A Vaping Tax Would Slow Teen Use — Temporarily

There’s not enough reliable data about adolescent e-cigarette consumption. So, these researchers turned to Instagram.

Based on research by Piyush Anand (Rice Business) and Vrinda Kadiyali (Cornell)

Key takeaways:

- Teen smoking rates dropped significantly from 1991 to 2021, but e-cigarette use is now reversing this trend, with 37% of 12th-graders reporting vaping in 2018.

- A study using Instagram posts as a proxy for underage vaping found that California's 2017 e-cigarette tax temporarily slowed the increase in vaping-related posts, but the effect only lasted about six months.

- Taxing e-cigarettes may be preferable to banning them, as vaping can be a lower-harm alternative for adult smokers, but more research is needed to determine how to make tax effects more lasting.

Sometime in the 1990s, adolescent smoking began to be very uncool.

Between 1991 and 2021, the percentage of U.S. teens who smoked even one cigarette dropped from 70.1% to 17.8%. And the rate of teens who smoked daily fell from 9.8% to 0.6%.

This downward trend is good news, given that smoking remains the leading cause of preventable death in the United States — still about 500,000 deaths every year — and 9 out of 10 daily users take it up in their teenage years.

The bad news? This trend has shifted direction. With the advent of e-cigarettes, also known as vapes, teens are returning to nicotine. 37% of 12th-graders reported vaping in 2018, compared to 28% in 2017.

One possible explanation for this reversal is that vapes have social media appeal. E-cigarettes come in a wide range of colors and flavors, and their marketing is bright and fun. Online vaping communities form organically around hashtags like #vapenation.

It’s hard to know for sure that social media is causing this directional change because reliable data is hard to come by. For researchers wanting to study the potential impact of a national ban or tax on illegal teenage vaping, the dearth of data is a challenge.

But in their recent Marketing Science article, Piyush Anand (Rice Business) and Vrinda Kadiyali (Cornell) use vaping-related social media patterns to their advantage. By treating Instagram posting behavior as a proxy for underage e-cigarette use, Anand and Kadiyali draw conclusions about what might happen in the wake of federal regulation.

On July 1, 2017, California expanded its smoking tax to include e-cigarettes, which raised the retail price of these devices by 38.1%. Anand and Kadiyali wanted to know how the tax impacted teen vaping rates.

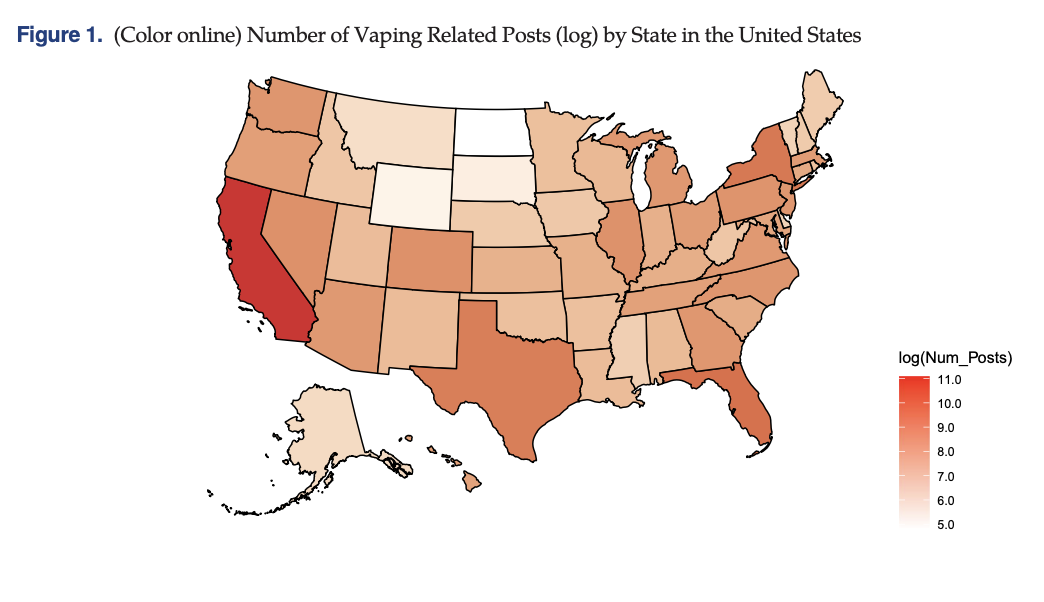

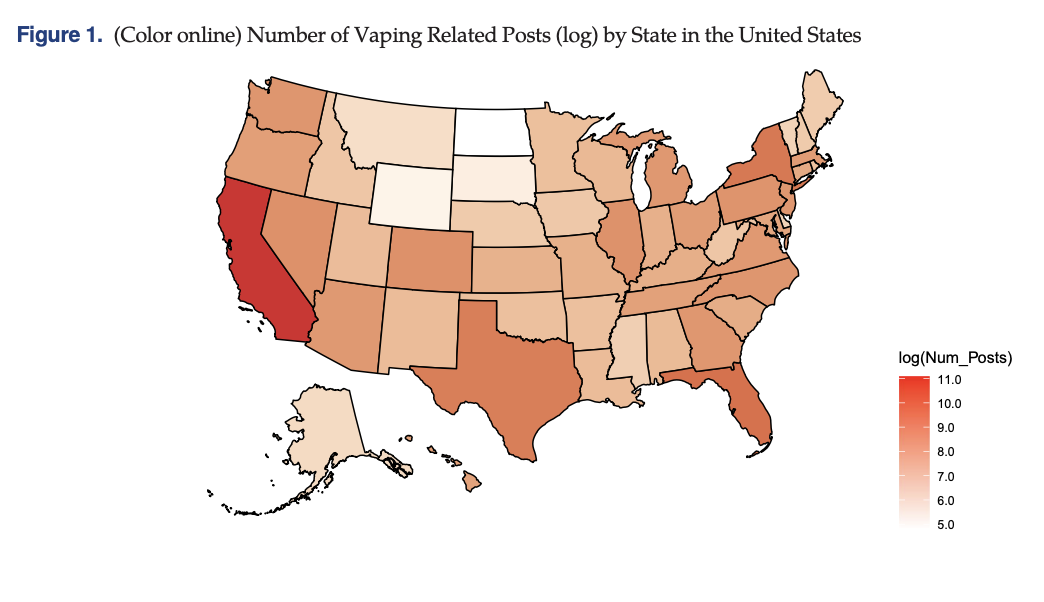

To arrive at their findings, they scraped over 380,000 public vaping-related Instagram posts during the period of January 2016 to December 2018. This allowed them to gather content data from before, during and after the California tax.

It turns out that the tax did have an impact. While the number of Instagram posts showing underage vaping continued to increase, it did so at a slower rate compared to the pre-tax period. However, this relative decline only lasted about six months. (Engagement in the form of likes, comments and hashtags remained consistent.)

Why was the effect short-lived?

It could be that companies implemented counter-strategies such as releasing new flavors. Or perhaps they increased their ad spending. Whatever the reason, the study makes clear that the impact of taxes can be undone in a short time unless regulatory bodies combine them with heightened attention to firm strategy. For example, policy language needs to be broad enough to anticipate innovation that could skirt oversight.

For many adult smokers, vaping can provide a lower-harm alternative to the more carcinogenic consumption of traditional nicotine. So, banning e-cigarettes would actually be counterproductive to the larger smoking cessation effort.

There’s also the issue of lessened tax revenue. If an adult smoker uses vaping as an exit ramp from cigarettes, that represents an economic loss unless a vaping tax is in place. So, in theory, a tax would simultaneously deter underage use while providing adult smokers an avenue for harm reduction.

More research is needed to figure out how to make the effects of a tax last longer. Perhaps social media is partly to blame for what seems like a temporary impact. But for now, it’s good to know Instagram isn’t purely a cause of the underage vaping trend — we can also use it to better understand how the trend works.

Written by Scott Pett

Anand and Kadiyali (2024). “Frontiers: Smoke and Mirrors: Impact of E-cigarette Taxes on Underage Social Media Posting,” Marketing Science.

Never Miss A Story