Men In The Mirror

Do the Latino boxers in a border gym know something other men don’t?

By Mary Lee Grant

Do The Latino Boxers In A Border Gym Know Something Other Men Don’t?

I am punching the bags at the Kingsville Boxing Club in Deep South Texas, the only Anglo and the only woman in the gym. It is a place of aspiration, a mix of professional boxers who make between $2,000 and $10,000 a fight, amateurs hoping to enter the big leagues and guys who drop by after work to punch the bags. Outside, the heat index is 107. Inside this abandoned tortilla factory with only two narrow windows and no air conditioning, it feels much hotter. Sweat drips into my eyes as I hit the heavy black bags with plastic Everlast gloves, slick with perspiration. The deep voice of salsa singer Celia Cruz resonates from crackly speakers though the cavernous old building.

The tattooed, muscled chests of the men moving next to me gleam as they grunt and grimace with every punch. Sweat gathers on the floor in pools that the boxers take turns mopping up. A sign reminds us: “Don’t spit on the floor.”

I have been practicing boxing at this mainly Mexican-American gym for two hours every day for the past year. Along the way, I have become close to men from both sides of the border, men who are boxing their way to a future they hope will bring them money and fame.

Mexican men may be the most maligned denizens of Trump’s America. Yet as I found myself growing ever more intimate with this group of macho athletes, I noticed qualities in them that the white men who are so quick to criticize might envy.

Watching them flex before the mirror, one throwing a glittery rosary around a neck, another perching a baseball cap at a studied sideways angle, I am reminded of the visual poverty that dominates the lives of most white men I know. I should point out that I am white and love many white men, so this is said with no ire. It is simply an observation, the musings of a woman who grew up as a minority in South Texas and watches with interest the differences between my own Anglo culture and the predominantly Mexican-American culture that formed me.

Unlike these vatos, white American men find few chances to relish their masculine beauty. Much ink has been spent on the rage of white men — school shooters, incels, suicides. Could white men be so angry in part because our society does not allow them the full expression of their masculinity?

We live in a society that says macho is toxic; some of its manifestations are so, profoundly. But perhaps our rules for masculinity are too limited. The result is a culturally enforced lack of style, panache and even physical grace, relentlessly mocked in popular culture from movies like “White Men Can’t Jump,” to country music, with songs like “If Bubba Can Dance, I Can Too,” and “Barney Jekyll & Bubba Hyde.”

Here at this border gym, I see something very different. I spend much of my time with men whose focus is the brute display of masculine power, who feel it is their calling to be warriors. And the anger and resentment against women that so often rears its head in the white professional world is absent here. Perhaps this arises in part because in the traditionally masculine fields in which many of them work — refineries, construction — women offer little competition. Unlike incels, who insist women must have the bodies of virginal 12-year-olds, these men enjoy women in their infinite variety. If the men at this gym have a problem with women, it is not that they hold them to impossible standards, but that they find too many of us attractive. I can’t help but wonder if their openness towards female beauty springs in part from embracing their own.

I am curious about what white men, constrained still by old Puritan ideals about excess and adornment in dress, might learn from Latino men, who come from a different strain of men’s style, one informed by the breezes of the Mediterranean. It is a sensibility shared by other men with cultures rooted in southern Europe, perhaps most flamboyantly Cretans, with their bandoliers, chapeaus, and styled moustaches. Perhaps if white men incorporated a bit of Latino style into their look, swag could become an everyday affair rather than an anomaly, a glass of wine with dinner instead of a drunken binge.

I see this style in the pride these boxers take in their bodies as well as their clothes. These are men who work out nine hours a day, jumping rope for an hour, running five miles twice a day, doing 100 sit-ups and a hundred pushups each day. And at a time when obesity rates are increasing among Americans, research has shown that overweight men face far more discrimination than those who aren’t obese.

In a study by Rice Business professor Mikki Hebl, overweight men were more likely to face casual discrimination than leaner men, both when shopping, and when serving as clerks at retail outlets. While past research has focused more on women and weight, it turns out that obesity affects how men are treated too.

“There is no doubt that I have self-confidence,” pro boxer Anthony Navarro told me. Like all professional boxers, Navarro watches his weight carefully so he doesn’t have to jump up to a higher weight class and fight bigger guys. He even sweats off final pounds in a sauna so he can make weight before a big bout. Navarro combines this body consciousness with a styled casual look, distinguished by bald head, tattooed backward baseball cap, white shirt, baggy jeans and Gangsta Nikes.

“Sometimes I see a really preppy white guy and I think, ‘That looks good. I could wear that,’” Navarro said. “But I notice they don’t wear as much jewelry and I really enjoy my jewelry. I got my ears pierced really young, just like my father. I wear gold chains. I have a black and silver rosary I really like. Sometimes, I wear it into the ring.”

The world of Latino boxing is one of grit, flash and corazon, or heart. Each boxer has a boxing persona, often correlating with his ethnic identity or nationality. One may walk out to fight in a sequined sombrero, another in Mexican flag shorts, accompanied by traditional Mexican tunes like Vicente Fernandez’s “El Palenque."

Their ring names exemplify hyped-up masculinity. I know three different men with rooster names: El Gallo Negro, El Gallo Giro, and El Gallo Fino. For all of them, the glitz and toughness of the boxing world carry over into their daily style. Outside the gym, for example, boxer “Toro” Herrera De La Paz sports a variety of looks, from fancy suit with green tie and matching green vest, to a sleeveless Lakers shirt showing his toned, arms paired with a blue and white rosary and blue and white cap. “I think it is all about having brown pride on you,” De La Paz said.

And while white men complain of feeling oppressed and aggrieved by American society, these men, who work as custodians, nursing home aides and ditch diggers, look at their own reflection with pride. In the tradition of Charles Atlas, transforming himself from a scrawny weakling into a muscle man, they stand with confidence, despite — maybe inspired by — having sand constantly kicked in their face by the dominant society.

A big part of this style, several boxers told me, is not physical prowess but attitude. “My grandmother always told me I have too much pride, because I don’t back down, but I think that is also part of the way you carry yourself,” said “Baby Jesus” Moreno who works out occasionally at the gym. “My main advice to white men is to relax. They don’t seem to feel at ease with themselves. You know, comfortable in their own skins. Also they might consider more bling.”

With all the talk of style, it may seem strange that carrying a baby is considered an excellent look by these men. But children play a key role at this boxing gym, crawling in and out of the ring, hanging on the ropes and watching their dads spar. Professional boxer Omar Rojas said he has been taking his son into the ring since he began to crawl, keeping an eye on him while he practices. Little girls in pink dresses with bows in their hair run between the punching bags, occasionally pounding them alongside the toughest of men. I have often seen these guys, with their hands wrapped, ready to put on boxing gloves, carrying a toddler out of harm’s way.

This comfort with the presence of children is not, of course, exclusive to Latino culture. But Latino tradition may encourage it. Navarro said his love of kids in no way counteracts his tough image. “If anything, I am more macho with a child in my arms,” he said. “Having children changed my life and turned me away from the streets. The most important thing for me is to be a role model to the little ones, both my own children and others. Plus, you know if they are here at the gym with us, they aren’t getting into trouble.” (Journalist Claudia Kolker addresses children in public life in the Latin American plaza in her book, The Immigrant Advantage: What We Can Learn from Newcomers to America about Health, Happiness and Hope.)

Spending much of my life as a journalist on the border, I have observed the daily horrors of machismo as I compiled the police blotter in hardscrabble towns whose names no one north of Corpus Christi would recognize. “Subject threw multiple unopened cans of Bud Light at female victim's face, then pushed her backward off porch. Subject said he was acting in self-defense. Victim transported to hospital. Victim chose not to press charges at this time.” It is no accident that many Latinas prefer to date and marry white men. Yet these boxers have shown me another side of Mexican masculinity. On these arid South Texas plains, I see displayed valor and dreams of glory worthy of a Cervantes hero.

And although a recommendation of “more bling” might seem a superficial solution to the existential crisis some white men face, perhaps the seemingly superficial can act transformatively. Actions seem to follow feeling, William James famously wrote, but actually the two are intertwined. “By regulating the action, which is under the direct control of the will, we can indirectly regulate the feeling, which is not. Thus the sovereign path to cheerfulness, if our cheerfulness be lost, is to sit up cheerfully and to act and speak as if cheerfulness were already there.”

Or as 12-step programs would have it, “fake it 'til you make it.” Maybe white men can imitate Latino style until they internalize it. Then Mexican macho swag will become as American as fajitas and breakfast tacos.

Mary Lee Grant has a degree in history from Yale University and a PhD from Texas A&M University, specializing in Mexican-American history and gender history.

Never Miss A Story

You May Also Like

Keep Exploring

Can We Ever Agree on What Corporate Responsibility Means?

A new theory offers a practical way to evaluate corporate behavior worldwide.

Based on research by Duane Windsor

Windsor’s vision for consistent corporate social responsibility wouldn’t require strict regulations carved into stone tablets. Instead, he argues, participants need to strike a balance between high ethical standards and the freedom for companies to grow — and allow room for standards to evolve over time.

Key findings:

- Clearer concepts of corporate social responsibility and irresponsibility would make it easier to measure whether companies are meeting ethical standards.

- Establishing a reliable method of evaluating corporate social responsibility could lead to more consistent business practices worldwide.

- Crafting a new approach that’s both theoretical and practical could pave the way for improving corporate responsibility worldwide.

What’s the definition of a fair wage? What obligation do corporations have to protect the environment — or to maintain human rights? The answer depends on who you ask.

Corporate social responsibility and irresponsibility are nettlesome, ambiguous concepts — and nearly impossible to enforce. The literature about both currently spans several disciplines, forming a patchwork of principles. And this theoretical chaos poses a serious practical problem, both for corporations and for the countries where they do business. Consumers may suffer most of all.

But what if someone devised a formula for evaluating good business practices — one that could pave the way for consistency in corporate social responsibility across the globe?

Rice Business professor Duane Windsor resolved to try. In a recent paper, he tapped institutional theory, international policy regime theory, stakeholder theory and theories of how firms operate. He brought them all together with one overarching assumption: that people all over the world want better lives for themselves and their families.

To understand what role corporations could — and should — play in helping to maintain and improve the lives of stakeholders (and non-stakeholders), Windsor looked at the way theory and experience influence each other in the workplace. Secondly, he analyzed the ways persuasion and negotiation can encourage social responsibility and still allow for progress. This could involve UN and EU sponsorships that directly address such corporate policy issues as fighting corruption, promoting environmental protection, supporting human rights and developing and maintaining industry standards.

Pairing logical analysis with a review of the literature, Windsor articulated 19 specific points that could be tested, such as a firm’s performance outcome, the well-being of shareholders and non-shareholders and overall social welfare in the communities that corporations serve.

Since corporate social responsibility is currently evaluated across a variety of disciplines, specific conceptual boundaries could make good practices easier to identify — and to enforce. A consistent set of guidelines would also shape legal and ethical standards for public policy and business practices.

But these boundaries can only be created through a consensus between nations and corporations. And that can only take place with steady scholarship, persuasion and negotiation, Windsor says.

Windsor’s vision for consistent corporate social responsibility wouldn’t require strict regulations carved into stone tablets. Instead, he argues, participants need to strike a balance between high ethical standards and the freedom for companies to grow — and allow room for standards to evolve over time. This is crucial, he says, since lasting success depends on balancing corporate social responsibility and an environment where companies can flourish and succeed.

An international standard of corporate responsibility would not only help businesses interact better with each other and the governments that oversee them, but, ideally, would increase transparency and improve quality of life around the world.

A consistent framework alone won’t make this happen — it will also take a commitment to meaningful enforcement by company leaders and government officials. But it would help if they could all start out on the same page.

Windsor, D. “Corporate Social Responsibility and Irresponsibility: A Positive Theory Approach.” Journal of Business Research 66 (2013): 1937–1944.

Washington Campus Board of Directors

Never Miss A Story

You May Also Like

Keep Exploring

Here’s How to Encourage Creativity in Your Team

Companies can and should train supervisors to cultivate creativity in their management choices. Here's how.

Based on research by Jing Zhou and Inga J. Hoever

Choosing and hiring employees who are creative is not enough, it turns out. If your workplace is discouraging, creativity will wither in almost anyone. On the brighter side, cultivate a nurturing environment and creative tendrils may sprout even in the most no-nonsense workers.

Key findings:

- Creativity is the lifeblood of modern business — the spark behind innovative ideas.

- Today’s managers have a mandate to cultivate creativity in their workforce.

- Managers can nurture creativity, even in workers who appear less creative, by building a supportive environment.

Give a kid a toy car, a stuffed bear, or an armful of blocks, and she is off on an imaginative romp, staging epic battles, building palaces or creating new worlds.

Coaxing creativity from adults is more challenging. But if creativity in children develops their spirits, creativity in adults enriches productivity — especially at the office.

It’s simple math. Creativity is where ideas come from; ideas form the basis for innovation. In an increasingly competitive world economy, it’s innovation that allows businesses to survive and thrive. This makes creativity a prized commodity in the job market. For managers, cultivating creativity in their workforce is a crucial professional skill.

Identifying the best circumstances to make creativity bloom is one of the driving questions in a study by Rice Business Professor Jing Zhou and colleague Inga J. Hoever, a professor at the Barcelona School of Management in Spain.

To explore the mystery of creativity, the two scholars first reviewed the hefty body of research by organizational psychologists and management scholars who’ve studied innovation in employees and teams. Most early research in this field, published since 2000, focused on the creativity of the actor — the individual or the team — or else revolved around the work environment.

Current academic research takes a more holistic look. By studying the interaction between the character traits of the worker or the team, the leader or the supervisor, and the prevailing atmosphere at the workplace, researchers are unveiling new insights.

Studies show, for example, that the benefits of benevolent leadership expand when workers recognize creativity as an important component of their role. Not only that, creativity is highest in employees who experience high levels of both positive and negative moods and feel supported by their supervisors. Other research finds that leaders who empower their workers get a greater payback in creativity.

To explore these findings further, Zhou and Hoever developed a typology that sorts out research about workplace creativity based on interactions between the worker (which they call the “actor”) and the workplace (which they call “context”).

The best-case scenario is a positive actor in a positive context, a mix that is synergistic for creativity. Worst case: When a positive actor languishes in a negative context or, similarly, when a negative actor stews in a positive context. At the extreme end of possibility, a negative actor in a negative context is downright antagonistic to creativity, Zhou and Hoever found.

There’s one final type of employee-workplace interaction: the “configurational” experience, which includes factors that are neutral in shaping creativity, but, when combined with other factors, cause a kind of chemical reaction that boosts or blocks creativity.

Zhou’s research serves up some bad news and good news for managers. Choosing and hiring employees who are creative is not enough, it turns out. If your workplace is discouraging, creativity will wither in almost anyone. On the brighter side, cultivate a nurturing environment and creative tendrils may sprout even in the most no-nonsense workers. Best of all, good managers can build a nurturing greenhouse environment. Practically speaking, it means that companies can and should train supervisors to cultivate creativity in their management choices.

Plenty of research gaps remain, however. To fill them, Zhou has outlined an ambitious agenda for future research, including a close look at the impact of workplaces on collective creativity; exploring as-yet unidentified factors in workers and work settings that spark creative thinking; and seeking ways to vanquish the effects of unsupportive environments.

Making creativity happen at work, in other words, isn’t child’s play.

Zhou, Jing, and Hoever, Inga J. “Research on Workplace Creativity: A Review and Redirection.” Annual Review of Organizational Psychology and Organizational Behavior 1 (2014): 333-59.

Mary Gibbs Jones Professor of Management and Psychology – Organizational Behavior

Never Miss A Story

You May Also Like

Keep Exploring

Under Pressure

What happens when coercive leaders feel cornered?

By Thomas Kolditz, founding Director of the Ann and John Doerr Institute for New Leaders.

What Happens When Coercive Leaders Feel Cornered?

This op-ed origianlly appeared on The Hill.

To leadership experts, Donald Trump has never been a particularly interesting exemplar. He mostly manages with coercive power — fear — and such a leadership style is all too common in formally appointed business leaders.

In addition to being common, the outcomes are predictable. Early research in leadership, by classic researchers John French and Bertram Raven in the 1950s, predicts that fear-based leadership leads to high levels of outward compliance but low levels of follower loyalty.

In other words, people who work for a leader like President Trump will do what he wants if they are vulnerable to him, but tend to be disloyal when not under his direct influence. This is why formerly loyal associates like Michael Cohen are willing to flip when confronted with something worse than the president’s wrath — namely jail time.

We can expect much more of that behavior as others leave the White House, particularly if they are indicted. It’s predictable and common, and uninteresting from a leadership perspective.

The recent anonymous op-ed in the New York Times, indicating significant disloyalty and undercutting of the president by his senior staff is interesting, even if it is also somewhat predictable.

The majority of the American people, that majority that did not support President Trump, are experiencing considerable angst over perceptions of disarray in the West Wing.

The anonymous op-ed writer clearly intended to put some of us at ease by revealing hard work (if surreptitious work) by the president’s staff to avert major disasters.

Given the president’s coercive style and his lack of familiarity with the workings of the government, it is not surprising that senior staff members are focused more on their constitutional obligations than on blind obedience to the president. That one of them anonymously reported this to the people of the United States seems almost expected.

What becomes much more interesting to leadership experts, however, and should be of interest to every American, is what happens now? What is the probable effect of having a group of dissenters in the White House staff?

Earlier research published in the Academy of Management Journal in 2012 and 2014 by Burris & Associates forewarns a pessimistic and dangerous reaction by a leader in President Trump’s circumstances. The work centers on leaders who are ego-defensive and challenged by subordinates.

The research suggests three distinct reactions by President Trump, all of which are disastrous for his ability to lead. First, he is likely to identify his staff as less competent and to listen to them less than before being challenged by the op-ed.

The opposite would be true for those he knows for sure are loyal — but exactly who might those people be? Thus, for those who are worried that President Trump tends not to listen to staff, hold onto your hats, it is likely to get much worse.

Second, the research would predict that the op-ed would trigger ego defensiveness because the letter is an unquestionable threat to the president’s self-image. This defensive stance will cause an increase in the president’s tendency to denigrate people, especially people with suggestions counter to his.

Such ego protective behavior will manifest in a near paranoid suspicion of other around him — something already apparent in his personality.

Lastly, the research strongly suggests that staff who are subjected to such treatment will partially (or perhaps entirely) shut down.

Almost certainly there will be a marked decrease in constructive dialogue around the president, and there is likely to be a decrease in the constructive dialogue among the White House staff themselves, given the risk of an unwanted idea being proffered to the president.

President Trump has now become an interesting leadership exemplar. The existing leadership literature clearly predicts a rapid, dramatic increase in many of the negative presidential leadership qualities and outcomes highlighted recently in books by Bob Woodward and Omarosa Manigault Newman.

Time will tell, but the unfolding of the story should now have the attention of everyone who believes that leadership based on character rather than coercion is an essential quality in the leader of the free world.

Tom Kolditz is the founding director of the Ann and John Doerr Institute for New Leaders at Rice University.

Never Miss A Story

You May Also Like

Keep Exploring

Act II

Raising the curtain when your artistic vision has been swept away.

By Tarra Gaines

Raising The Red Curtain When Your Artistic Vision Has Been Swept Away

Like many Houston arts organizations after Hurricane Harvey, Mildred’s Umbrella, a women-centered theater company, struggled through months of fund-raising and rent-induced financial stress. For Jennifer Decker, Mildred’s founder and artistic director, producing shows had become less like art and more like toiling on an assembly line as they raced to keep ahead of bills. Finally, Decker had to face the question: Should she try to keep up with the frantic pace of a traditional theater company – or step away from the conveyor belt and remake Mildred into something smaller, nimbler – different?

Most of us, including artists, prefer our drama onstage rather than in real life. But disasters such as flood, fire and personal adversity are inevitable, forcing artists and arts groups to perform without a guiding script or score. And an unscripted future can sometimes lead to occasional, magnificent, second acts.

Rice Business professor Otilia Obodaru is an expert on liminal experiences at work: those uncertain periods of transition between careers and roles. While these times naturally fuel anxiety, she said, they may lead to greater identity growth and self-discovery. For artists, especially, this can be a breakthrough.

“The key advice about how to use liminality,” Obodaru said, “is to deliberately engage in identity play, to see the liminal period as a time to experiment with possibilities and to do exactly that — try on a variety of what my research co-author Herminia Ibarra calls ‘provisional selves.’ You see how you feel when you are trying to be that kind of person.”

This process helped transform one of Texas’ most innovative theater companies, the Rude Mechs. For almost two decades, the group created and performed new works while participating in community outreach from their East Austin performance warehouse, the Off Center. Then their landlords, the University of Texas, raised the rent 300 percent and the Mechs had no option but to leave. They were faced with the choice of giving up or experimenting with a different identity.

They chose the latter. Settling temporarily in the old Austin American-Statesman warehouse, they had to come to terms with semi-homelessness. Then they went further and embraced uncertainty, announcing crushAustin, an experimental period of new work and initiatives in alternative venues across the city.

“The work is lean. A lot of it fits in a suitcase or an app,” co-artistic director Kirk Lynn said. “The primary tools are minds and bodies and dreams and early mornings and bad attitudes and a lot of love.”

In Houston, theater director Decker made a similar external change. She ended the long-term lease of Mildred’s home near the Houston Heights and moved it to short-term rented theater space. Then, to salvage the group’s creative integrity, she quit the assembly-line approach and shifted from four full productions to two.

“It will be tremendously productive creatively, because we’ll have time between the productions to really dig into the art,” Decker said. “It will allow me to participate more often myself as an artist, the reason I was drawn to theater in the first place, and it will give us more time to plan and collaborate as a group.”

Dallas dance company Bruce Wood Theater had to find its way through a different sort of liminal fog. In 2014, just three weeks before the world premiere of its new work Touch, founding choreographer Bruce Wood died. Without their visionary leader, the dance company had to choose whether to die as an organization — or be reborn.

“We went forward ‘Bruce-style,’ as we called it,” executive director Gayle Halperin said. In his last years, Wood carefully mentored protégés and emerging choreographers. Since his death, the group has focused on furthering that mission, commissioning new works and cultivating choreographers from within.

According to Obodaru, this reinvention process is akin to the strange, sometimes awkward experience of trying on piles of unfamiliar clothes. “See how they look on you, whether they fit, and how other people react when seeing you in these new clothes,” she said. “Allow yourself to try on things you would have never considered before, precisely because the point is to experiment.”

Rebecca French, founder of FrenetiCore multimedia dance theater and the Houston Fringe Festival, is another artist who faced disruption, in this case from within her nonprofit. Her decision: moving on.

As the founder, she was told in 2016 that she had the option of dismissing the entire board and staff and keeping the nonprofit. But because she wanted to see the Fringe Festival continue, she chose to walk away.

Two years later, French has found the she is creating as many new projects and championing as many artists as she always did, but now sees a once-frightening future as filled with possibility.

“There were certain risks that I didn't feel comfortable taking as the head of my former nonprofit because certain stakeholders might not approve,” she said. “Stepping away has allowed me to have complete control over each project that I choose to create.”

Tarra Gaines is a Rice Business Wisdom guest contributor.

A version of this article first appeared in Arts And Culture Texas as "Second Chapters: Texas Artist Navigates Change."

Never Miss A Story

You May Also Like

Keep Exploring

Hand In Glove

What values should businesses observe besides profits?

Based on research by Duane Windsor

What Values Should Businesses Observe Besides Profits?

Never miss a story! Join our free monthly newsletter.

- Virtuous behavior doesn’t necessarily conflict with rational self-interest and stakeholder wellbeing, Windsor finds.

- A near-universal principle of ethics is to do no harm without an acceptable moral justification, which could be a basic premise for businesses.

- Businesses should only be willing to cause harm if it can be justified in narrow circumstances, such as in legitimate competition that might harm a rival firm.

Flames filled the air and the saltwater licked fire as thick, hot oil spread through the Gulf of Mexico. The Deepwater Horizon explosion killed 11 people and resulted in incalculable environmental damage. In the aftermath, government agencies found British Petroleum responsible for one of the worst offshore disasters in history, arguably the result of corporate cost-cutting and inadequate safety precautions.

How do tragedies like Deepwater Horizon fit with the popular idea that firms are the best police for their own industries? Is there even such a thing as a foundation for business ethics – one on which most people would agree?

Rice Business professor Duane Windsor set out to define such a foundation, arguing that virtuous behavior in the business world does not necessarily conflict with rational self-interest and stakeholder wellbeing. Such an ethical foundation could even function in fields where scarcity often predominates and players must fight for advantage, Windsor argues.

Sound business ethics can be based in a variety of philosophical and spiritual systems, according to Windsor. Many religions, including Islam and Judaism, explicitly promote business ethics. Philosopher Immanuel Kant argued that an act is not right or wrong because of its consequences, but based on whether it fulfills the supreme moral duty he labeled the Categorical Imperative.

Virtue theory takes a different approach, arguing that character, rather than duty, should underpin human actions. And utilitarianism maintains that actions are right if they lend themselves to the greater good of the majority.

What about in the workplace, though? Can a moral science for business really spring from a universal foundation? And can such a foundation be non-controversial and coexist with the assumption that managers act rationally for self-interest?

In each of the theories mentioned above, a fundamental ethical principle is to do no harm without an acceptable moral justification. A moral science of business ethics should proceed from this simple premise, which is nearly universally agreed upon, Windsor argues.

At the same time, many business decisions obviously cause harm to someone: competitors, dismissed employees, or out-negotiated suppliers. These decisions are not necessarily morally wrong, though, if they can be justified and if they are accepted or regulated by the political community. Even so, the question remains: Is economic rationality compatible, or by nature antithetical, to business ethics?

Adam Smith advocated for separating business from morality, praising self-interest and scoffing at those who affected to act in the public interest. In Smith’s view, competition would regulate self-interest, courtesy of the market’s famous invisible hand. Modern businesspeople who oppose ethically-based business education still agree, arguing that markets are self-correcting and that voluntary self-regulation is sufficient.

The AACSB, the main accrediting group for American business schools, takes a different position, maintaining that ethics, social responsibility and sustainability should play a pivotal role in business school curricula. Nevertheless, the AACSB does not promote discussion of how uniformly to implement these standards. Instead, a technical or scientific approach – one that emphasizes economics and psychology – has shaped business school ethics in the United States.

And some in the business world actually object to the teaching of business ethics, calling the endeavor quixotic. Moral values, they argue, are subjective, and conventional business ethics tends to simply fuel self-serving rationalization. Some in this school of thought argue that the sole purpose of business is to maximize wealth for owners.

Cultural relativism also stymies ethics education for students of international business, since what’s ethical in one country may be downright criminal in another.

Windsor takes a very different view. American firms should adopt a principled basis of operation, he argues, and refuse to cause unjustified harm. Although arguments can be made about what constitutes harm and whether some forms of harm are acceptable, some types of harm should not be acceptable in any industry.

All firms, Windsor argues, should avoid practices that lead to direct harm. But harm may not always be as direct as an oil spill. The so-called Vitamin Cartels that wreaked havoc on pricing during the 1990s show how monopolization can harm consumers, while AT&T has been fined for deception and fraud in communications transmission.

None of these acts of harm, Windsor says, can be justified. Instead, he writes, American business leaders need to concern themselves with moral leadership and social responsibility. In his view, the primary job of business is to create social good. That principle means protecting the wellbeing of the organization, its employees, its customers – and the world around them.

Duane Windsor is the Lynette S. Autrey Professor of Management and Strategic Management at Jones Graduate School of Business at Rice University.

To learn more, please see: Windsor, D. (2016). “Economic Rationality and a Moral Science of Business Ethics.” Philosophy of Management, 15, 135-149.

This paper, presented at the 2015 Philosophy of Management Conference at St. Anne’s College, University of Oxford, was recognized as the best paper of the conference.

Never Miss A Story

You May Also Like

Keep Exploring

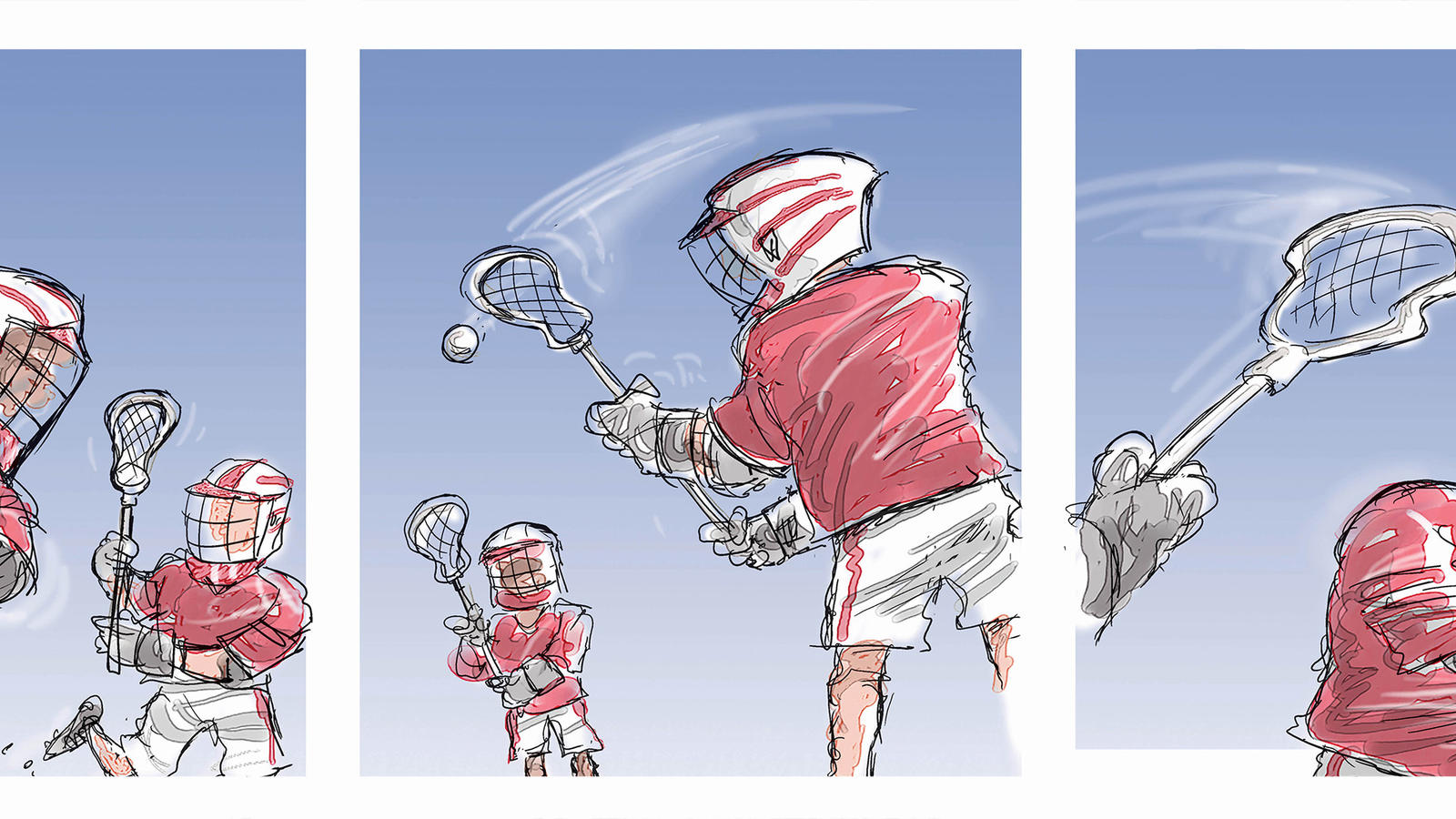

Old Boys Club

That glow from old school memories shines on...in CEO pay.

Illustrated by Nick Anderson. Based on research by Alexander W. Butler.

That Glow From Old School Memories Shines On ... In CEO Pay.

Sports, parties, friendship — there's so much to savor about college memories. For CEOs who graduated from the same schools as board members, there's even more to savor: better chance of a pay raise. The nostalgia is not quite so fun for leaders who don't share those school ties. Rice Business professor Alexander W. Butler explains the business perks of belonging to the alumni club. Cartoonist Nick Anderson shows a glimpse of the playing field.

Alexander W. Butler is a professor of finance at Jones Graduate School of Business at Rice University.

Nick Anderson is a Pultizer Prize-winning editorial cartoonist.

Never Miss A Story

You May Also Like

Keep Exploring

Crosscurrent

How speedy loan-loss recognition can save banks billions.

Based on research by Brian Akins, Yiwei Dou and Jeffery Ng

How Speedy Loan-Loss Recognition Can Save Banks Billions

- Timely loan-loss recognition can work as a powerful tool in fighting corruption in the banking sector.

- The faster a bank recognizes a problem, the easier it is to address the issue.

- Recognizing losses quickly, however, only really matters in places without government ownership of banks.

The loans should have been sure things. Two high-profile lenders — Russia’s VTB Bank and Credit Suisse — provided $2 billion to two government-backed companies in Mozambique. What happened next was a corruption case of epic proportions.

The funding, approved five years ago, was meant to support a tuna fishing fleet and naval protection for vessels operating out of the southern African nation’s territorial waters. Credit Suisse and VTB pocketed $200 million in loan fees.

The only problem: The two companies were woefully mismanaged and never generated any meaningful revenue. And to this day, at least a quarter of the money remains unaccounted for. It’s not even clear that it ever arrived in Mozambique: The banks sent the funds to offshore companies in Abu Dhabi. Meanwhile, Mozambique’s parliament was never informed of these government-backed loan applications — nor was the public.

How can banking institutions avoid entering into corrupt deals like this? And how does corruption on this scale happen in the first place? Rice Business professor Brian Akins, along with Yiwei Dou of New York University’s Stern School of Business and Jeffrey Ng of the Hong Kong Polytechnic University’s School of Accounting and Finance, delved into these questions in a recent study.

What they found is that banks can better address corruption if they quickly recognize when they’ve made bad loans. It’s an important finding because loan-loss recognition is a relatively simple way to stem corruption, and little research has been done on the effects of quickly spotting bad deals.

The researchers examined the records of 3,600 firms across 44 countries and found that timely loan-loss recognition decreased the likelihood of corrupt lending practices. The quicker banks recognize a problem, the easier it is to address the issue quickly.

Loan-loss recognition matters because it provides investors and depositors information they can act on, according to Akins and his colleagues. Investors who see that banks are making corrupt loans are likely to correct the issue quickly. Depositors won’t stay with a bank very long if they know it is wasting the money in their accounts on bad loans.

But the study notes that in countries where banks were largely owned by the government, there was a greater chance that the lending institution would be bailed out in the event of loan failure. That is to say, there was less in the way of incentives for speedy loan-loss recognition.

The greater the government involvement in a banking institution, the less likely it was that outside stakeholders would monitor the banks very closely, the study shows. “Government ownership of banks leads everyone else who is supposed to be monitoring the bank to just let it go because they expect the government to back their claims on the bank if it fails,” Akins explains.

Deposit insurance, too, works as a disincentive for outside stakeholders to monitor banks closely. Loan-loss recognition doesn’t work as a disciplining mechanism in this case because depositors have the security of knowing that their claims are backed by insurance. And banks have a greater incentive to take risks. After all, if the loans fail, the burden will fall to taxpayers.

The Mozambique case was hardly unique. In 2014, the Indian government fired the chairman of the state-run Syndicate Bank for taking bribes in exchange for loans, while in 2012, the head of one of China’s largest banks, The Postal Savings Bank of China, was arrested on charges of bribery and illegal lending.

In developing countries especially, corruption plays a big part in the way wealth is distributed. A $2 billion dollar loan anywhere is a large sum, but in a country like Mozambique, it amounts to a sizable portion of the nation’s wealth. That is to say, protecting against corrupt lending practices through timely loan-loss recognition amounts to yet another tool to ensure that economic resources are more likely to go to those who need them instead of a corrupt few.

Brian Akins is an assistant professor of accounting at the Jesse H. Jones Graduate School of Business at Rice University.

To learn more, please see: Akins, B., Dou, Y., & Ng, J. (2017). Corruption in Bank Lending: The Role of Timely Loan Loss Recognition. Journal of Accounting & Economics, 63, 454–478.

Never Miss A Story

You May Also Like

Keep Exploring

Watershed Moment

Harvey washed away homes, jobs and memories; it also brightened a few reputations.

By Clifford Pugh. Photo credit to James Zhao '15

Harvey Washed Away Homes, Jobs And Memories; It Also Brightened Some Reputations.

Moments of crisis bring out our best and our worst. Some people emerge from catastrophe bathed in praise for their heroism; others are drenched in public disdain for their actions in the same moments.

That’s what happened with Hurricane Harvey.

Whether they were big corporations, small businesses or struggling nonprofits, the storm gave an array of Houstonians the opportunity to shine – even if they didn’t think of that during the downpour.

In times of calamity, most people aren’t thinking about their personal brand, says Utpal Dholakia, a marketing professor at Rice Business. “How they behave in normal times is how they are going to behave in an emergency or a disaster,” he says. Nevertheless, Dholakia adds, personal and institutional brands often are profoundly affected by how people act at those times. “Every action that they perform in good and bad times is going to have an effect on their reputation.”

A year after the worst natural disaster in Houston’s history, here’s a look at some of the people and organizations whose credentials were enhanced by their instincts – and some whose names were tarnished by what they did when the chips were down.

Halo Enhancers

In the decades before Harvey, Jim “Mattress Mack” McIngvale was best known as the loudmouth owner of Gallery Furniture who promised to “Save You Money!” in incessant TV commercials. But when Harvey pummeled his community, another side of McIngvale emerged. He transformed his stores into temporary shelters and told evacuees to “come on over” in a Facebook video. He gave out his personal cell phone number. And for those who couldn’t make it to a store on their own, he dispatched delivery trucks and drivers to haul them to safety.

Since then, McIngvale has given hundreds of thousands of dollars to help those hammered by Harvey, and he and his wife, Linda, have launched an ambitious program to offer job training and other community services at their stores.

“We believe in unity and community,” McIngvale told Furniture Today. “Our thoughts have always been, ‘If we went out of business, would the customer miss us?’ This is another way to become part of the community.”

Houston Texans superstar J.J. Watt had less of a transformation to make. Just when it seemed he couldn’t be more beloved, Watts burnished his halo with a Harvey relief fund that brought in a whopping $41.6 million from 200,000 donors. In a recent Twitter post, Watt’s foundation called it “the largest crowdsourced fundraiser in world history.”

Watt’s efforts have enabled repairs to more than 600 homes and 420 child-care centers and after-school programs. They’ve allowed distribution of more than 26 million meals, offered mental health services for more than 6,500 individuals and bought medicine for more than 10,000 patients.

Watt, who has received a host of awards for his Harvey fundraising, including the NFL Walter Payton Man of the Year Award, has laid out a plan for the coming year as well: Funds will go toward continued home restoration, physical and mental health services, rebuilding damaged Boys & Girls Clubs and support for food distribution with Feeding America.

In Purgatory

Lakewood Church, by contrast, is still overcoming its Harvey moment. After its perceived sluggishness in opening its doors to those seeking help, the church led by Pastor Joel Osteen has been working to rehabilitate its reputation. Osteen got a recent boost from megaproducer Tyler Perry, who took to the pulpit to praise Osteen’s response to the storm during a nationally televised Lakewood service.

Lakewood also gleaned a city proclamation for its contributions after the floodwaters receded, such as providing $5 million in financial assistance and supporting 9,300 volunteers who aided more than 1,100 Houston-area families.

However, the proclamation prompted a storm of criticism on social media. In its wake, a city official revealed that Houston made 3,600 such proclamations in 2017, and that anyone could apply for one online or by mail.

Pitching In

The Islamic Society of Greater Houston weathered the storm differently. Before Harvey hit, the organization had already prepped several of its mosques to offer temporary refuge for storm evacuees.

Members who lived near the mosques brought in clean sheets, towels, diapers and food, while hundreds of volunteers worked around the clock to run the shelters and distribute supplies. Dozens of Muslim doctors also volunteered at the citywide shelters in the George R. Brown Convention Center and NRG Center.

The society raised $275,000 to help members of the Muslim community, plus another $300,000 for the community at large.

M.J. Khan, the organization’s president, estimates that around 40 percent of the Houstonians who took refuge in the mosque shelters were non-Muslims. Religious affiliation didn’t matter. “The first thing on the minds of people in the community was, ‘What can we do?’” Khan says. “We knew in a time like this we had to step up and help out. We take it as our responsibility to help our fellow human beings.”

Strange Bedfellows

And then there were the odd couples. These days few Republicans and Democrats play well together, but Harris County Judge Ed Emmett (Republican) and Houston Mayor Sylvester Turner (Democrat) were universally praised for the way they stood shoulder to shoulder as leaders in the crisis.

They appeared on TV together so often during Harvey that it became a crowd-pleasing bromance – one that continued as they both urged voters to approve a $2.5 billion bond issue to more than quadruple annual funding for flood control in Harris County. The bond issue passed overwhelmingly.

Weather Watchers

Houston-based meteorologist Eric Berger gained countless new fans during the storm with his reports on Space City Weather, a website he founded to “cover Houston weather news and forecasting with accuracy and without hype.” Soft-spoken and camera-shy in daily life, the former Houston Chronicle reporter was the subject of a gushing profile in Wired magazine, titled “Meet the Unlikely Hero Who Predicted Hurricane Harvey’s Floods.” Berger has since become a hotly pursued public speaker.

Harris County Flood Control District meteorologist Jeff Lindner also drew a large following with his frank and concise live updates on Harvey’s water levels. Lindner now has 21,000 Twitter followers.

Small Business Winners

Overall, it was figures such as Berger, people not normally in the spotlight, who were most likely to transform their public profile during Harvey, Dholakia says. That also applies to the small businesses and local mom-and-pop restaurants that stepped up to help their neighbors during the storm.

Dholakia cites Proud Pie, a coffee shop and artisan bakery in Katy, where owner Scott Chapman was active on social media during Harvey and offered free meals to first responders and the Cajun Navy. Chapman also opened his food truck in the parking lot of Grace Methodist Church and served 200 free meals a night for four nights to displaced families.

“One year after Harvey, they are one of the most popular restaurant/food shops in Katy,” says Dholakia. “People remember that there was a store owner who helped and was very proactive during the crisis.”

On the other side of town, at El Bolillo Bakery, seven employees rode out the storm by baking the store’s signature Mexican rolls for two straight days. Trapped in the store by high waters, the staff turned 4,000 pounds of flour into nearly 5,000 pieces of bread.

Owner Kirk Michaelis eventually rescued the bakers and took them to his home. “The next morning, they said they were ready to get back to work,” he said. “By 1 o’clock the next day, the stores were open and there was a line of people down the street. It was tough because a lot of my employees lost everything. And they still showed up to work.”

Employees took the excess bread to citywide shelters first, and then to smaller churches and shelters that hadn’t received the attention the larger ones had.

Since then, Michaelis says, “our business has increased, because people read about it and responded, although we didn’t do it for that reason. It’s like paying it forward; people started coming back.”

The city of Houston has proclaimed September 27 El Bolillo Bakery Day. To celebrate, Michaelis is planning a “share day” at the store’s three locations, offering five free bolillos or pastries for every five purchased.

“Hopefully you will share them with someone that helped you during Harvey,” he says. “We want to keep it going.”

Never Miss A Story

Keep Exploring

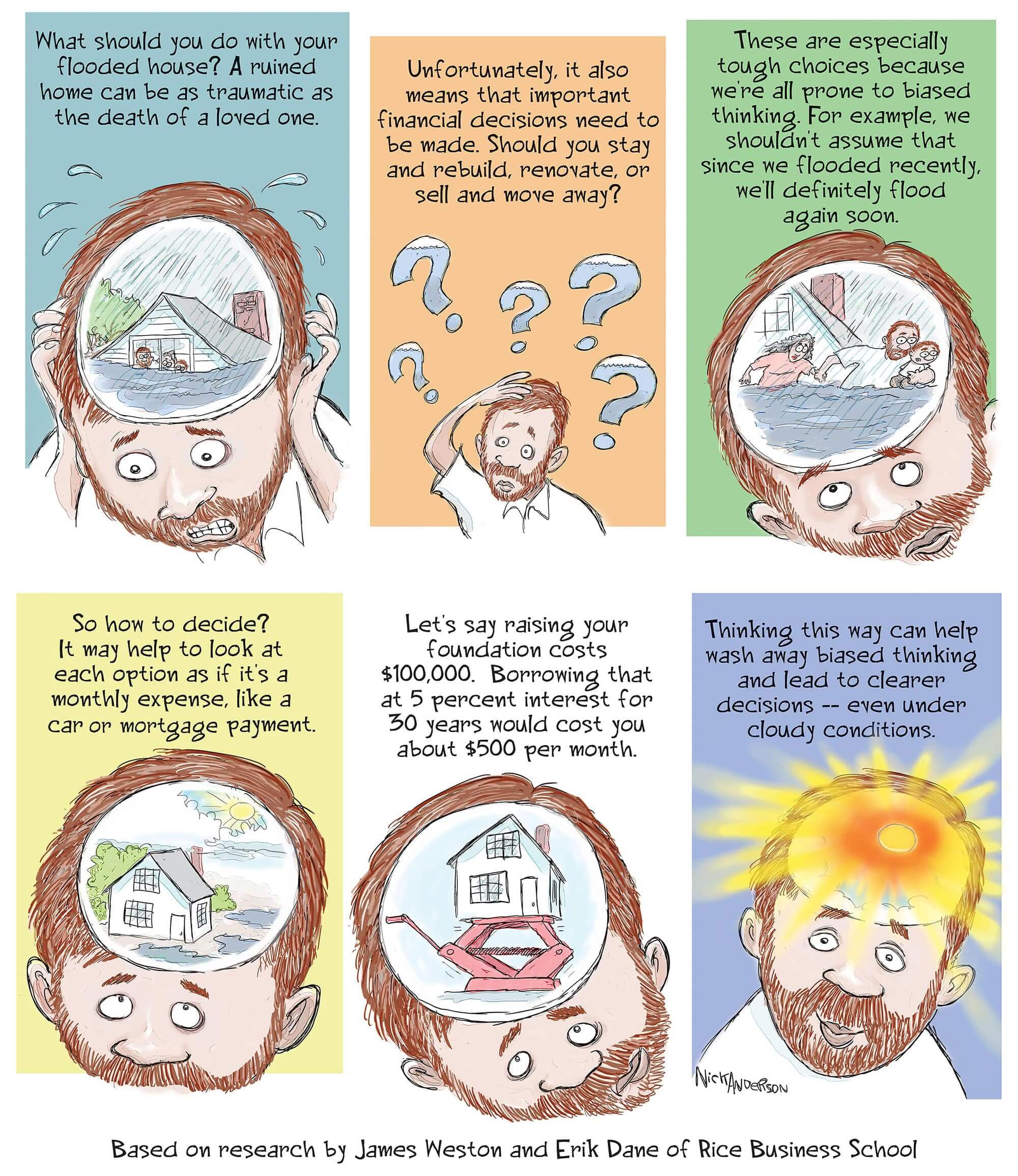

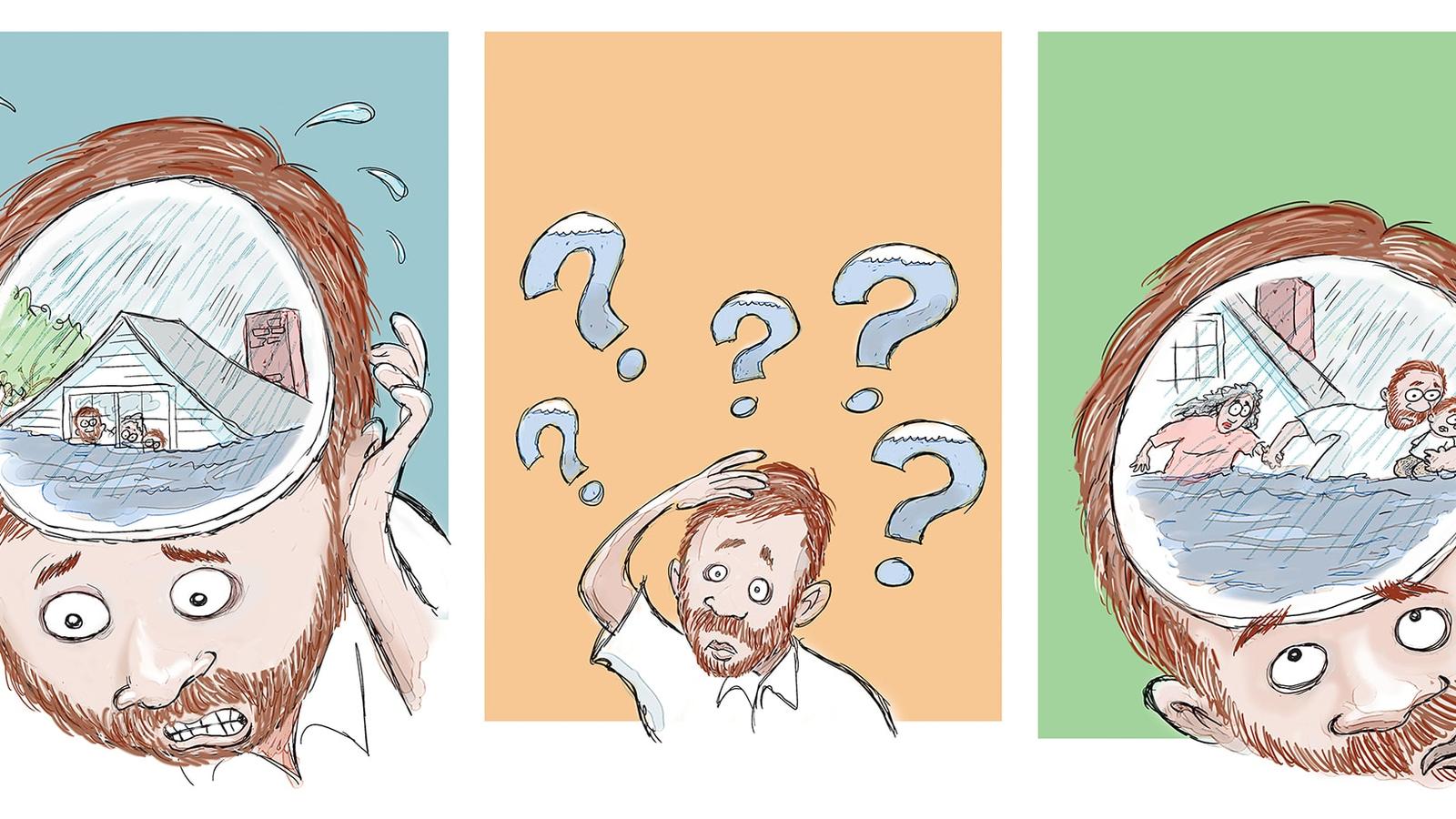

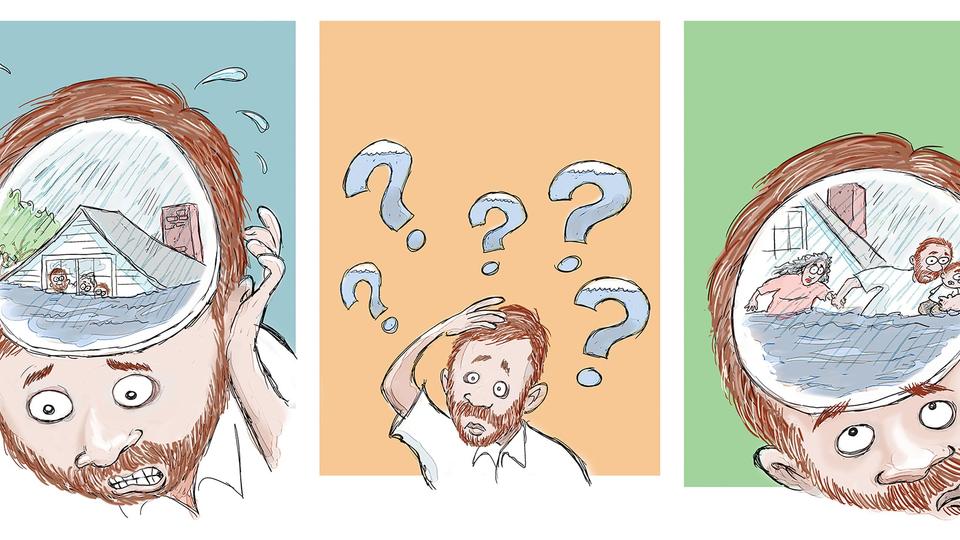

Up In the Air

How do you decide whether to sell your Harvey-drenched home?

Illustrated by Nick Anderson. Based on an article written by James Weston and Erik Dane.

How Do You Decide To Sell Your Harvey-Drenched Home?

A year after Harvey displaced thousands of homeowners, many are now wrestling with what to do with their beloved, damaged homes. Rice Business Professor James Weston and former Professor Erik Dane offer essential guidance on how to think about this big decision in their article Should I Stay Or Should I Go? Nick Anderson illuminates.

James Weston is the Harmon Whittington Professor of Finance at the Jones Graduate School of Business at Rice University

Erik Dane is a former professor and was the associate professor of management at the Jones Graduate School of Business at Rice University

Nick Anderson is a Pultizer Prize-winning editorial cartoonist

Never Miss A Story