Clean Tech, Climate Change, and the Future of Energy feat. Phoebe Wang ’13

Season 3, Episode 24

In another episode from our 2023 Alumni Reunion series, host Maya Pomroy ’22 and Phoebe Wang ’13 chat about her passion for fighting climate change for future generations, her work with Amazon’s Climate Pledge Fund, and winning a C3E business award.

Owl Have You Know

Season 3, Episode 24

In another episode from our 2023 Alumni Reunion series, host Maya Pomroy ’22 and Phoebe Wang ’13 chat about her passion for fighting climate change for future generations, her work with Amazon’s Climate Pledge Fund, and winning a C3E business award.

Watch

Listen

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

Episode Transcript

-

[00:00] Intro: Welcome to Owl Have You Know, a podcast from Rice Business. This episode is part of our Flight Path series, where guests share their career journeys and stories of the Rice connections that got them where they are.

[00:13] Maya: Welcome to Owl Have You Know, on this Reunion weekend here at Rice University. Our guest today is Phoebe Wang. You are a Full-Time MBA of 2014. Thank you so much for taking time out of this fun and exciting weekend to be with us for a bit of time, to check in and, and talk about all of the magnificent things that you've done since you graduated from Rice.

[00:33] Phoebe: Absolutely. So, actually, I graduated... I know that my name tag is, like, a 2012 —

[00:39] Maya: '14

[00:39] Phoebe: ... but actually, I graduated 2013.

[00:40] Maya: Oh, '13, okay.

[00:42] Phoebe: Yes, it's actually my 10 years anniversary.

[00:44] Maya: So, you graduated 10 years ago. That's right.

[00:46] Phoebe: Yes, yes.

[00:47] Maya: So, in the 10 years since you've graduated, you have to tell us about all the phenomenal things that you've done. So, you, you are very passionate about clean tech.

[00:56] Phoebe: Mm-hmm.

[00:56] Maya: And about the energy transition. And you are part of, of Amazon's team to really be carbon net zero by what year?

[01:06] Phoebe: 2040. So, that's 10 years ahead of Paris Agreement, which was on 2050. Yeah.

[01:11] Maya: So, how did you get interested in clean tech?

[01:13] Phoebe: Absolutely. And first off, thank you so much for having me in this Owl Have You Know Podcast. So, as Maya has mentioned, I have been in the Rice program back in, like, from 2011 to 2013. That has been, like, a phenomenal two years in my life. Learned a lot. It's a really great program I would recommend to everybody. So, my interest in the clean tech, or what we call climate tech, actually stemmed really early.

Like, when I was very little, I grew up in Asia. And then, if you see over there, like, pollution is such an important issue. And it is actually, like, the global issue now. So, back then, I actually almost did environmental engineering, but job market was not very good, like, over two decades ago. So, I actually switched over to material science engineering. So, now it's, kind of, coming through a full circle that I'm looking at investments in the climate tech. Especially in Amazon, we have this $2 billion Climate Pledge Fund. And primarily, looking at a few sectors, including technology and transportation and mobility, food and agriculture, circularity.

We also do a lot in the, like, energy storage, utilization, and production, as well as recently, given the rise of the generative AI, we look at a lot of new technologies in data center, how to actually continue to provide those, like, a power consumption or power in the data center for the ChatGPTs, the BlackRock from Amazon. So, a lot of, kind of, cooling technologies in data center and chip design technologies, fascinating stuff. And it's just amazing to see the, the rise of the climate tech industry.

[02:59] Maya: Well, yes. And it's, it's definitely... it almost has become exponentially more of an issue. And, and there's more of a push to do it faster and faster and faster, based on how much research has gone into, you know, the, the amount of carbon that we are breathing in every single day.

[03:21] Phoebe: Absolutely.

[03:22] Maya: Right? I mean, and, and I think that now we have, you know, capabilities that we didn't have before to, to really assess the impact of, of carbon on all of us in, in humanity. So, so, you recently accepted an award in 2022, the C3E Business Award. And it's in here, in this magazine over here. So, tell me, let's find it. It's, like, one of the first...

[03:44] Phoebe: I think it's like first or second page.

[03:48] Maya: That's... well, I mean, that's where it should be.

[03:50] Phoebe: Yeah.

[03:50] Maya: So, tell me about this amazing award that, that you received.

[03:54] Phoebe: Yeah, so I was really honored to receive this award from the Department of Energy in United States. So, every year, they actually select, like, one woman per category in eight categories. And then, I won this award, amazing award for the business category for my investments in the past few years in the clean energy and climate tech space. So, so far, I have invested in over 30 companies, out of those three unicorns, and have created, like, tremendous job opportunities in local markets, and then also have a big impact in the carbon market.

So, as Maya have mentioned, right, we, we're now looking at a lot of different areas with the CO2 lens. And in addition to that, we are also looking at how to preserve the biodiversity, because we don't want to have unintended consequences if we only apply the carbon lens when we do the investments.

Yeah. So, it's... I feel very honored. Last year, we actually, like, I went to D.C., did my award recipient speech. and just, it's so empowering to see all the women in the room and who has been trailblazers and then make sure that we have the right gender equity in the space. And then, also, like, lots of good deal-making on conversations.

[05:13] Maya: So, you said three unicorns. What are the three unicorns?

[05:17] Phoebe: Yeah. So, I'll maybe just talk about, one, given the...

[05:22] Maya: Okay, the best one.

[05:24] Phoebe: Yeah, yeah, the, the best one. Yeah. So, Xpansiv is one of the companies that, that we have, but when I was at BP Ventures, we have actually seeded their first check in. And so, think about that as, when you are doing, like, commodity trading, you have the marketplace, right? Or, exchange. So, this is actually a platform that you can do, kind of, get the CO2 or the green property of your commodities. So, whether you're natural gas, your electrons, how green are they, how much energy that are actually going in, that you can actually use the blockchain technology to underwrite that. So, that company has done really tremendously well. And that was back in 2017 when there's no MRV category, which is the monitoring, reporting, and verification for CO2. And also, like, at the time, it was through at the dawn of the blockchain space.

[06:23] Maya: 2017, yeah. I know.

[06:24] Phoebe: Yeah. So, I was, like, very, very fortunate to work with previously my boss, Meghan Sharp and David Hayes in the deal. And it's super fascinating to see how the company progressed.

[06:35] Maya: Because your background is also venture capitalist, right?

[06:38] Phoebe: Yes, yes. So, I have a very interesting route. And then, I think, for the people who are interested in, kind of, the career during and after the MBA, so I actually started as an engineer. So, I spent my first few years in my career as a chemical engineer, and then also as a semiconductor engineer. I used to do IC designs with DRAM, which is dynamic random access memory, for a semiconductor. After a while, I realized that I want to, kind of, move more towards the business side. So, I actually did CFA, which is a charter financial analyst program, as well as Rice MBA, which I think let me, kind of, leapfrog in my career as well. So, yeah, so, kind of, did a bunch of things, like investment banking, private equity, commodity trading.

[07:23] Maya: Okay, all at the same time.

[07:24] Phoebe: And consulting. Yeah. And also started my own company before I actually, kind of, got into the VC side to become a full-time at VC. So, that was back in 2012 when I first graduated. I also graduated one semester early, so that...

[07:39] Maya: Really?

[07:40] Phoebe: Yeah, yeah. That, that's a whole different story but...

[07:43] Maya: Well, we'll talk about that, too, because I want to know how you graduated a whole semester early. Like, do you sleep?

[07:49] Phoebe: That's a good question. Yeah, I still, I get my full eight hours. But I also did Ride Fund, which is a flagship program in Rice, which is a $1 million student led. And I think it's equity only, long only. We don't do short, kind of, equity fund. So, I was, like, a first junior analyst and eventually senior analyst selecting the public stock market, like, different stocks.

So, that actually gave me a, kind of, leg up for getting all my credits in. And plus, like, I had already done my CFA, like, the first two levels. Many of the courses are, kind of —

[08:28] Maya: In finance.

[08:29] Phoebe: Yeah, finance.

[08:30] Maya: Economics, all those, yeah.

[08:32] Phoebe: Yeah. So, I did, I think I did a lot of credits. I also did, like, a summer and winter credits, too. So, I was able to actually get two minors, plus my major. Well, two minors in the MBA. So, did, like, I think energy and finance minors in the MBA, and then still graduated a semester earlier.

[08:53] Maya: Wow. So, what did you do with your free time?

[08:56] Phoebe: That's a good question. I probably don't have much free time, but I, I like to, kind of, work out. As I mentioned, I like to run a lot. And I do yoga. I also teach nowadays, like, teach baby yoga or kids yoga.

[09:08] Maya: Wow.

[09:09] Phoebe: Yeah, I found that's, kind of, fascinating and also, kind of, teach in different schools. I have taught in the Berkeley Haas for the past five years as a guest lecturer, and then a few times in the MIT Sloan Business School. And now, like, looking into more, like, different ways of giving back to Rice and exploring opportunities here.

[09:31] Maya: By being part of the Rice Alliance, which we're sitting in the Rice Alliance Building.

[09:35] Phoebe: Yes.

[09:35] Maya: So, so, tell me, tell me about your work with the Rice Alliance and how you've given back.

[09:38] Phoebe: Absolutely. So, I think Rice Alliance actually have several, like, a signature programs. So, one of them is the Rice Business Plan Competition. I have been judging and involved in the Rice Business Plan Competition in the past 10 years. So, kind of, really see that...

[09:53] Maya: Since you graduated.

[09:54] Phoebe: Since I graduated.

[09:54] Maya: Since you graduated.

[09:55] Phoebe: Yeah. And then, back then, also, when I was at Shell, we were one of the key sponsors. So, I actually also get the opportunity to hand the, like, a gigantic check to the students, which is a fascinating thing, fascinating thing to do. So, right now, like, I still continue to serve as the lead judge for, kind of, the final selection for the prize. I'm also involved with... I sit on the board for the Rice Alliance Advisory Board. So, like, I think every quarter, I come back here, either virtually or, like, in person.

[10:26] Maya: Somehow, yeah.

[10:28] Phoebe: Yeah. So, yeah, so, it's great to meet with the fellow advisory board members, and then also Brad is a really good advocate in terms of the innovation.

[10:38] Maya: Brad Burke?

[10:39] Phoebe: Yeah, Brad Burke.

[10:39] Maya: We'll be talking to him later.

[10:41] Phoebe: Yeah, yeah. And then, I think the third part is more on the... there's a Clean Energy Accelerator. So, I'm on the selection committee over there, kind of, at the inception, I've been involved. So, kind of, these are the three main programs that I, I find is great opportunity for students and for the general ecosystem for the innovation, but also greater value for me to give back. I can... I always, kind of, raise my hand whenever Brad reaches out, "Hey, Phoebe, do you have time to, to help out or invite folks?" Yeah, I would always...

[11:14] Maya: Say yes.

[11:15] Phoebe: Say yes.

[11:15] Maya: You can't say no. You have to say yes.

[11:17] Phoebe: Yeah. We're a family, so, obviously.

[11:19] Maya: Well, that's, that's, that's true. It is very much a family. And that's one of the things about, about Rice and, and having, you know, we've seen the energy here today with the Reunion Weekend and everybody reconnecting. And it's just such a, such a joyous occasion —

[11:31] Phoebe: Yeah.

[11:32] Maya: ... that, that, you know, the, the energy is palpable.

[11:35] Phoebe: Yeah.

[11:36] Maya: So, you were very optimistic about the clean energy and, and climate, you know, control so that we can, we can shift it back to having clean air for, for everyone. So, so what progress do you hope to see over the next few years? What are you the most excited about?

[11:52] Phoebe: Yeah. So, right now, whenever we are looking at the technology, we actually have a lens of whether, when at the mature stage, whether the technology can sequest or can abate gigaton equivalent of CO2, because we need to have that level so that we can actually move towards a future that is livable for our next generations. So, that's something not very easy to do. But fortunately, we have a ton of innovation, a ton of entrepreneurs, and ton of venture capital coming into this industry. In addition to that, I need to highlight, kind of, yeah, it's not news, IRA, the Inflation Reduction Act from the Biden administration. I think that's super helpful. And it really, kind of, help reduce the payback period for many of the key technologies, like hydrogen and green hydrogen, or CCUIs. And then, we are also looking at nuclear. I know that is, kind of, somewhat political, but there are a ton of capital coming in into the nuclear fusion equation so that we can have a clean source and large enough, like, energy density source for the future use.

[13:00] Maya: That's magnificent. There's a lot of wonderful things coming, coming our way because of you.

[13:05] Phoebe: No. I'm like a very, very small part of that, but I'm trying to, kind of, give my 100% or 200% to support the entrepreneurs and the, the folks in the ecosystem.

[13:15] Maya: Well, we can't wait to see what, what you do next, Phoebe. And thank you so much for being here today with us and, and sharing a little bit of your story. And, and we'd love to have you back on, you know, to keep on, keep our finger on your pulse. Because you, you know what's going on and, and the latest innovation of, of what really is, is the most important thing for all of our teachers.

[13:34] Phoebe: Yeah. Thank you. Thank you so much, Maya. And obviously, Brad Burke and the whole Rice Alliance team. Those are great. Thanks for having me here. Thank you.

[13:42] Maya: Absolutely, yeah.

Thanks for listening. This has been Owl Have You Know, a production of Rice Business. You can find more information about our guests, hosts, and announcements on our website, business.rice.edu. Please subscribe and leave a rating wherever you find your favorite podcasts. We'd love to hear what you think. The hosts of Owl Have You Know are myself, Maya Pomroy, and Scott Gale.

You May Also Like

Business is booming: major growth, two years later

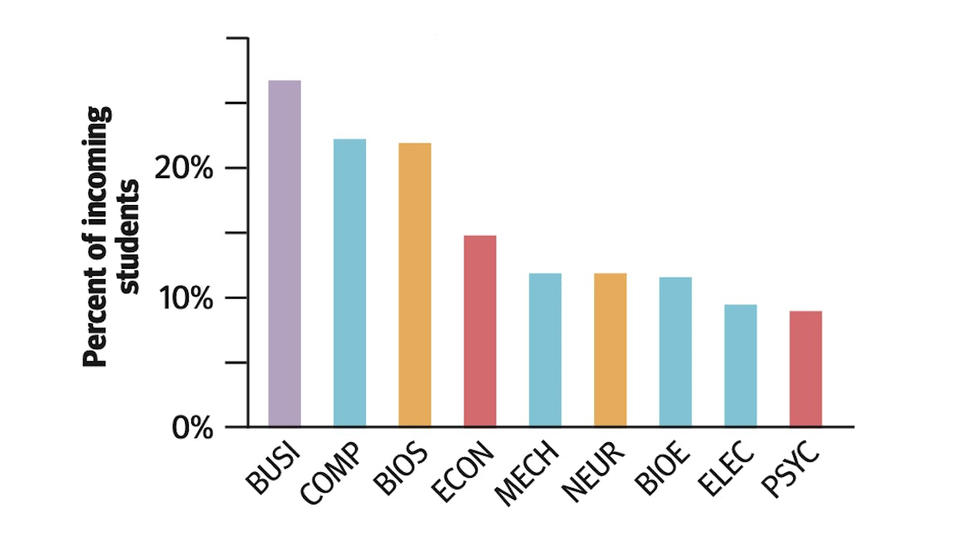

Move over, engineers — there’s a new major in town. According to the Office of Academic Advising, 26.7 percent of new students are interested in the business major, surpassing all other potential majors.

Meet Chike Osunkwo, Member of the Inaugural Hybrid MBA Cohort and Engineer in the Industrial Machinery Manufacturing Industry

Meet Chike Osunkwo, hybrid MBA Class of 2025, who always knew that he belonged at Rice University.

Introducing Chike Osunkwo, hybrid MBA Class of 2025, whose decision to enroll in the MBA program was an easy one because he always knew that he belonged at Rice University. Chike is located in Katy, TX and works as a design and product engineer at Celeros Flow Technology, an Industrial Engineering firm that designs, installs & sells various products from pumps to valves. “As a working professional, it is not easy to balance work and family with full-time school. So, having an academic program that is structured around my busy schedule made the Rice Hybrid MBA an easy choice,” he says. Keep reading to learn more about Chike's path to Rice Business.

Why did you select Rice Business and why did you choose the Hybrid MBA program?

I always knew I belonged at Rice University, but it was only a matter of time. Rice embodies quality and prestige, so it was easy to make that decision. Rice Business is ranked amongst top universities nationally and has a very strong network. I believe the Rice MBA will give me an unlimited breadth of exposure to a world of possibilities in my professional development as a leader.

As a working professional, it is not easy to balance work and family with full-time school. So, having an academic program that is structured around my busy schedule made the Rice Hybrid MBA an easy choice. Lastly, being amongst the pioneers of an elite class of students in the Hybrid MBA program makes it an even cooler experience. I’m now part of the school’s history.

Can you describe your preparation process for business school?

Part of my preparation process for business school was to speak with friends and alumni within my immediate network about their experiences and the opportunities the program offers. I also followed day-to-day progress updates with Rice Business online.

What do you most look forward to as an MBA student?

The networking opportunities.

Can you describe your professional goals after Rice Business?

I see myself developing as a world-class leader taking on opportunities to drive solutions for impactful changes.

What advice would you give to someone applying to the Hybrid MBA program?

For anyone with an extremely busy schedule but would want an intimate in-person learning experience that works well for your schedule, then the Hybrid program could be best tailored for you.

Interested in Rice Business?

Remember the $5 footlong? The behavioral economics behind “reference prices”

Whether it's the cost of a sandwich or a gallon of gas, the behavioral economics principle of reference prices shape our views of inflation. Rice Business professor Utpal Dholakia shares his knowledge on the subject.

Energy experts discuss impact of Inflation Reduction Act at annual Renewable Energy Leadership Conference

Renewable Energy Alliance Houston (REAL Houston) and Rice Business Executive Education hosted the second annual Renewable Energy Leadership Conference Aug. 22 on Rice’s campus to explore the impacts of the Inflation Reduction Act (IRA) one year after it was signed into law.

Renewable Energy Alliance Houston (REAL Houston) and Rice Business Executive Education hosted the second annual Renewable Energy Leadership Conference Aug. 22 on Rice’s campus to explore the impacts of the Inflation Reduction Act (IRA) one year after it was signed into law.

The discussion provided an opportunity for voices from leading renewable energy companies, the U.S. Department of Energy and capital providers to discuss the impact the IRA has had on Houston and beyond, and what to expect going forward.

REAL Houston Board Chair Kay McCall said the act was a significant change for U.S. energy policy.

“The impressive array of historic investments made in renewable technology, carbon capture and storage, hydrogen and more demonstrate the concrete steps we are taking toward a lower-carbon future,” said McCall. “What we heard from the diverse voices gathered here today — all but one from Houston — bodes well for the coming decades in energy and for Houston’s role in transforming the industry.”

John Berger, CEO of Sunnova Energy, said the IRA’s expansion of federal tax incentives has resulted in a surge of investments in the renewable and clean energy section.

“A year into its enactment, this transformative legislation continues to yield dividends, equipping both residential and commercial customers — including those in historically underserved communities — with a more affordable and more reliable source of energy,” Berger said.

The growth opportunity created by the IRA has allowed clean energy projects to accelerate at a faster pace, said EDP Renewables North America CEO Sandhya Ganapathy.

“The IRA’s incentives and subsidies are also helping to lower electricity costs for consumers and make already affordable renewable energy even more economical,” Ganapathy said. “This legislation has created a fantastic opportunity for our industry and for consumers who want clean energy at affordable prices.”

As a premier business school, Rice Business is proud to unite diverse stakeholders with the common purpose of revolutionizing renewable energy, said Michael Koenig, associate dean for innovation initiatives and executive director of executive education.

“With unwavering commitment, we steer toward a greener future, knowing businesses redefine energy’s landscape,” Koenig said. To learn more about Rice Business Executive Education, click here.

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

How To Make Major Decisions

A new mathematical model can help transplant centers make decisions about when to move forward with a matching donor and when to wait.

Based on research by Süleyman Kerimov (Rice Business), Itai Ashlagi (Stanford), Itai Gurvich (Northwestern)

Key findings:

- Researchers developed a mathematical model that helps clarify when it's best to match patients to donors as quickly as possible and when it's best to wait.

- Their findings could help optimize all manner of matching markets in which participants seek to connect with potential partners based on mutual compatibility.

- The researchers surmise that the wisest course of action would be to alternate between periodic (periodic matches that accumulate over time) and greedy policies (matching donors as soon as they become available) as circumstances dictate.

To wait, or not to wait? That is the question — or at least it might be, if you need a kidney transplant.

Nearly 89,000 Americans with chronic kidney disease are on a waitlist for a new organ, and an estimated 13 people die each day while awaiting a transplant. But there are real costs to matching patients with the first donor that becomes available, just as there are equally real costs to having them wait in hopes of finding a better one.

Recently, Rice Business professor Süleyman Kerimov and colleagues at Stanford University and Northwestern University developed a mathematical model that helps clarify when it's best to match patients to donors as quickly as possible and when it's best to wait.

Their findings, which appear in two papers published in Management Science and Operations Research, respectively, could help optimize all manner of matching markets in which participants seek to connect with potential partners based on mutual compatibility — a sprawling category that encompasses everything from e-commerce platforms to labor markets that match employees with employers.

Kerimov and his colleagues focused on programs that match live kidney donors with people who need transplants. Live donors typically volunteer to give one of their kidneys to a loved one. But biological differences between a donor and their intended recipient can render the pair incompatible.

Kidney exchange programs solve this problem by swapping donors amongst different patient-donor pairs, choreographing a kind of kidney-transplant square dance aimed at finding a compatible partner for every willing donor.

In countries such as Canada and the Netherlands, kidney-matching programs perform a batch of matches every few months (called periodic policies). American programs, meanwhile, tend to perform daily matches (called greedy policies).

Both models seek to produce the greatest number of high-quality transplants possible, but they each have advantages and disadvantages.

Less frequent matches in a periodic policy allow more patient-donor pairs to accumulate in the kidney exchange network, creating potential for better matches over time. But this approach risks making some patients sicker as they wait for a better match that might never appear.

Arranging feasible matches as soon as they become available in a greedy policy avoids that predicament. But it means passing up the opportunity to make a potentially better match that could represent the possibility of a longer, healthier life.

Balancing these trade-offs is tricky. There is no way of predicting precisely when a patient-donor pair with a particular set of characteristics will show up at the kidney-exchange network. And in the world of organ transplants, there are no do-overs.

Kerimov and his colleagues have constructed a mathematical model that represents a simplified version of a kidney exchange network.

Within the model, the researchers could dictate which patient-donor pairs could be matched with one another. They can also assign different values to individual matches based on the number of life years they provide. And they can establish the probability that various kinds of patient-donor pairs with particular characteristics might arrive at the network and queue up for a transplant at any given time.

Having set those parameters, the researchers applied different matching policies and compared the results. As it turns out, the answer to whether one should wait or not is: It depends.

To determine which policies generated the best outcomes — i.e., performing matches either daily or periodically — the researchers calculated the difference between the total value in life years that could possibly be generated within the network and the amount generated by a specific policy at a particular point in time. The goal was to keep that number, evocatively dubbed "all-time regret," as small as possible over both the short and long term.

In their first paper, Kerimov and his team explored a complex network in which donor kidneys could be swapped amongst three or more patient-donor pairs. When such multiway matches were possible, the cost of applying a daily-match policy turned out to be onerous. Using all available matches as quickly as possible eliminated the chance of later performing potentially higher-value matches.

Instead, the researchers found they could minimize regret by applying a periodic policy that required waiting for a certain number of patient-donor pairs to arrive before attempting to match them. The model even allowed the team to calculate precisely how long to wait between matchmaking sessions to get the best possible results.

In their second paper, however, the team looked at a simpler network in which kidneys could only be swapped between two donor-patient pairs. Here, their findings contradicted the first: Applying a daily-match policy minimized regret; a periodic matching process yielded no benefit whatsoever.

To their surprise, the researchers discovered they could design a foolproof algorithm for making two-way matches in simple networks. The algorithm employed a ranked list of possible match types; and the researchers found that no matter how many patient-donor pairs of various kinds randomly arrived at the network, the best choice was always simply to perform the highest-ranked match on the list.

In future research, Kerimov hopes to refine the model by feeding it data on real patient-donor pairs that have participated in actual kidney exchange programs. This would allow him to create a more realistic network, more accurately calculate the likelihood that particular kinds of patient-donor pairs will show up, and assign values to matches based not only on life years but also on rarity and difficulty. (Certain blood types and antibody profiles, for example, are rarer or more difficult to match than others.)

But Kerimov already suspects that in a real-world situation, the wisest course of action will be to alternate between periodic and greedy policies as circumstances dictate.

In a simple region within a kidney exchange network that only allows for two-way matches, pursuing a greedy policy that involves taking the first match that appears on a fixed menu of options would be the best choice. In a more complex region that allows three-way matches, however, pursuing a periodic matching policy that involves waiting to make rarer and more difficult matches would ultimately offer more patients more years of healthy life.

The benefits of choosing flexibly between greedy and periodic policies should hold for any kind of matching market that can be represented by a network with simpler and more complex regions, such as a logistics system that matches online orders to delivery trucks or a carpooling system that matches passengers with drivers across different parts of a city.

Kerimov, et al. (2024). “Dynamic Matching: Characterizing and Achieving Constant Regret,” Management Science.

Kerimov, et al. (2025). “On the Optimality of Greedy Policies in Dynamic Matching,” Operations Research.

Never Miss A Story

You May Also Like

Keep Exploring

Rice’s Mikki Hebl honored with Academy of Management’s Advancing Women in Leadership Award

Michelle “Mikki” Hebl , the Martha and Henry Malcolm Lovett Professor of Psychological Sciences and professor at Rice Business, is the 2023 recipient of the Advancing Women in Leadership Award from the Academy of Management (AOM).

Hebl lauded for ‘deliberate, relentless and generous mentorship provided to female students’

Michelle “Mikki” Hebl , the Martha and Henry Malcolm Lovett Professor of Psychological Sciences and professor in the Jones Graduate School of Business, is the 2023 recipient of the Advancing Women in Leadership Award from the Academy of Management (AOM).

Presented by the diversity, equity and inclusion (DEI) division of the AOM, Hebl received the honor at the organization’s annual meeting earlier this month. The accolade recognizes a deserving individual for significant contributions to educational practices that support the advancement of women in leadership.

When reflecting on the award, Hebl said she owes a lot to her own undergraduate experience at Smith College.

“It made me very aware of the gender inequities that have existed and continue to predominantly affect women in our world,” she said. “I have been blessed to be able to watch so many Rice women and people from underrepresented backgrounds break down barriers that have long held them back from reaching their full potential.”

Elena Doldor, chair of the award committee, said competition for the award was stiff with many impressive nominations, but Hebl stood out for a number of reasons. She has authored 200 publications exploring workplace and other subtle forms of discrimination and how to address it, is the recipient of 21 teaching awards throughout her career, and is a champion for diversity both at Rice and in her profession.

But Doldor said the most touching aspect of Hebl’s nomination was her “deliberate, relentless and generous mentorship provided to graduate and undergraduate female students throughout her career.”

“So many personal experiences shared with us in glowing award nomination letters tell the story of someone who doesn’t just talk the talk, but truly walks the walk of promoting diversity and inclusion,” Doldor said.

Hebl said it is a joy to help her students even in some small way.

“I love my students and I believe in them,” she said. “I also know we will eventually see the pendulum swing forward the right way and women will gain the professional and personal rights that they so deserve. They will be CEOs en masse, they will have paid leave, they will have the right to choose and they will not have to ‘juggle the struggle.’ I am hopeful that I get to see that day, and until then, my work is unfinished.”

Hebl has been at Rice since 1998. More information on her scholarship and lab is available at https://www.mikkihebl.com . More information on the award and past recipients is online at https://dei.aom.org/dei/awards/advwomenlshippastwinners .

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

Top Five Reasons to Apply Early to the Rice MBA

You've decided on a business school. When should you apply? The earlier the better.

You’ve made the decision to go to business school. Congratulations. What a huge first step. Next, you work on essays, recommendations, test scores, transcripts and resume. Then what? Hit submit.

Why now? Here are our top five reasons to apply early to an MBA program:

1. Show your interest.

Submitting your application early signals to the school you’re truly interested in them. Enthusiasm and commitment to a program demonstrate the kind of student we’re looking for: someone eager to learn and be part of our community.

2. Secure Your Spot.

Like all programs, the Rice MBA has a limited number of spots available. Applying early gives you an edge on acceptance because your cohort won’t be full yet. As the year progresses and accepted students enroll, the number of seats decreases and the competition increases.

3. Time to finance.

Merit-based scholarships are awarded to full-time students as they apply to Rice Business. When you apply early, you become part of the consideration set. And you’ll also have time to work with our financial aid office on financing your degree. Maximize your chances.

Interested in Rice Business?

4. Visit campus.

Applying early gives you time to integrate in the school community and culture earlier. Once you’re enrolled, you get to participate in events at the school and career workshops. And as an added bonus, you’ll have time make connections with your classmates, get to know the campus better, and expand your professional network before you start classes in the summer.

5. Plan ahead.

An earlier acceptance gives you time to evaluate options and plan for seamless onboarding. If you're moving to Houston, explore neighborhoods near campus and enjoy the arts, sports, and restaurants.

MBA Application Tips: Applying early provides flexibility and peace of mind. Reduce the stress. Apply early to secure your spot at Rice Business, request more information, or reach out to our team for guidance on the application process, financing, and transitioning to student life. Get ready to change your life with one of our MBA programs.

You May Also Like

Keep Exploring

What Happens to a Business When the Founder Leaves?

Startup founders are often fired by investors who want the company to steer into a new direction, yet new research co-authored by Rice Business professor Minjae Kim shows that these entrepreneurs have what it takes to effect change.

2023 MBA To Watch: Mónica Hicks

"Rice Business is one of a handful of top business schools with an intentionally small class and a Consortium cohort. As someone who values genuine connection with others, I was looking for a smaller class size, individualized support, and a diverse class. Rice checked all the boxes."