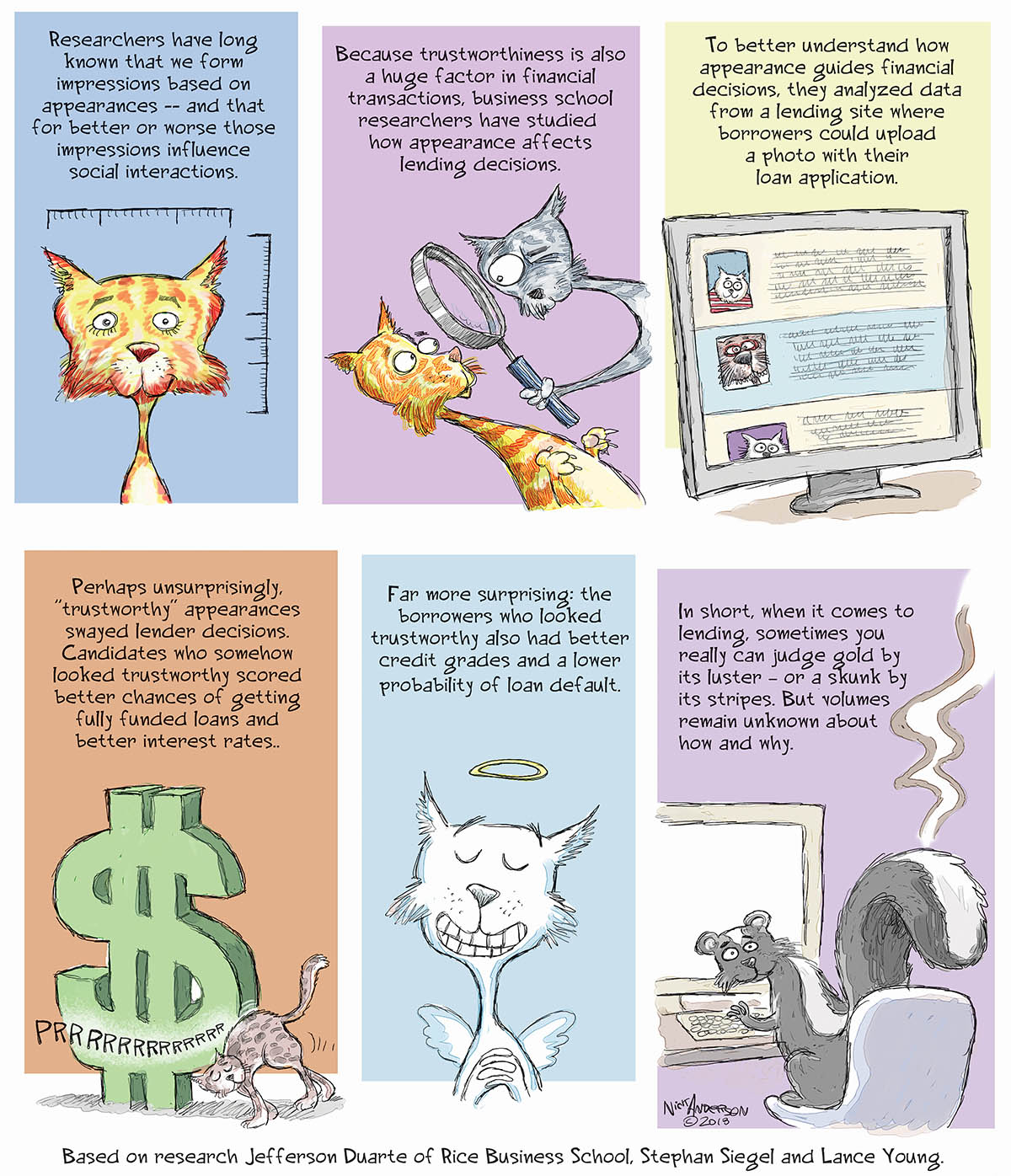

Lie Detector

Can a snapshot reveal your chances of a loan?

Illustrated by Nick Anderson. Based on research by Jefferson Duarte.

Can A Snapshot Reveal Your Chances Of A Loan?

To learn more, please see: Duarte, J., Siegel, S., & Young, L. (2012). Trust and credit: The role of appearance in peer-to-peer lending. Review of Financial Studies, 25, 2455-2484.

To learn more, please read: Trust Me On This

Jefferson Duarte is an associate professor of finance the Gerald D. Hines Professor of Real Estate Finance at the Jones Graduate School of Business at Rice University.

Nick Anderson is a Pultizer Prize-winning editorial cartoonist.

Never Miss A Story

You May Also Like

Keep Exploring

Extra Credit

Want reliable credit ratings? Improve reporting.

Based on research by Brian Akins

Want Reliable Credit Ratings? Improve Reporting.

- When Credit Rating Agencies have access to better financial reporting, there’s greater agreement among agencies and less credit risk uncertainty.

- After the 1997 implementation of Statement of Financial Accounting Standards, firms that were most affected by the standards had less credit risk uncertainty.

- While higher quality financial reporting lowers risk uncertainty for all credit reporting agencies, it’s especially important for agencies that rely heavily on publicly available reports.

Credit Rating Agencies (CRAs) help make the economy go ‘round. That’s why investors rely so heavily on CRAs such as Moody’s Investor Service (Moody’s) and Standard and Poor’s (S&P) to let them know how likely their “bet” is to pay them back in a timely fashion — or ever.

So imagine that you’re thinking of investing in a company with a strong credit rating from a top CRA. As you conduct your due diligence, you discover that yet another top CRA has assigned the very same firm a significantly lower credit rating, indicating that it’s more likely to default on its loans.

Not surprisingly, this disagreement between the CRAs introduces a greater uncertainty of risk, which could influence your investment decision. You might decide you need a higher yield, or request any number of other measures to protect yourself from the perceived risk.

Fortunately for would-be investors, Rice Business professor Brian Akins set out to find out what can be done to increase the harmony between CRA ratings. In particular, he wanted to know if improving the financial reporting that CRAs use would lower the risk uncertainty that ensues when they disagree.

To find out, Akins studied data from three major CRAs: Moody’s and S&P — both of which have access to not just public reports but also corporations’ private information — and Egan-Jones Rating Company (EJR), which relies mainly on public reports.

Akins began by trying to see if reporting quality affected disagreement between Moody’s and S&P, since they have access to similar data. As an indicator of reporting quality, Akins used a measure called “debt contracting value of accounting” (DCV), which shows how well a firm’s earnings information predicts a possible rating change. He calculated the DCV for 1,959 bonds representing 875 firms that were rated by both S&P and Moody’s between 1985 and 2008.

Next, Akins looked at the default risk that S&P and Moody’s assigned to each of these 1,959 bonds. He found that on average, the higher the DCV — that is, the higher the reporting quality — the more likely the agencies were to agree in their ratings. In other words, better reporting quality was indeed linked to less risk uncertainty.

But what about firms such as EJR, which doesn’t have the luxury of accessing a corporation’s privately available information?

Akins found that for EJR, better reporting quality was even more important. That’s because nearly all of the data the firm uses come from the “publicly available” bucket, so the better the quality of this data, the more aligned its ratings will be with other agencies.

Akins wanted to be sure that reporting quality, and nothing else, was indeed the key variable at play, so he analyzed the level of disagreement among credit ratings before and after a mandatory change was made to accounting standards in 1997. This change, Statement of Financial Accounting Standards (SFAS) 131, is recognized as having improved reporting quality.

What Akins found is that after SFAS 131 was put into effect, the firms most impacted by the standards had far less disagreement on their credit ratings than similar firms less affected by SFAS 131. Consistent with Akins’ earlier findings, better reporting quality meant more consistent ratings.

In short, when CRAs analyze firms that have higher quality reporting to determine their ratings, they’re more likely to agree on those ratings. This, in turn, means less risk uncertainty for investors, who can be more decisive. Because when it comes to investing money, no one likes surprises.

Brian Akins is an Assistant Professor of Accounting at Jones Graduate School of Business at Rice University.

To learn more, please see: Akins, B. (2018). Financial reporting quality and uncertainty about credit risk among the credit ratings agencies. The Accounting Review, 93(4), 1-22.

Never Miss A Story

You May Also Like

Keep Exploring

Marie Kondo, super-sorter, gets her own reality show

Her third and latest book, ‘Joy at Work: The Career-Changing Magic of Tidying Up’, written with Scott Sonenshein, a professor of management at Rice University School of Business, out this coming spring, was bought at a competitive auction for seven figures by Little, Brown, said her US agent, Neil Gudovitz.

Apple's poor sales in China spurs global instability

The falling iPhone sales amid an ongoing trade war between Beijing and Washington have sparked concerns about the cooling of China’s economy.

Rice U. expert available to comment on release of accused priests’ names

In recent months, dozens of Catholic bishops have decided to take action by releasing lists of the priests in their dioceses who were credibly accused of child abuse. Releasing the names is a small step in the right direction, in particular relating to healing relations with parishioners, according to a reputation management expert at Rice University’s Jones Graduate School of Business.

In recent months, dozens of Catholic bishops have decided to take action by releasing lists of the priests in their dioceses who were credibly accused of child abuse. Releasing the names is a small step in the right direction, in particular relating to healing relations with parishioners, according to a reputation management expert at Rice University’s Jones Graduate School of Business.

Anastasiya (Annie) Zavyalova, assistant professor of strategic management at Rice Business, is available to discuss Catholic dioceses’ crisis and reputation management with the media.

Zavyalova’s recent research includes an in-progress study of how parishioners reacted to the names of priests released by the Archdiocese of Philadelphia in 2005.

“Organizational consequences of scandals may be shaped by which units within the organization employed the transgressors, the geographic proximity of a focal unit to those associated units, and whether members engage with the organization through ceremonies or rituals,” said Zavyalova, whose general research focuses on negative events in organizations and the role of the media and organizational identification for stakeholder support following such incidents.

To schedule an interview with Zavyalova, contact Jeff Falk, associate director of national media relations at Rice, at jfalk@rice.edu or 713-348-6775.

Rice University has a VideoLink ReadyCam TV interview studio. ReadyCam is capable of transmitting broadcast-quality standard-definition and high-definition video directly to all news media organizations around the world 24/7.

Follow the Jones Graduate School of Business on Twitter @Rice_Biz.

Follow Rice News and Media Relations on Twitter @RiceUNews.

Related materials:

Zavyalova bio: http://business.rice.edu/person/anastasiya-zavyalova

Jones Graduate School of Business: http://business.rice.edu

Anger Management

Is it worthwhile to blow a gasket during a negotiation?

Based on research by Hajo Adam (former Rice Business professor) and Jeanne M. Brett

Is It Worthwhile To Blow A Gasket?

- Getting mad to get your way only works in limited contexts.

- In balanced situations, such as sales negotiations, acting out angrily can lead to big concessions.

- In more competitive or cooperative situations, however, showing anger can destroy the negotiation altogether.

You desperately want to make a deal. Will it help you to bellow like an angry elephant? Scientists used to think the answer was yes. Displaying anger, they believed, could gain concessions in making a deal. Recent research into negotiations, however, shows that angry outbursts are more likely to shut the deal-making process down — and even prompt retribution.

In a paper, former Rice Business professor Hajo Adam partnered with Jeanne M. Brett from the Kellogg School of Management to show that anger can provide a tactical advantage, but only in specific contexts.

According to past research, in negotiations — when a participant aims for any advantage over the opponent — displaying anger sometimes led to better outcomes. Adam’s new experiments demonstrate that, more often than not, the opposite is true. When a negotiation is highly charged and fiercely competitive, angry outbursts are more likely to spark so much hostility that the infuriated counterpart may actually seek revenge. In these cases, sharp words, rising voices and insults actually reduce the chances of getting to yes.

Adam’s findings align with research on the psychological idea of “competitive arousal.” In highly competitive situations, according to this concept, strategic considerations fade in the heat of strong negative emotional reactions, igniting the need to win at all costs. A study of mediated disputes on eBay, for instance, revealed that negotiators who got angry merely elicited anger from other bidders, reducing the odds of a settlement.

Anger also proved ineffective in cooperative negotiations, when participants negotiate amicably and try to build value together. Take, for example, a disagreement between partners starting a business. In a two-person, virtual teamwork environment, researchers found, subjects who blew their stacks increased interpersonal aggression and drove team performance downward. Subjects who maintained a steely composure were more likely to get a successful outcome.

To test when angry outbursts did and didn’t work, Adam and Brett looked at a mix of negotiating scenarios via computer-mediated experiments.

In one experiment, subjects had $12,000 to hire an IT company to update a website to the latest technical standards. But the best service provider’s bid was $15,000. Participants had to negotiate for a lower price with a counterpart who was either angry or emotionally neutral.

A third of the participants were told that the negotiation should be approached in a competitive spirit; another third were told that it should be approached in a cooperative spirit and the last third were not given any advice. The results offered initial evidence that expressing anger was less effective at scoring concessions in competitive and cooperative negotiations, compared to negotiations where the two factors were balanced.

In a second experiment, Adam and Brett asked 198 participants to negotiate a situation between a chef and an entrepreneur. Again, the negotiation was framed as either competitive, cooperative or balanced. In the competitive situation, the chef and entrepreneur were trying to settle a dispute; in the cooperative condition, they were trying to start a catering business together; in the balanced condition, the chef was attempting to sell the catering business to the entrepreneur.

Once again, getting angry elicited larger concessions in a balanced negotiation context, but backfired in cooperative and competitive contexts. Taken together, these studies suggest that fiery negotiation styles only work in limited circumstances.

But the flames of anger aren’t easy to modulate in the heat of the moment. Instead of assuming that angry outbursts are a viable tactic and then trying to identify the moments when they won’t work, Adam suggested, it probably makes more sense to assume anger isn’t a particularly effective negotiation tactic — and then identify the rare situations when it may work.

In part, this is because it can be so hard to judge how a negotiating partner views the interaction. A conversation that one negotiator may see as clearly cooperative, competitive, or balanced may be characterized entirely differently by the person on the other side of the table. As in the Indian parable of the blind men touching an elephant, everyone comes with their own emotional history, temperament and background, which all but guarantees they will each perceive a different animal. The only certainty, Adam said, is that it’s likely a mistake to poke it with a pointy stick.

Hajo Adam is a former assistant professor of management at Jones Graduate School of Business at Rice University.

To learn more, see Adam, Hajo and Brett, Jeanne M. (2016). Context matters: The social effects of anger in cooperative, balanced, and competitive negotiation situations. Journal of Experimental Social Psychology 61, 44-58.

Never Miss A Story

Keep Exploring

Playing The Long Game

Why President George H. W. Bush went to bat for NAFTA.

By Peter Rodriguez

Why President George H. W. Bush Went To Bat For NAFTA

A version of this op-ed originally appeared in the Houston Chronicle as "Bush played the long game with NAFTA"

Whenever dozens of heads of state gather, it’s a safe bet they’ll be photographed at ornate desks where politically valuable deals are signed. The G20 Summit held in Buenos Aires on December 2, 2018 framed just such a moment as President Donald Trump, Canadian Prime Minister Justin Trudeau and outgoing Mexican President Enrique Peña Nieto sat side by side to sign a new trilateral trade agreement among their countries. But it would be misleading to call this trade deal truly new. The three countries first signed such a deal under former President George H.W. Bush more than 25 years ago. While the latest trade deal makes some valuable improvements to the existing agreement, it is new only in the sense that a longstanding house is new after a kitchen renovation.

For Houston, the North American Free Trade Agreement transformed the city into a new U.S. center of global trade. For the three participant countries, it fundamentally changed commerce among their economies. And for Americans now remembering the former president, it was a critical moment when a U.S. leader made a difficult, highly controversial decision for the country’s long-term strategy.

In knitting together the economies of North America, Bush culminated an ambitious global vision. Lowering trade barriers among countries would integrate the continent, foster competition and, eventually, build supply chains that could compete with other regions and emerging economic giants around the globe.

Then, as now, free trade was a hard sell politically, requiring a deep commitment to the principles of openness, competition and economic alliances. For all the economic opportunity it would create, Bush surely knew, NAFTA would also result in job churn, losses and gains unequally and sometimes painfully apportioned across the economy.

In standing up for NAFTA in an election year, Bush had to spend precious political capital. It made him vulnerable to many opponents, including the spirited anti-NAFTA Texan H. Ross Perot, and may have drawn enough ire to cost him a second term.

Nevertheless, NAFTA’s signing was not a first, but a final, act for an era of economic opening. The deal was the natural extension of the Reagan-Bush view on global commerce and the United States’ role within it. At the height of ‘Japanaphobia’ in 1986, Reagan opened the Uruguay Trade Round of the GATT (Global Agreement on Tariffs and Trade) negotiations, leading to the creation of the World Trade Organization. Two years later, Reagan signed the US-Canada Free Trade Agreement, the essential precursor to NAFTA — and the most significant U.S. step toward open trade in forty years.

A year after Bush signed the agreement, and after making alterations that addressed labor and environmental concerns, President Bill Clinton signed NAFTA into law on Dec. 8, 1993.

And then: nothing happened.

Or rather, nothing much happened quickly because, despite the sometimes-hyperbolic rhetoric of trade, reorganizing industries and economies takes time. Building new plants takes time, moving workers and relocating firms takes time, growing ports, roads and airports takes time. Certainly, dropping tariffs has some notable immediate effects for commodities and some finished goods, but the real impact of a sweeping trilateral trade deal eases in slowly. In the process, new trade hubs and centers are built, and cities are transformed, none more so than post-NAFTA Houston.

Houston was a global city before NAFTA owing to its oil, gas and petrochemicals industries, and because of the Port of Houston. But in the 1990s, trade exploded in ways that humbled prior metrics as growth boomed across China, India, and a newly-opened Eastern Europe. Remarkably, Houston kept pace, creating new manufacturing jobs and a mountain of finance and professional services jobs to orchestrate the new trade flowing through North America and across the world.

Today, at the onset of a new, more global era, few people could have envisioned the scale of change in this city. When Bush signed the NAFTA agreement in 1992, Houston’s economy employed 1.8 million people. Today it employs just over 3 million people. NAFTA and the transformation it stoked supported Houston’s growth, perhaps easiest to see at the Port of Houston, which is now the nation’s second largest exporter after New York City. For the United States, trade with NAFTA partners has grown to more than three times its level in 1993 at over $1 trillion annually, nearly double the level of our trade with China.

The North American trading bloc, meanwhile, has new and increased relevance as NAFTA buoys each of its three nation’s economies in competition with China.

In his latest book, The Fifth Risk, author Michael Lewis warns that one of our nation’s least appreciated challenges is “the risk a society runs when it falls into the habit of responding to long-term risks with short-term solutions.” Avoiding that risk requires facing tough choices, bold thinking and acting for the future. Whatever history ultimately writes about NAFTA, it is plain that Bush was willing to pay a price for his belief in it — and that he was right about the agreement’s power to grow and transform Houston over the long haul.

Peter Rodriguez is a Professor of Strategic Management and the Dean of the Jones Graduate School of Business at Rice University.

Never Miss A Story

You May Also Like

Keep Exploring

Worth It

How much should a leader get paid?

By Emily Pickrell

How Much Should A Leader Get Paid?

When Mexico City shop assistant Eva Maria Tatemura first heard that her newly elected president planned to cut his salary in half, she felt a spark of hope. Maybe change really was coming to Mexico’s corruption riddled government. After all, as Tatemura, who earns about $200 a month, said, “In Mexico, most citizens think that becoming a politician is a better deal than winning the lottery.”

Mexican president Andrés Manuel López Obrador, who was sworn into office December 1, captured Mexico’s imagination and won a landslide victory by promising to take on corruption and excess. Shortly after being elected, he announced he would take a 60 percent pay cut as president, earning roughly $72,000 a year.

Skeptics, including the country’s political class – many of whom will also see their salaries reined in – question whether the pay cut will benefit Mexicans. A price cut for the president, they warn, could mean a competence cut for the government itself.

The debate launched by López Obrador’s announcement echoes a longstanding one across the border: whether executive pay in the United States is too high. Granted, there are huge differences in the two frames of reference. In Mexico, public officials are some of the highest wage earners, while in the United States, executives in the private sphere are the ones most likely to earn top pay.

Yet on both sides of the border, in both sectors, the fundamental question is the same: What, exactly, should an essential leader be paid? Are high salaries needed to retain top talent, or do they just ensure the hiring of executives who know how to earn them? As it turns out, the answer for Mexican politicians is deeply influenced by the answer in U.S. businesses.

In the United States, one of the first factors in setting executive salary is gauging the competition, said Harry Jones, an attorney with Littler, a human resources legal firm. “In formulating a CEO salary offer, a board of directors for a company will always want the compensation committee to ensure that the pay is commensurate with a peer group,” he said.

The next challenge is putting a price on the extra talent a CEO brings, said David De Angelis, an assistant professor of finance at Rice Business. This benefit, known in compensation lingo as the marginal productivity of talent, can be astonishingly expensive – yet still in the company’s best interest to pay.

“If I am a bit more talented, the small difference in talent will induce a huge change in the productivity,” De Angelis said. “Even if there is a small difference in talent, it may result in a large difference in compensation because the sums are so big.”

To determine if this talent difference has paid for itself, though, companies need to accurately measure the performance of one individual leader. In the U.S. for-profit sector, De Angelis said, this is often done by comparing how a company’s stock price fares against that of its rivals, a metric known as benchmark performance.

But benchmarking fails to explain why compensation has skyrocketed in the U.S. in the last generation. In 2017, for example, the average CEO of an S&P 500 company earned $13.9 million – more than 360 times the salary of an average worker, according to the Economics Policy Institute. The ratio is more than ten times what it was in the late 1970s, when CEOs earned about 30 times what an average worker made, and a 70 percent increase over the stock market in the same time period.

“If you were to pick a country to be a CEO in, it’s America. But if you were to pick a country that has had a top economic performance in the last generation, it would not be the U.S.,” said Jeff Hauser, executive director of the Revolving Door Project at the Center for Economic and Policy Research. “The overall compensation of your top employees in America is radically disproportionate to comparable peer industrial CEOs in other wealthy countries.”

Using compensation committees and boards of directors to determine executive pay is a major flaw in the U.S. formula, human resources attorney Jones said. That’s because boards of directors are typically selected by other executives, who indirectly benefit from this approach. Because boards tend to overlap throughout the corporate world, they rely heavily on a small cadre of compensation firms to formulate pay packages.

“The same consultancies are designing a package that gets used again and again,” Jones said. “And the boards end up interlocking – they know each other to the point where there is a groupthink when it comes to salary.”

The same circular logic has been replicated in Mexico, said Oscar Urgateche, an economics professor at the National Autonomous University in Mexico City. While Mexican politicians don’t receive Wall Street-level salaries, they’re still very highly paid, even in comparison with Mexico’s private sector. Mexican politicians’ salaries are typically double or more those of elected officials in other Latin American countries, ranging from about $200,000 to $300,000 in a nation where the average wage is about $6,000 a year.

But without these high salaries, defenders argue, Mexico’s best leadership talent would go to organizations such as the World Bank or top U.S. companies. Like defenders of top executive salaries in the United States, they say the key factor is scarcity.

“The high-ranking Mexican sector compares itself with the U.S. private sector – that’s why those levels of salaries are possible,” economics professor Ugarteche said. “Their argument has always been that if they don’t earn that much they will go to the U.S.”

But Lopez Obrador, he adds, is right to maintain that candidates for public service should have a more philanthropic focus than a focus on personal compensation. Government employees bent on maximizing their salaries, he argues, may be less qualified for their jobs because their focus on society will be skewed. And according to Urgarteche, a decrease in salary for public officials might actually change the nature of those attracted to serve.

“The current salary justification is a colonialist way of thinking – that only U.S.-elite trained politicians have any value,” Urgarteche said. “My impression is that you will get younger people who are better related to their own country and who want to work in Mexico for the Mexican government. That will produce a closer relationship between citizens and the government.”

Manuel Molano, assistant director of the Mexican Institute for Competitiveness, is more circumspect, arguing that López Obrador should focus on what his government can deliver – and that his and other political salaries should reward competence, not selflessness.

“It is in the interest of the state to pay the bureaucrats handsomely,” Molano said. “If you are paying less than market rates, you are going to get people with less talent. You don’t want the assets of the government in the wrong hands.”

At a time when Mexico’s corruption ranks close to that of Papua New Guinea, however, López Obrador’s reduced salary may be most significant as a down payment on his promise to work for his country’s future and not his own. “In Mexico, a corrupt politician will not only leave office as a millionaire,” Eva Maria Tatemura said from the shop where she works. “He will secure enough wealth to set his family up for the next three generations.”

Never Miss A Story

You May Also Like

Keep Exploring

Picture This

What does our growing ability to document personal life mean for business?

Based on research by G. Anthony Gorry (1941-2018)

What Does Our Growing Ability To Document Personal Life Mean For Business?

- Digital advances make it possible to record minute details of daily happenings.

- When everyone’s life is recorded — and searchable — there are profound implications for businesses.

- Companies are already curating individual employee experiences as learning tools for the entire workforce.

Behind an iron gate, a young Tony Gorry plays in a wading pool with a childhood friend. Wet towels and toys lie on the lawn nearby. His dad tosses a ball into the pool for the boys to catch, as he talks about a new client with his mom. An aunt offers a stick to the family’s aging cocker spaniel, Jack.

This memory comes back — sharp as a high resolution photo — when Gorry, a Rice Business professor, returns to his hometown for his 50th high school reunion. Stopping in front of his boyhood home, he remembers that summer afternoon in the 1940s. Then his cell phone rings.

From more than 1,500 miles away, Gorry writes, “a call flashed through the air to interrupt my reverie. Brusquely, it summoned me back to a life already mediated to a great degree by technology.”

Professor Gorry, who died in October 2018, was a Professor Emeritus who taught computer science and led Rice’s Center for Technology in Teaching and Learning. In a 2016 essay for the journal, Knowledge Management Research & Practice, he elegantly bridged personal memories from his own life with analysis of the way pervasive technology may impact companies’ use of knowledge management.

Our lives are already heavily influenced by technology, Gorry notes. These ever-advancing technologies act as multimedia scrapbooks, or “memory machines.” Embedded digital technology, such as iPhone apps track sleep, FitBits count steps and Siri tells us the number of minutes to routine destinations, while companies can monitor employee movement with webcams, voice recorders and email tracking.

The abundance of data allows organizations to unlock hidden brainpower by sharing one worker’s knowledge with countless others. Companies have already started to do this with digitized instructions manuals and smart devices that link employees to each other and to work processes. To further this ability, companies will continue to blend knowledge management systems with advances in technology.

Such integration can happen fast. In the 2009 book, Total Recall, How the E-Memory Revolution Will Change Everything, Bill Gates postulated that individuals will one day have instant access to all of the information they come across throughout their lives. Just three years later, IBM’s Watson showed its fantastic memory recall and associative powers by beating a person at Jeopardy.

Digital life, in other words, has accelerated the scope and detail of what we can record. As a result, the nature and scope of knowledge management systems in business will change too: New business structures and processes will emerge, alongside new paradigms for the interplay of digital memory machines, human intentions and behavior.

For companies, this means that once-private artifacts of personal experience — documents, scribbled notes, contacts and recorded lunch conversations — can now be curated to establish best practices, create company narratives and to train employees.

Ultimately, big data will transform corporate processes and the way workers interact with one another. But, Gorry notes, there is of course a dark side.

Will coworkers’ lunchtime conversations, topics ranging from business to politics and gossip, be recorded? Will the company then own the personal elements of employees’ conversations? How will concepts of privacy change?

Gorry does not offer anything like a quick snapshot for answer. Instead, with an understatement worth a thousand words, he observes: Interesting times lie ahead for knowledge management.

Tony Gorry was the Friedkin Professor Emeritus of Management at the Jones Graduate School of Business at Rice University.

To learn more, please see: Gorry, Anthony. (2016). Memory machines and the future of knowledge management. Knowledge Management Research & Practice, 14, 55-59.

Never Miss A Story

You May Also Like

Keep Exploring

Rice President David Leebron on President George H.W. Bush

Rice University President David Leebron reflects on the passing of former President George H.W. Bush: “President Bush was a quintessential Houstonian and a remarkable American: generous, hard-working, driven to lead and determined to serve a purpose greater than himself. He was a gentleman whose kindness and decency were fundamental to his extraordinary character."

Rice University President David Leebron reflects on the passing of former President George H.W. Bush:

“President Bush was a quintessential Houstonian and a remarkable American: generous, hard-working, driven to lead and determined to serve a purpose greater than himself. He was a gentleman whose kindness and decency were fundamental to his extraordinary character. He served our country and the world in a unique set of roles: as ambassador to the United Nations, U.S. liaison to China, director of the CIA, vice president and ultimately president of the United States. We will always remember and be grateful for the leadership and service of George H.W. Bush.

“The president and his wife, Barbara, were dear friends of Rice University. It was President Bush who bestowed upon the university its proudest moment on the world’s stage: hosting the G-7 Economic Summit in 1990.

“Students who attended Rice in the late 1970s had the honor of taking classes from the future president at what is now Rice’s Jones Graduate School of Business, where he held the title of adjunct professor of administrative science. A generation later, our graduates of the class of 2000 listened as former President Bush delivered a commencement address in which he reminded students that ‘actions speak louder than words. Words are important, and speaking can be an important part of leading — of rallying the troops. But leading by example, in my mind, is the best way to get things done whether it’s in politics, business, you name it.’

“On behalf of my wife, Y. Ping Sun, and the entire Rice community, I extend our deepest sympathy to the Bush family, including his grandson, George P. Bush, whom we are proud to call an alumnus of the university.”