than ever for them to get involved.

“There are there are platforms that allow you to do text canvassing, and there are programs that allow you to do call scripts,” said Brandon Naylor of Democracy Works, a nonpartisan group promoting its “TurboVote Challenge” to reach the lofty goal of 80 percent voter turnout by 2024. “There are a bunch of different ways these days that introverts can be involved.”

Texting as a tool for voter outreach is just one way to mobilize a growing army of introverted volunteers. Texting came of age during the 2016 presidential campaign and has gained ground with the 2018 midterms.

To Gerrit Lansing, it’s just a sign of the times. “In general, I think politics is moving from a service-based industry to a technology-based industry,” said Lansing, a former chief digital officer for the Republican National Committee and the White House, and co-founder of Opn Sesame, a texting app used by Republican campaigns. “While I’ll be honest, I don’t think we built these tools with introverts in mind, the fact that it’s a positive outcome is great. You can bring more people into participating in managing the republic, and having a good election.”

Resistance Labs, a texting platform used more by Democrats, employs a third-party app called Hustle so that volunteers can text from their own phones without revealing their phone numbers.

“For someone who’s introverted, it’s wonderful,” says Jacinth Sohi, the platform’s operations manager. “When someone replies, you have that layer of the phone. People who are more analytical want time to process and think through a more thoughtful response.”

But texting works on many levels, and not just for introverts, says Sohil, who identifies not as an introvert, but as a millennial.

“It’s generational, too. I think that younger folks, we’re not used to calling on the phone. I seem very much like an extrovert, but I’ll avoid cold-calling somebody at all possible costs,” she says. Text messaging also gives the messenger the advantage of time. “People who are more analytical want time to process and think through what their answer will be, and you don’t have that luxury with a live phone call.”

But there are much older technologies that are mobilizing introverted activists, as well. One is postcarding; another is sewing.

Tony McMullin was phone-banking as a volunteer for a congressional campaign in Georgia when he started seeing Facebook posts from friends in other parts of the country who were frustrated at not being able to help out with the campaign. He hit on the idea to share his list and his talking points with his friends and ask them to send postcards to the voters. Eighteen months and 3 million addresses later, his Postcards to Voters project has engaged more than 40,000 volunteers in campaigns all across the country.

“It’s not a new thing; in fact, it’s a very old approach, but it’s sort of lost its place with all the technology,” said McMullin. “This is activism for introverts. They really can’t bring themselves to get on the phone and talk to strangers — they cannot go door to door, they just feel horrible doing it.”

But postcarding, like texting, appeals to a wide range of people for a host of reasons, says McMullin. People with mobility issues, or foreign accents — and in some places, people of color — can find it difficult to go door-to-door. This gives them another option.

Another door has opened with the advent of craftivism, a concept popularized by, among others, British author Sarah Corbett, founder of the global Craftivist Collective.

As a professional activist, Corbett worked for nonprofits on issues ranging from maternal health to fair wages to climate change. She is passionate about the work, but found that it left her drained and exhausted, no matter how much she believed in the cause. She never understood why until she encountered Cain’s writing on introverts. “The more I read, the more I realized I wasn’t a freak — and that I had a different skillset that was just as valid.”

Corbett’s breakthrough led to a shift in her career that has resonated internationally as she began tailoring her work to introverts — and to extroverts who long for a kinder, quieter, more creative approach to activism that has proven to be highly effective.

Her campaigns began to take a different shape. She discovered sewing on a train trip, where she wanted to do something creative but couldn’t paint — and then hit upon an idea. She ended up creating a campaign in which activists created gift handkerchiefs with embroidered messages for business and political leaders, ultimately leading to pay increases for 50,000 people. Other campaigns generated embroidered “mini-banners” to be hung at eye level in public places, and other messages were worn on a heart on one’s sleeve.

A fashion industry intervention involved “shopdropping” — essentially the opposite of shoplifting. Makers would drop tiny, hand-lettered scrolls into, for example, the pockets of clothing sold by retailers who engage in unfair trade practices, hoping customers would find and contemplate their questions about the clothing’s origins. The campaign resulted in global media on the homepage of BBC News, a double-page spread in the Guardian and coverage in fashion magazines because of Corbett’s “gentle protest” approach to activism.

Her experiences in organizing such campaigns led to her book, “How to be a Craftivist: The Art of Gentle Protest,” released earlier this year in the U.S. The idea, Corbett said, is to “strategically thread love, humility and beauty through their activism instead of hate, ugliness or aggression.”

“Craftivism can be a useful tool to encourage people to participate in two ways. First, you can use the process of crafting to channel your anger or fear into action,” she said. “Secondly you can use the handmade object itself as a catalyst for conversation, connection and action in others. It might sound naive but it’s far from it. I’m proud to say our craftivism has helped change hearts, minds, policies and laws.”

Tracy L. Barnett is an independent writer based in Guadalajara.

Never Miss A Story

You May Also Like

Keep exploring

Paper Work

How can Mexico’s regulatory code strengthen its markets?

Based on research by Brian Rountree, Richard Price and Francisco J. Román.

How Can Mexico’s Regulatory Code Strengthen Its Markets?

- Because fair markets are central to a vibrant economy, in 1999 the Mexican government enacted regulations to bring more transparency to financial reporting.

- Despite the new regulations, companies remained largely inefficient.

- To revamp its capital markets, Mexico needs a slew of changes including commitment to enforcing financial regulations that protect minority shareholders.

Theoretically, at least, capital markets allow millions of investors to allocate resources in a way that maximizes competitiveness and efficiency. When these markets are fair, they play a central role in a vibrant economy and society. Transparent financial markets lure capital, allowing economies to pick up steam and grow more quickly. Without transparency, on the other hand, investors are more easily defrauded. Inequality spreads. A country’s economy can quickly decline.

In 1999, Mexico initiated a Code of Best Corporate Practices in order to ensure greater market efficiency and better corporate performance. The following year, roughly 28 percent of publicly traded firms complied with three-quarters or more of the criteria. By 2004, compliance jumped to 79 percent. One would think that this compliance with the new regulations would mean that corporate performance generally would increase.

But good intentions are one thing and reality another. After studying market behavior, Rice Business professor Brian Rountree, professor Richard Price at the University of Oklahoma and professor Francisco Roman at George Mason University found that compliance with the code had little, if any, effect on Mexican firms’ overall corporate performance. In fact, the regulations also showed little if any effect on overall earnings management or return on equity.

To reach these conclusions, the professors analyzed a sample that included all nonfinancial firms listed on the Mexican stock exchange as well as stock returns, financial statement data, and governance data over the period of 2000 to 2004. Governance data was collected from each company’s annual Code of ‘Best’ Corporate Practices questionnaire filed with Mexico’s regulator.

As a proxy for governance strength, the researchers devised a “governance score” based on the level of compliance with the code’s recommended provisions.

So what went wrong with the code? On paper, its mandates were exemplary. Company boards were supposed to include at least 25 percent independent directors, and firms were to limit their size to 20 directors and use audit committees led by independent directors. But while many provisions of this code are mandatory, there was little in the way of oversight by regulators. Company reports were simply not questioned.

The same held for investor protections. Firms from Mexico that were cross-listed in the United States often escaped enforcement of insider trading laws by the Securities and Exchange Commission. And as late as 2010, the Mexican judicial system’s commitment to minority shareholder protection was still untested, prompting significant questions about the perceived improvements in minority shareholder protection by stock market participants.

Regulations, in sum, are only as good as efforts to enforcement. And while insider trading laws have existed in Mexico since 1975, the first enforcement attempt didn’t occur until 2005. Even then, the action was spurred by the United States, without firm commitment from Mexican authorities.

And those companies that complied with the letter of the law still had to adopt costly measures to signal their investment worthiness to the market. These firms, the scholars found, had a higher propensity to pay dividends and give marginally greater dividend yields than did the lower-compliance firms that also paid dividends. In other words, to reduce agency concerns, the Mexican firms with higher governance scores resorted to the costly mechanism of paying dividends, because the market simply did not value compliance with the code.

The researchers theorize that the weak links they found between company performance and compliance could be related to the limited competition among Mexico’s public firms. Together, the concentrated ownership environment and weak legal system muffled the impact of the new regulatory code on Mexican capital markets. Market monitoring alone was just not enough to create fundamental economic changes.

The results suggest that Mexico’s efforts to boost transparency must be supplemented with stronger enforcement. It’s unclear, however, whether the conflict between insiders and minority outside shareholders can be overcome without major changes in the company ownership structures. While the groundbreaking 1999 code showed the will to improve market efficiency, the scholars warned, only enforcement and perhaps restructuring can pave the way.

Brian Rountree is an associate professor of accounting at the Jesse Jones Graduate School of Business at Rice University.

For further reading please see: Price, R., Román, F. J., & Rountree, B. (2011). The impact of governance reform on performance and transparency. Journal of Financial Economics 99(1), 76–96.

Never Miss A Story

You May Also Like

Keep Exploring

Tweetstorm

What’s at the heart of campaign word storms?

By Wagner Kamakura

What’s At The Heart Of Campaign Word Storms?

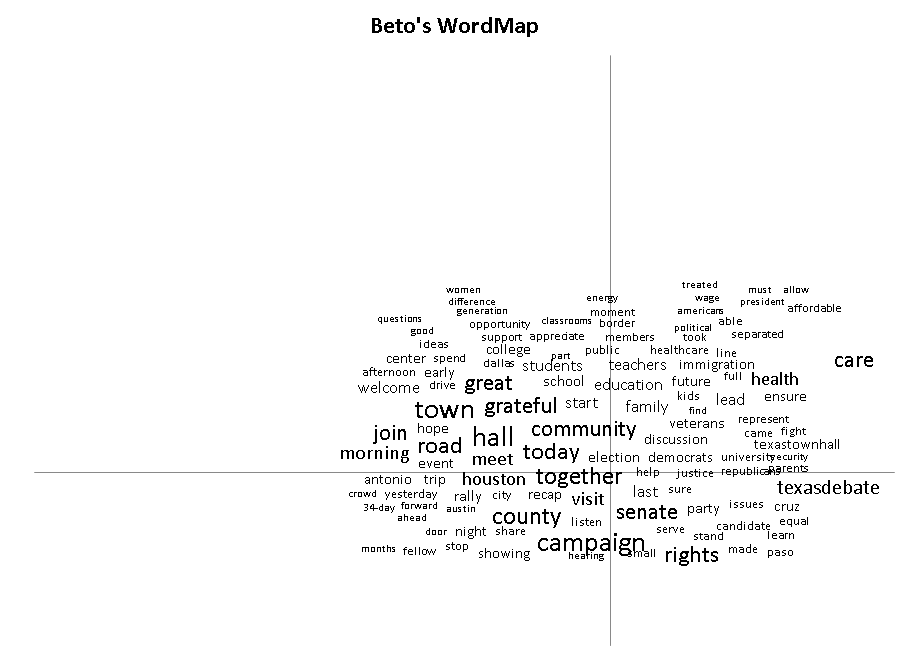

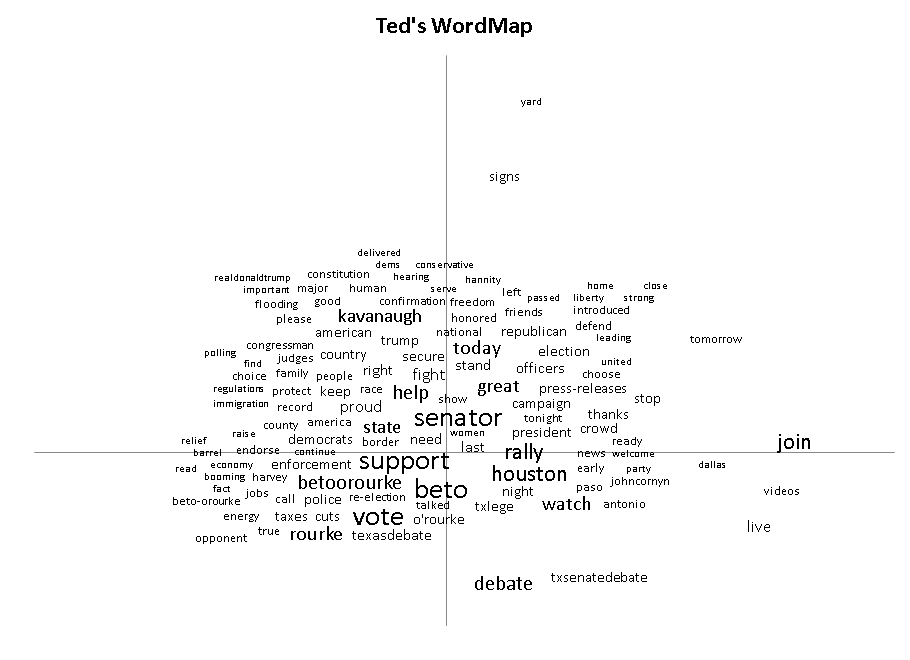

- Rice Business Professor Wagner Kamakura created a tool called WordMap, which he used to analyze tweets in the 2018 midterm elections.

- These images produced by WordMap are word clouds formed from the 500 longest tweets from U.S. Senate candidates Beto O’Rourke and Ted Cruz.

- WordMap can also be used to understand what consumers are saying about brands on social media.

Wagner Kamakura: The images above show word clouds formed from the 500 longest (more than 100 characters) tweets from competing U.S. Senate candidates Beto O’Rourke and Ted Cruz. I created the word clouds by some text-mining using my WordMap tool (you can view a YouTube tutorial video).

The tool produces a word cloud that reflects not only the frequency of the words used by the two candidates (as other word clouds do), but also how often they are used in the same tweet. In these images, frequency is represented by the font size, while affinity is represented by proximity of the words in the WordMap.

WordMap is one of the tools of KATE (Kamakura’s Analytic Tools for Excel), which I use in my Advanced Business Analytics course in the Rice Business EMBA program. WordMap can be used to understand what consumers are saying about your brand on social media, or to understand customer reviews. You can see a description of KATE here. I should note that WordMap tool is most useful for advanced users who are familiar with Excel add-ins. Its product, these candidate word clouds, like the candidates, speak for themselves.

Wagner Kamakura was the Jesse H. Jones Professor of Marketing at the Jones Graduate School of Business at Rice University.

Never Miss A Story

You May Also Like

Keep Exploring

Poll Vaulting

Innovators are finding new ways to encourage people to vote. Will it work?

By Tracy L. Barnett

Innovators Are Finding New Ways To Encourage People To Vote. Will It Work?

Austin event planner Natalie George has a talent for transformation. A pop-up clothing boutique she designed turned an abandoned strip mall into a hip showroom; a furniture store became a cozy dance venue for a cabaret series she concocted. Creating the buzzworthy is her business. Now, to her own surprise, she’s turned that talent toward getting out the vote.

“I never looked out and saw someone who looked like me — so I saw no reason to connect to politics,” George says. But as she watched the stakes rise on the political landscape, something shifted. When two of her friends, haunted by the family separation crisis on the border, approached George about doing a fundraiser, she said yes. Their idea evolved into The Show Up: a pop-up event that became an ongoing platform for energizing artistic types to vote.

George isn’t the only innovator urging more people to vote. From New York to San Diego, and from Memphis to Minnesota, activists are launching everything from flash mobs to food trucks to mobilize voters. Sites for get-out-the vote schemes range from beaches to music festivals, and in the case of a troupe of costumed superheroes, the annual San Diego Comic-Con.

Most famously, the formerly apolitical pop star Taylor Swift caused a furor — and a 370,000-person spike in voter registrations in 72 hours — with a single Instagram post urging her fans to register and vote.

But will these efforts make a difference? Earlier efforts to increase the vote have had only paltry success. Voter turnout in the U.S. trails that of most developed countries, even in presidential elections.

On the bright side, the turnout for early midterm voting this month has been astronomical: On the first day of early voting in Texas, turnout was up 325 percent in Dallas County and 213 percent in Harris County compared to 2014. Historically, however, turnout at midterms is up to 20 percent lower than in presidential years. The reasons are many, experts say: from the complexity of our country’s voting system to widespread disillusionment.

For one thing, the U.S. system is not really designed to facilitate participation, said Wagner Kamakura, a marketing professor at Rice Business. A two-round voting system such as the one used in his native Brazil, and on which he has done extensive research, can yield much higher voter participation, he noted.

“This two-round election system, the most common in the world for electing heads of state, is quite different from the crazy system we have in the U.S., where people are discouraged — or even blocked — from voting, and the actual winner is not the one with the most votes. I wouldn’t call it real ‘democracy,’” Kamakura said. “In Brazil, close to 73 percent of eligible voters cast their votes in the first round, which is a far cry from what we see in the U.S.”

Compare that to the 2012 and 2016 U.S. presidential elections, when voter participation was just a little over 61 percent. In the 2014 midterm election, voter turnout was a dismal 36.6 percent, the lowest since World War II.

Boosting those numbers has motivated a whole host of data geeks, designers, event planners, artists and others who have focused their creative energy on the challenge. Houston computer programmer Nile Dixon, for example, developed a chat bot to help people find the closest shelter during Hurricane Harvey; now he’s adapted it to help up to 20,000 Texas voters find their polling place.

Boston attorney and environmentalist Nathaniel Stinnett, wondering why the environment didn’t show up in more political discourse, discovered that environmentalists as a group have an extremely poor voting record. So he left his position to found the Environmental Voter Project, bringing on an army of interns to mobilize the environmental vote.

In St. Louis, picking up on the excitement generated in the African-American community by the blockbuster film “Black Panther,” activist Kayla Reed helped launch #WakandaTheVote. The project allowed people to set up voter registration events at local movie theaters or register to vote via text message. The success of that drive was followed with #WrinkleTheVote, aimed at parents, young adults, babysitters and teachers who took their children to see “A Wrinkle in Time.”

Sacramento journalist and poet Raquel Ruiz, meanwhile, was moved to tears and then to action by the immigration issue. Her arts group MAP California teamed up with Nagual Theater Inc. to produce “Letters from the Wall,” a work of street theater compiled from letters written by the families of immigrants who have lost loved ones. The idea is to raise awareness about immigration policy and motivate people to go to the polls. Ruiz, herself a Colombian immigrant, will be reading the letter of a mother who lost her son at the border while seeking asylum.

While much of the current activity is designed to increase voter turnout in this year’s election, there are also initiatives designed to improve turnout in the years to come.

Adam Eichen, co-author of the book Daring Democracy: Igniting Power, Meaning, and Connection for the America We Want, points to a number of ways to build voter turnout, beginning with how we register voters. “Our voter registration system is antiquated and deters voting,” Eichen said. “We’re in the 21st century; election officials don’t need multiple weeks to process a registration form. Voters, many of whom have busy lives, should be able to register to vote on Election Day.”

One reform that could bring on an estimated 50 million new potential voters in one fell swoop: automatic voter registration. Under this system, eligible citizens who interact with government agencies — for example, when they get their driver’s license – are automatically registered to vote unless they choose to decline. Since Oregon adopted this approach in 2016, its voter registration has quadrupled; 12 other states and the District of Columbia have followed suit.

Making Election Day a national holiday is another idea we could import from other countries. In the last midterms, some 35 percent of those who didn’t vote said scheduling conflicts with work or school kept them from the polls. Vote.org has launched ElectionDay.org to encourage companies to give their employees Election Day off, and more than 250 have signed on. One of those, New York-based Blue Point Brewery, has launched a Voters’ Day Off beer, complete with petition on the side of the can that consumers can sign and mail to the Senate, advocating a national holiday.

Allowing voters to participate through innovative “Democracy Voucher” public financing programs like the one in Seattle could foster engagement, as well, said Eichen. There every voter is given four $25 vouchers to donate to the candidate of their choice. “Beyond democratizing political financing, the program encourages residents to research candidates and decide whom they want to financially support,” he said. “This should lead to more of an affinity for the political process, while also expanding who has a voice. In Seattle, one candidate even reportedly collected donations from the homeless population.”

What impact all of this might have, of course, won’t be clear until after Nov. 6. But there are already indications that for this year, at least, the push to get people to the polls is working. A surge in voter turnout for the spring midterm primary was one indicator. And a poll from Tufts University showed high levels of young people, usually the least likely to vote, paying attention and planning to vote.

By the second day of Texas’ early midterm voting this month, the in-person vote and mail-in ballots in six counties had already exceeded the total early voting in 2016’s presidential election. Nearly 20 percent of those first day ballots were cast by non-primary voters, while between 5 and 9 percent appeared to be first-time voters. It may not yet be the crashing wave that get-out-the-vote innovators hope for. But it’s clearly a rising swell.

Tracy L. Barnett is an independent writer based in Guadalajara.

Never Miss A Story

You May Also Like

Keep Exploring

Hunger Games

How snacking and spending reflect beliefs about inequality.

Based on research by Vikas Mittal, Yinlong Zhang and Karen Page Winterich

How Snacking And Spending Reflect Beliefs About Inequality

- “Power distance belief” is the degree of power disparity that people expect and accept in their culture.

- Power distance belief and compulsive spending are inversely related.

- The less people accept that there is inequality in power, the more likely they are to buy vice products such as junk food.

Power imbalance in our society is a fact of life. Get over it.

If you disagree with this statement, you may also prefer Ben and Jerry’s ice cream over a handful of almonds after dinner. You may even be more likely to be an impulsive shopper.

Improbable as this may sound, a study by Rice Business professor Vikas Mittal and colleagues Yinlong Zhang of the University of Texas at San Antonio and Karen Page Winterich of Pennsylvania State University shows there is a link between our beliefs about social equality and our buying habits. In six different studies that included surveys and experiments with more than 15,000 urban households in in the U.S. and 14 different Asian and Asia-Pacific countries including China, New Zealand, Japan and India, Mittal and his colleagues examined the link between a country’s level of “power distance belief” and shopping habits.

Power distance belief is the extent to which an person sees social inequality as inevitable. It’s a subtle mindset, not predictable by factors such as political ideology, country GDP or nationality.

Instead, it’s revealed by “yes” answers to survey questions like these: “As citizens we should put high value on conformity.” “I would like to work with a manager who expects subordinates

to carry out decisions loyally and without raising questions.” “In work-related matters, managers have a right to expect obedience from their subordinates.” While power distance belief is an individual trait, past researchers have also measured its levels in various countries.

People who tend to accept power disparity, Mittal and his fellow researchers found, work harder to control their impulses during shopping. Those who don’t believe inequality is the rule tend to fill their carts with junk food.

To be sure, Mittal and his team write, there’s a big difference between impulsive buying and shopping that is simply unplanned. Impulsive buying tends to be haphazard, a behavior of consumers who just can’t seem to control themselves.

What’s the connection? In countries where people refuse to accept power imbalance as a norm, Mittal says, people speak out much more. Students from such cultures are encouraged to express their differences publicly and disagree with their teachers if necessary. In other words, they’re encouraged to exhibit less restraint. Over time, people in such countries tend to place a higher emphasis on immediate gratification as opposed to restraint, the researchers found.

But does it follow that choosing donuts over egg whites for breakfast reflects one’s beliefs about power? Mittal and his fellow researchers demonstrate that it does.

One study, involving 170 undergraduates from a large U.S. university, illustrated such choices in action. First, the students were screened to judge their beliefs about power imbalance. Next, each was given a task assessing their willingness to spend money on junk food.

Imagine you had $10 in cash, each student was told. Now, choose from a list of items that includes both “vice products” — a Snickers bar, potato chips and cola — and “virtue products” — a granola bar, an apple and orange juice. Students who rejected power disparity were more likely to crave the Snickers and Coke.

The ability to act with self-restraint, Mittal and his team theorize, is linked to how we understand inequality. Individuals who accept power imbalance as a fact of life are more conditioned to show self-control. In turn, this helps develop a kind of mental muscle memory to control different urges — including the urge to spend whimsically.

Critically, the researchers found, these choices have little to do with an individual’s innate character. Instead, acceptance of power disparities could actually be prompted in labs, where messages designed to prompt acceptance of power inequality actually led to less consumption of vice products.

From a business perspective, the research could be groundbreaking for firms in multicultural markets. Studying cultural beliefs about inequality could yield key advertising strategies, based on whether members of a particular market see their product as a virtue or a vice.

Mittal’s research also presents implications for more than selling ice cream and chips. Whether we reach for a Snickers bar or a handful of almonds, it’s worth examining how these traits correlate to our internal views of power. Do we live in an equitable society? Can it ever be made so? How would we eat, buy, and spend if the world looked like it could change?

Vikas Mittal is the J. Hugh Liedtke Professor of Marketing and Management at Jones Graduate School of Business at Rice University.

To learn more, please see: Zhang, Y., Winterich, K. P. & Mittal, V. (2010). Power distance belief and impulsive buying. Journal of Marketing Research, 47(5), 945-954.

Never Miss A Story