Courtney Morris

Meet Courtney Morris, Professional MBA '23

Why did you choose Rice Business?

I chose Rice Business for several reasons. First, the Rice MBA program has a stellar reputation and is nationally recognized and ranked! I’ve desired to pursue entrepreneurship for many years, and Rice has the No.1 graduate entrepreneurship program in the country, which I was pleasantly surprised to learn! Lastly, the atmosphere of “family” that the admissions and recruiting team have created is warm and welcoming from the very beginning. I relocated to Houston 15 years ago for work, and it just made sense to pursue an MBA in the city I now fondly call home. :)

What are you most proud of from your time at Rice Business?

I’m proud of the many relationships I've forged and experiences gained while at Rice. I’ve been able to travel to Argentina for the Global Field Experience (GFE), attend conferences such as the Women in Leadership Conference (WILC), participate in competitions (Venture Capital Investment Competition), volunteer at the largest and richest intercollegiate startup competition (Rice Business Plan Competition), and take amazing entrepreneurship electives such as new enterprise, enterprise acquisition and financing the startup venture. All these experiences have sharpened my skillsets as I prepare for my journey post MBA!

How has Rice helped you in your career?

I currently work in the energy industry as a financial analyst. Rice has further developed my teamwork mindset and networking skills which are both paramount in my organization. Rice Business has also ignited newfound career interests for me, specifically in the areas of venture capital and entrepreneurship due to the amazing curriculum offered.

What advice would you give prospective students who are considering an MBA?

Don’t think twice about it. Take the leap of faith and apply! I am better because of the experiences I've had at Rice Business. Your trajectory after a Rice MBA is literally unimaginable!

What do you think organizations should do better to build a diverse, equitable, and inclusive organization?

Organizations should implement DEI training initiatives such as “unconscious bias” to raise awareness among leaders and employees. Awareness of biases is a critical first step in managing perspectives and bringing about change. Organizations should also consider other forward-thinking actions to support DEI, such as promoting pay equity internally and requiring diversity on hiring panels.

What suggestions do you have to work with allies within the workplace or at school?

Allies are a necessity for advancement in DEI. Allies are typically those whose privilege comes from their sex, skin color and/or position in life, and they support those who don’t have the same advantages. It is critical to identify allies (especially organizational leaders) as they can offer mentorship, advocacy, a platform for raising awareness and financial support to progress initiatives.

Do you have any other comments or anecdotes you would like to share?

Embrace the Rice MBA experience, even if you aren't completely sure what lies ahead. There is so much on this journey that will pleasantly surprise you! Life is precious and to be lived to the fullest as evidenced by COVID. Make the most of each day and show grace to others as you never know what challenges they may be facing! God speed!

Interested in Rice Business?

As tax season approaches, accounting firms are short on staff

Rice Business professor of accounting Ben Lansford says graduating students who might have pursued accounting a decade ago are now going into investment banking, data analysis and consulting: “Those jobs pay more and also don’t require the fifth year of college education.”

Rice Business ranks in top 10 for consulting, finance and more

Rice Business is in the top 10 in eight categories in the Princeton Review’s newly released specialty business school rankings for 2023. The latest accolades come on the heels of the school’s fourth straight No. 1 entrepreneurship ranking and second straight No. 4 online MBA ranking.

Rice Business is in the top 10 in eight categories in the Princeton Review’s newly released specialty business school rankings for 2023.

The latest accolades come on the heels of the school’s fourth straight No. 1 entrepreneurship ranking and second straight No. 4 online MBA ranking.

Rice rose to No. 5 among the top MBA programs for students wanting to go into consulting or finance, up from No. 6 and No. 10 in 2022, respectively. Additionally, it was ranked in the top 10 for the first time in several categories, including best career prospects (No. 8) and greatest resources for minority students (No. 7).

“This is the first year Rice Business has been ranked in career prospects, administration and resources for minority students,” said Dean Peter Rodriguez. “These rankings are a reflection of our continued efforts in providing Rice Business students with the resources to help them succeed during their time at school and beyond.”

Rice Business’ 2023 specialty rankings:

- Top 50 Online MBA Programs: No. 4

- Best MBA for Consulting: No. 5

- Best MBA for Finance: No. 5

- Greatest Resources for Minority Students: No. 7

- Most Competitive Students: No. 7

- Best Career Prospects: No. 8

- Best Administered: No. 8

- Best Classroom Experience: No. 10

Princeton Review rankings are based on a combination of institutional and student survey data, including career outcomes, admissions selectivity and academic rigor, among others. Learn more here.

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

Banking in the Bay Area feat. Danielle Conkling ’09

Season 3, Episode 9

Danielle is the director of corporate social responsibility and ESG (environmental, social and governance) for Silicon Valley Bank. She chats with host Scott Gale ‘19 about her start in the world of finance and banking, getting acclimated to Houston and its weather as an out-of-towner, the future of ESG, and her travels with her family.

Owl Have You Know

Season 3, Episode 9

Danielle is the director of corporate social responsibility and ESG (environmental, social and governance) for Silicon Valley Bank. She chats with host Scott Gale ‘19 about her start in the world of finance and banking, getting acclimated to Houston and its weather as an out-of-towner, the future of ESG, and her travels with her family.

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

Episode Transcript

-

[00:00] Intro: Welcome to Owl Have You Know, a podcast from Rice Business. This episode is part of our Flight Path Series, where guests share their career journeys and stories of the Rice connections that got them where they are.

[00:14] Danielle: I realized that so much of the MBA program for me was, really, learning from my friends and my professors, and how do you make tough decisions.

[00:27] Scott: On today's episode of Owl Have You Know, I'm joined by Danielle Conkling, 2009 graduate of Rice's full-time program. Danielle is the Director of Corporate Social Responsibility and ESG at Silicon Valley Bank. Her unique role at SVB combines her passion for giving back to the community with her extensive experience in advising entrepreneurs and leaders in the innovation economy. Danielle, welcome to the show.

[00:54] Danielle: Scott, so great to be here. Thanks so much for having me. This is super exciting. It's my first podcast.

[00:59] Scott: That's fantastic.

[01:00] Danielle: So, hopefully, you don't judge me too harshly on my performance.

[01:04] Scott: No, not at all. Really looking forward to getting to know you more and sharing your story with the Rice community, at large. And so, I just really wanted to start, like, where did you grow up? And why did you get into banking, in the first place?

[01:21] Danielle: Oh, yeah, that's actually really interesting. So, I grew up in San Francisco in the Bay Area. And back then, the Bay Area is, you know, wasn't quite what it is today, Silicon Valley, with all the tech companies and venture firms. You know, even in the '80s and '90s, we had a few established tech companies, but it was, you know, a very diverse economy. So, a lot of folks around me were like doctors and lawyers and teachers, just like anywhere else. And now, it's funny to think we have all these tech luminaries around us — and HP and Oracle. Some microsystems were certainly here, but they were kind of far and in between back then.

And to think that I was living amongst all of that and decided to get into banking is kind of funny. So, it happened, really, by accident. I went away to boarding school for high school in Connecticut. And I came back for the summer after I graduated from high school. And I knew I was going off to college in the fall, back again on the East Coast. I was going to go to Georgetown. And my parents asked me to figure out something for the summer, basically. And I think, at the time, they thought I would go to the mall and maybe get, like, a retail gig or go to the local water park or something. I really don't know what possessed me to do this, but I borrowed a couple of my mom's suits today, took the BART into San Francisco. I didn't even tell her, I don't think. I had like a half-page resume with some babysitting jobs and volunteer work from high school. And I went up and down the elevator at 555 California, also known as the chocolate towers back then. It was before 9/11. So, you could just do that. And I would drop off my resume with the front desk and ask them if they needed a temp or an intern for the summer.

And I got a couple of callbacks. But I have to be honest, I mean it could have been an architecture firm, a law firm. It could have been a lot of places, but it was Robertson Stephens, which back then was one of the premier technology investment banks. They called me for an interview and asked me if I'd be interested in working in their PR and events team for the summer. And that's how I got into banking.

So, that was an exciting summer. So, as part of that, we had a big equity research conference in San Francisco. And Sandy Robertson, CEO and founder of the firm, was hosting it. And Bill Clinton and a couple of other folks were attending. And I got to escort them from the office to the hotel on Nob Hill. And I got to learn a lot about equity. And so, that's what got me sold, was a summer at Robbie Stephens in San Francisco that I got by luck, elevator surfing.

[04:27] Scott: That's amazing. That's awesome. So, it didn't scare you off, because you... how does the story kind of continue? You went off to Georgetown. And did that sort of experience lead you into an undergraduate major in things?

[04:42] Danielle: Yeah, absolutely. Because when I applied, I was supposed to be a psychology major, which I guess was probably useful in financial markets because, you know, as we all know, there's, especially these days, a lot of psychology and mental strength to the economy and the markets. And so, I switched over to the business school as a finance major and decided to study and focus, really, on finance and international business.

I spent my subsequent years... I went back for another summer to Robbie Stephens, and that year worked with a similar team, but was more focused with the equity research team, starting to learn some of their business. And then I think, the next summer, I did an internship, actually, at a investment firm. It was UBS-PaineWebber. And so, I was with their private banking arm. The summer after that was with Chase in their investment bank. And I got to spend a lot of time with the fixed income traders. And so, learned a lot about that business. And then, ultimately, yeah, I was really focused.

And I think it just kind of built on each other, in terms of I was learning so much, and the scope of banking and financial markets became more and more appealing to me because it was all very new. But also, it was really exciting, especially as a young woman. That summer, I spent a lot of time interviewing with various investment banks in New York City. And ultimately, that's another funny story. I ultimately turned down an offer with Chase and took a job with J.P. Morgan with a role in their equity group, only for a month later for them to announce that they were merging. Things happen. Okay. And I remember, when that happened, and I got... you know, there's like you get your sign-on bonus and you sign your contract. I remember the HR recruiter saying, "See, we wanted you so badly, you know. We paid how many billion dollars." I was like, "Right, uh-huh." I wonder if you’re disappointed because I turned you down and now I'm back. But it all worked out.

[07:06] Scott: That's fantastic. So, I mean banking in... And so, you ended up in New York City early on in your career. How was that? I mean what was, kind of, the environment like? And what were some of the unique challenges of being a woman in New York City in banking? And what were some of the, kind of, the key takeaways from that time?

[07:22] Danielle: Yeah. I mean it was really exciting to be in New York City and having my first apartment, living on my own. You know, I was lucky enough because I was in banking, I could actually afford a studio. Although, truth be told, I was really nervous, you know, with all the taxes. And, you know, in New York City, you've got federal taxes, but you also have your state taxes, and you also have your local taxes, all the way down to your city taxes. And I really didn't know what I was going to end up with in the end. So, my first couple of weeks, I ate a lot of Chinese takeout and pizza and hotdogs off the street in New York because I really didn't know. But I was surprised that I had some leftover to actually have some decent meals and buy some groceries.

But I worked a lot back then, probably not too dissimilar from how it is for a lot of our investment bankers at Rice, those who decided to pursue that career path. It was a lot of fun. I learned a lot. I worked really, really hard. I didn't sleep a ton, but I also had a lot of fun. I got to meet a lot of interesting people at work. And I think it was the first time for me, like, where I felt like I had more in common with some of my 45, 55-year-old colleagues than I did with, you know, my recent graduate friends, unless they were also in banking. So, that was really interesting. I mean, I got to meet a lot of people through my young colleagues at work, and we'd meet folks at other banks. And we would have a really good time in New York. So, you know, the late night hours, sometimes we would go out afterward and, you know, have a great time together and try to celebrate the little time we could get off. But it was definitely a work-hard-play-hard kind of atmosphere back then. But I wouldn't trade it for the world.

[09:14] Scott: What were some of the things that drew you to finance? Or, what is it about the profession that really drew you in and kept you engaged?

[09:22] Danielle: So, I think a few things. In the very beginning, I think, when I was just getting into it, especially with all my internships, it was very fast-paced. I really enjoyed, to some degree, like, the betting and the decision-making you had to make on economic indicators. And I found that really interesting. I think as I learned the business more, it became more about the relationships and the relationships with clients and my ability to guide and advise them and, really, offer them solutions for, you know, some of their challenges. And I think I really enjoyed that.

And, you know, I was young. And, you know, to be 23 years old and traveling with a CFO and a CEO and going on the roadshow was a huge responsibility. But it grew up a lot from that, right? I think there's very few people who have that kind of opportunity. And I look back and I think, gosh, that's pretty crazy. But I think it also gave me the confidence that I could, really, form relationships with people that were seemingly way ahead of me in life, but that I could build those relationships and learn from them, and maybe provide even some value to them. And so, I think I really enjoyed that and, like, of course, it allowed me to kind of have a lifestyle and security that, you know, you might not have in other careers.

But I think it kind of really drove me and exposed me to a lot of things, including, like, the work that I ultimately ended up in my more recent career. It helped me find my passions outside of work. What I realized was that you can be really, really good at something and enjoy it. It doesn't have to be your life passion, right? But it enables you to be able to do the things you really, really love. I think sometimes I'll say you become pretty good at something and it just becomes easy to stay with it. And like I said, it allows you to do other things on the side to kind of round things out.

[11:45] Scott: Yeah, I love that. So, you'd spent time, obviously, grew up on the West Coast, school on the East Coast. But then you decided to come do an MBA on, as I like to call us here, the third coast down here in Houston. And so, what ultimately got Rice on your radar? And what was some of the decision-making that led you to do a full-time MBA here?

[12:06] Danielle: So, to be honest, it kind of all happened very, very quickly. So, at the time, my husband was wrapping up graduate school in Boston and we were thinking about what our next steps might be. And I always had an MBA on my radar. And he had a few job offers. And one of them was with McKinsey in the Houston office, because he would be joining the energy practice. He was focused on renewable energy at the time, but the practice was really, at that time, based there. So, it wasn't really on our radar. But I knew he was really excited about the role. And I had a couple of cousins who actually lived in Houston. And so, that was kind of compelling. And so, I reached out to Rice about the MBA program.

I think I applied in the last round. So, luckily, they had enough space for me. But they were so gracious. I loved it because it was a small program. I've always been a fan of small schools and knew that the program had all the different elements of a graduate program that I was looking for in business. And it would allow me and my husband to be in the same area. There was a lot of couples who were splitting up for career reasons or for school, and I didn't really want that to happen. But when I visited, I really enjoyed the people and I had such a warm welcome. And I remember meeting another “McKinsey significant other” who was a year or two ahead of me, who had also gotten their MBA, and just spent a lot of time with her and convinced me that, you know, this would be a good path to pursue. And so, that's how I ended up becoming an Owl.

[13:59] Scott: Super cool. I mean, what were some of the experiences being in the full-time program that have stuck with you now over the decade now since you've graduated?

[14:08] Danielle: I really think it was the friendships and the relationships that I built over those two years. Moving to a city where, beyond two cousins, I didn't really know that many people. My husband was traveling four or five days a week. Getting to meet people from all over, it's funny now because it's been a while. It seems really crazy. It's been over 10 years. And I'm still in touch with classmates. I feel like wherever I go and I was just on WhatsApp with a couple of my guy friends from the program. And they just had babies over the last couple of years. And we were just really excited to show those cute photos.

And I think about when we first started getting to know one another, we were all trying to figure out the program and how to tackle it all. And I'm sure that first semester was stressful at times and trying to figure out how to work together and how we built relationships and how we learned from one another, and then all of that. And then, when we graduated, having those relationships, where we all went off and reconnecting how many years later and still having that commonality and that relationship to one another and, really, those memories. Because I think it's really special. For me, that's really what I got out of it.

And I think, you know, I learned a lot about how to think and how to develop leadership skills and strategies in business beyond what's sort of the more tactical work that you do. I realized that so much of the MBA program for me was, really, learning from my friends and my professors, and how do you make tough decisions? And I still think I rely on some of, some of that, maybe, to become a little innate to how I go about things.

[16:09] Scott: Yeah, very cool. Was there anything that surprised you about the experience? Coming to Houston and starting school, were there... was there anything that you kind of expected? Like you said, you had some cousins here and things. Maybe, you had a few expectations.

[16:20] Danielle: Yeah.

[16:20] Scott: But anything that surprised you as you kind of settled in?

[16:24] Danielle: So, the first couple of days of orientation, we were starting to meet our professors. And there was one who, like, couldn't make it. And it turned out... So, it had been one of those like super hot humid weeks. Like, those of us not from the area were like, "Whoa, this is intense." And then it would like... it'd start, like, raining golf balls every morning at like 3:00 a.m. and, like, tropical, right? It was like flash floods. And I was not used to that. Like, I had lived on the West Coast, on the East Coast. And I had never seen anything like it. And, turned out that, that professor had to go rescue his wife because she was caught in one of those underpasses, and they had to have, like, the firefighters. And I was like, wow, that's a real thing. And I remember at the time being like, "Wait a second. But I parked my car in the garage underground," and being like, I really hope there's not going to be a problem.

But, you know, we went through a lot of that, I think, together. And I remember Hurricane Ike happened when I was there. And I remember I was out of town and calling a business school buddy who lived around the corner to check on my house. And he did that. I mean, that's why, like, those things are so memorable to me, because that whole experience of living in Texas was just so different from anything I had experienced. But again, it was really my Rice friends that made it so special and, really, just so easy to, like, acclimate, because, of course, like, the local Texans were like, "Don't worry. We're on it," like, you know, because all of us from outside of the area were just like, what is going on? And Hurricane Katrina, I mean all that happened right around then.

[18:11] Scott: Yeah, the weather is definitely something to get used to. I wanted to touch on something. You kind of mentioned that your early career enabled you to kind of pursue some passions. And so, I wanted to explore a little bit of the next phase of just, how did you end up post-graduation back on the West Coast and some of the passions that you're pursuing and how some of those came to be?

[18:34] Danielle: Yeah, absolutely. So, the Rice experience was very special for me for many reasons. I went to New York for my summer internship. I worked at American Express. And I was doing some of their corporate card partnerships work. And during that summer, my husband and I ended up getting pregnant. Totally unexpected. And I remember calling the dean at the time and being like, "Hey, uh, bad news. I'm wrapping up my internship, but I'm having a baby in nine months. And so, I don't know if that's going to be an issue for graduating." And he was like, "Well, first of all, this is good news." Like, "Congratulations. And by the way, I just want to let you know that worse things have happened. And this is a good thing that's happened. We will make it work, and you will graduate on time." And that was amazing. And I did.

And so, I went to some extra classes. I did some classes with the evening MBAs. I did a special, sort of, in my last semester, once the baby was born, some research projects with some professors. But I was able to graduate. And my son, who's now 13 and a half, was able to be there for my Rice graduation. So, I don't know if that makes him like an honorary Owl or something, but he was in my belly.

And my classmates and my professors were so amazing about the whole thing, because I do remember, like, literally pitching, like, some real venture capitalists, very, very pregnant. And I couldn't even get on, like, a real suit on because it just was that time and it wasn't going to work. And they were just so fabulous. And I would bring food. Like, I was always hungry. So, I would, like, bring food to class. And people were like, "Oh, my God, there she is with her Whataburger and her burritos." And, like, the professors were just, like, amazed. They were like, "She is here. She is getting her work done. She brings, you know, her giant Freebirds burritos." But it's all good, so...

And I think what I realized with that and, really, like, the community and everything rallied around that, and just were so, so helpful is that I graduated in 2008, which was a challenging time and decided not to take my offer from American Express because I didn't want to move to New York City again with a baby. But I also... I don't know. I just wasn't in a place where interviewing made sense. And so, I decided to just not interview, and I would just revisit things when I was ready.

At that point, when I was graduating, I just started talking to, like, alumni. And actually, originally, I kind of shifted gears because I didn't know what I could do and where I wanted to end up. And I decided to just stay in Houston. So, my husband had this really great gig at McKinsey. And he was doing well with the Houston office. But I decided to go back into banking, which was not my plan because I was doing more like corporate development, partnerships, product development at American Express, which I was really excited about. But, you know, life's happened. And then, I was like, all right, how do I pivot my skills to something that's flexible in case like we need to move at some point and I'm not going to be in Houston? Like oil... you know, oil and gas is great, but the reality is that like it's more than likely I would move back to the West or East Coast.

And it was actually a Rice alum who graduated a year ahead of me. I had re-engaged with J.P. Morgan, who I'd started my career with right after college. And a colleague was like, "Hey, I don't know if you remember, there's another colleague that we worked with closely. He is now the head of the private bank for J.P. Morgan globally. You know, I'll put you back in touch." But then, also, I learned that there was a couple of Rice MBA graduates who were in the Houston office.

So, Charley Donaldson, if you're out there, as an alum, thank you. He got me introduced to the Houston office directly. And then it was great that friends of mine from my previous career kind of rounded out some of those introductions. And so, that's where I ended up. But pretty quickly into my career, I got an opportunity to move back to the Bay Area and help open the Silicon Valley office for J.P. Morgan's private bank. And that's what really brought me back.

But I'd say, throughout my entire career, particularly after my MBA program, I was doing a lot of nonprofit work on the side. So, even when I was, you know, a banker, a consultant early in my career, you know, I had limited time, but I was always like volunteering or mentoring or something. And that was a lot of what I had really enjoyed as well during my MBA program with those opportunities. So, when I got back to the Bay Area, I started looking for opportunities to like advise, join junior boards, and things like that. And that's what got me started.

And so, you know, I continued my career, went from J.P. Morgan's private bank to Citi's, stayed on with a number of nonprofits, working with them and advising them. And then when I joined SVB and took a leadership role, leading their strategy work for the private bank, I got to be really good friends with the head of corporate social responsibility at SVB. And that was exciting because, like I said, I was always doing this on the side because it was like my passion project. But then, one day it was like, well, what if this was your full-time role? And I was like, oh, and you would pay me for that? And he said, "Absolutely."

And it was kind of a leap of faith, but I also knew that, if I ever wanted to go back to banking, I probably could. And so, initially, you know, I was focused on sort of philanthropy and community and the strategy around that. And then, you know, it was also at a time that ESG and sustainability was on the rise and our board of directors and our legal and investor relations team were trying to figure out, sort of, how SVB would start to build, sort of, a strategy and program around it. And they were like, "You've done some of this work and you've built strategies before. Maybe not around ESG. You can figure this out." And so, complete departure from what I had started my career in, but not really, because for a long time, there was that lens of ESG investing. And so, it wasn't unfamiliar to me. It was just, you know, really, just different to do it from like an issuer perspective.

I never looked back. I took the opportunity and decided, yes, I'm going to try this. And I love it. And I don't think I would ever go back to banking. I mean, I miss the client work, but I've also figured out how to bring it together. So, a lot of the work I now do around ESG and sustainability is around, you know, how do we integrate this into how we do business, how we operate, and how we serve our client ecosystem?

[25:46] Scott: I think that's amazing. There's, like, two things there that I feel like I want to unpack. Let's stay on the Silicon Valley Bank thread for a minute, because like you're describing, ESG and corporate sustainability are all topics of interest and growing. And so, you are at an amazing organization, working on big important things. Like, how do you think about and describe the challenges around ESG and corporate sustainability for big organizations?

[26:16] Danielle: Yeah. I mean I would say that ESG is broad. Terminology is tricky, right? Everyone's like, "Well, what's the difference between ESG and sustainability and corporate responsibility?" So, that in itself is a challenge, and there's nuances to all of that. But it is broad. And depending on what stage your company is in or what type of industry or sub-sector, like, what's material to your organization, can be very, very different. So, it's not like this one-size-fits-all. And trying to wrap your heads around that and being able to prioritize, it is a learning experience, I think, for everybody. And sometimes, it's not even the obvious things.

So, I think that's one challenge. I do think another challenge right now, especially, in today's economic market environment, is where does this fit in and how is this prioritized, given that there's so much uncertainty for companies right now? How do they keep focused on this and see it as part of their long-term strategy and make those investments and see it as contributing ultimately to the bottom line when it sometimes feels like, because you're trying to stand it up, you know, they're simply expenses? So, I think that's another challenge right now.

And then I think the other challenge is, honestly, expertise. There's very few sustainability experts in the world, and certainly, those that have practical experience implementing this within a real operating organization. We've always had lots of academics and researchers and thought leaders. There's only so many consultants that can go around. And so, you'll see a lot of people like myself who came from within the industry and might be passionate about it but might be learning it as well for the first time.

[28:26] Scott: Fewer practitioners, and it's a, it's a practice that is evolving as we're experiencing it. It's an exciting space. You know, you see kind of in the news, like one article that I was just looking at recently was the Patagonia restructuring and assigning all the profits to address climate change and some of these big issues. How do you think about the spectrum of outcomes and the purpose of business... and I don't mean to put you on the spot with kind of a random example, but I'm just using that as an extreme example that's out there as organizations wrestle with their responsibility as an organization. Can you share just a couple of thoughts or things that, kind of, are guiding principles for you as you wrestle with those items?

[29:07] Danielle: Absolutely. I mean, Patagonia is so inspiring, but they are much more mature in their sustainability work. This is something that they were kind of founded on, that the principles they live by, and it's really integrated into how they operate as a company. I think most companies are much further behind in that they are so learning in trying to figure out how to catch up and figure out... like, it wasn't part of their founding and their purpose as a company. And so, now, they're trying to figure out, well, okay, how do we make ourselves purposeful? What is our purpose?

And for some, it's a bigger pivot, right? Like, it really challenges what they do and how they think about the world and the everyday widgets or services that they put out there into the market. So, I think it can be challenging for certain companies, but I think that the good news is that there's a lot of stakeholders out there who believe in this and understand that ESG and sustainability do have an impact on long-term sustainability of the company, success, and ultimately, its profitability and returns to investors, right? And it takes time to realize that because you really have to embed it into how you do business, right?

So, it's also... you know, it's as simple as diversity, equity, and inclusion. You know, if you have diverse perspectives, you're probably able to tap into a broader client base and also able to appreciate, like, others' values and interests and needs. So, that should be a good thing. But to be able to demonstrate that takes time, of course.

So, that's just like an example. The other example, right, would be around climate. A lot of the work, if you think about it, the investments in ESG actually allow companies to also reduce costs and create efficiencies over time. But again, that takes time. And a lot of it's new. So, there's that time that you need to kind of build it and then roll out and implement a lot of this work. And then, to realize the benefits also takes time. You know, I think most companies are just beginning that work right now.

[31:56] Scott: That's really helpful. And I'm curious, I suspect that there are people that come to you for advice on, like, how did you get into sustainability and how do you kind of make that transition? And it sounds like a bit of you pursued kind of some passions in your own free time that built some of those muscles and that exposure. Is that, in your view, kind of one of the best ways to execute that pivot? Or, are there other resources that you've seen that are, that are starting to kind of surface that people who have that interest might be able to take that leap and start to add to the talent and capability that are solving these kinds of problems?

[32:35] Danielle: Absolutely. I mean I think I'm kind of part of the generation scramble where they need to get leaders in place and they had to pivot some of us. I don't know that that's sustainable, obviously. But I do think that there is a lot of interest at many levels of talent in organizations. So, I always say, just don't dismiss that, because sometimes I've focused a lot on kind of the broad corporate responsibility. But as I shifted more of my time to ESG and sustainability and climate work, the philanthropy community work that I was doing... actually, a colleague took over who was passionate about that work. And she'd been a really, really senior leader, a managing director doing completely different things. But it was sort of her passion work that she would work closely with us.

And similar to me, a lot of people are looking for purpose in their careers. And I tell a lot of young people, I think there's more opportunities, because one, your universities and colleges now have sustainability-focused curriculum. So, you're going in with... you'll be going into interviews and opportunities with some kind of foundation versus I had to go, read about it, hire a bunch of consultants, and kind of learn on the job.

I think another opportunity is consulting firms, they are losing a lot of their top talent in-house, because every company that's now doing ESG has to be able to demonstrate that they have leadership focused on this work, which also includes talent with certain expertise. So, they're losing a lot. And then the big consulting firms who were not sustainability firms are also trying to hire those same consultants because they need to build sustainability practices. So, they need a bench. And so, I would say, you know, there are, like, the pure sustainability firms like ERM, BSR, and DSS, all of those firms. But then, the McKinseys, the BCGs, the EYs, the PW, all of them, the Deloitte, like, they're all also doing it. And what's nice is you have a lot of resources, and it's a good way to work on different types of consulting engagements and projects, you know. And then you can go on. Oftentimes, it's like their clients will hire them, which is why they're in this predicament that they don't have enough talent. So, I'd say there are different ways to go about it. But I mean, I really like the consulting approach, especially because ESG is still evolving. So, it's not a bad place to start.

[35:24] Scott: I would be remiss if we didn't get a chance to double-click and talk about some of the philanthropy work that you've done, an organization called Girls Leadership and another one called BUILD. And I'd love to just get a little bit of some of the learnings and experience and kind of how you got in and kind of sustained some of your work with these organizations.

[35:42] Danielle: Absolutely. So, I've known BUILD for a really long time. When I moved to the West Coast after my time in Houston, I was looking for something where I thought, you know, I could mentor but I could also be an advisor to the organization. And at the time, my company, J.P. Morgan, we had a corporate foundation. And there was a number of organizations that we've been supporting and doing work with, and, you know, out there in the community with our clients. And they were just on a list.

And I liked what BUILD stood for, which at the time was about helping kids who were struggling in high school in low moderate-income communities find purpose and academic re-engagement through entrepreneurship. And what I liked is because I think, a lot of schools, even challenged schools, have their really strong students. And this program actually targets those that are at risk of dropping out. And they use entrepreneurship and the idea of, like, get together with a group of your peers, learn how to start a business, learn how to put a business plan together. But they also learn things that we learned in our MBA program, like, how do you put a financial statement together. How do you put a marketing plan? Those are things I would never have done as a 14 or 15-year-old. And here they are, doing that, coming from some of the most challenging circumstances.

And they get these mentors from really cool companies like Google and Facebook and SVB and other companies. And they get the support of real Silicon Valley venture capitalists. And I loved it. I started out as a mentor, worked with them prepping for business plan competitions, became a business plan competition judge, joined their associate board, became a board member in Northern California. I'm now on the executive board of their California State Board. And I've just really grown with them.

And part of the reason why, like, I continue to be involved and support their work is because the outcomes and the fact that their programs really do change the trajectory of life for a lot of these kids and their families is just amazing. And, in fact, one of them who went through the program is now a fellow board member with me. Her story at one of the fundraisers is what really hooked me. And we're friends now. And it's people like her that really drive that. And then continue to be involved with Girls Leadership. Although, you know, there's a couple of others who have taken my board role recently at SVB. It was time to pass on the reins. But, you know, I really believe in that, as a woman, especially somebody who started her career in the investment bank in New York, being the only female on my first team, which was quite daunting, just helping girls really develop their voice and their confidence is really important. And so... and you really have to do that early, because they've seen a lot... There's a lot of research that sees two big drop-offs.

And a lot of them is actually, one, the age at which my daughter is in, that's a nine-year-old in fourth grade, is usually a big drop-off. That's also, like, the age where, like, girls and boys temporarily sort of split up. But sometimes, it's unintentional, but the grownups in their lives, whether they be teachers or educators or even parents, unintentionally, some of the messaging and signaling how they've treated signals that, you know, there are certain things that are meant for them versus others. And so, that's where you see a lot of that drop-offs.

There's another drop-off that tends to happen, actually, during the college years, where there's another drop-off in confidence amongst young women, whereas there's a rise in young men, oftentimes. And obviously, there's lots of factors to that. So, in today's age, you know, there's lots of things, you know, may not work exactly like that, but... So, that work is really important because it helps provide the programming to help support the girls in developing their voice very early, as early as, like, kindergarten, but really builds on that in an age-appropriate way as they get older all the way to university. It could be as simple as, like, book clubs and them being able to, like, voice their ideas around plot or a character to, like, improv.

And so, there's a lot of things that you can do. But a lot of it, too, is about educating the grownups in their lives along the way so that it's a consistent experience for those girls. And so, that's why I became involved because it's not always easy, especially if you are a young woman in a career that, you know, is maybe a little bit more male-dominated. That work is really important. It's been important to me, especially, because I have a young daughter, and a young daughter, I would say, that, you know, has kind of a very big, bold, independent dreams for herself.

[40:49] Scott: Really appreciate you sharing. I have three daughters myself that are in those age ranges. And just love hearing that perspective, and appreciate that. As we get close to the end here, Danielle, I wanted to ask, I understand that you like to travel to, kind of, some off-the-beaten-path places. And so, I want just to sharp-pivot in the discussion to get your top travel location recommendations, places you've been.

[41:18] Danielle: Oh, gosh, this is hard. So, my family loves to travel globally. And off-the-beaten-path is our preference. With COVID and everything, it's been a little bit of a challenge. But our family has been to Iceland, to Morocco, to some interesting places in Japan, Ireland. We are currently planning our trip to Europe next year and hoping to go to some sort of more remote islands in Greece. And I'd say, over the last couple of years, I've found some really cool gems in the U.S. as well. So, we discovered this amazing “dude ranch” experience in Wyoming. And now, it's become a little bit of a tradition. And my kids are kind of little cowboys and cowgirls. And it's been a really fun time and something we've done. And now, we've recruited a lot of friends to come do it with us. So, you know, cow sorting is our new thing. Take advantage and, you know, especially, while you're at Rice, there's always some really cool trips. I remember some classmates going to Africa and building incubators for communities out there. Take advantage because, as you know, you can't always take for granted, like, the time you have to do those adventures.

[42:39] Scott: No doubt. That's a great perspective. Danielle, really, it has been a privilege to have you on. This has been fantastic.

[42:44] Danielle: Thanks, Scott. It's been fun.

[42:47] Scott: Thanks for listening. This has been Owl Have You Know, a production of Rice Business. You can find more information about our guests, hosts, and announcements on our website, business.rice.edu. Please subscribe and leave a rating wherever you find your favorite podcasts. We'd love to hear what you think. The hosts of Owl Have You Know are myself, Scott Gale, and Maya Pomroy.

You May Also Like

Chikere Ogbonnaya

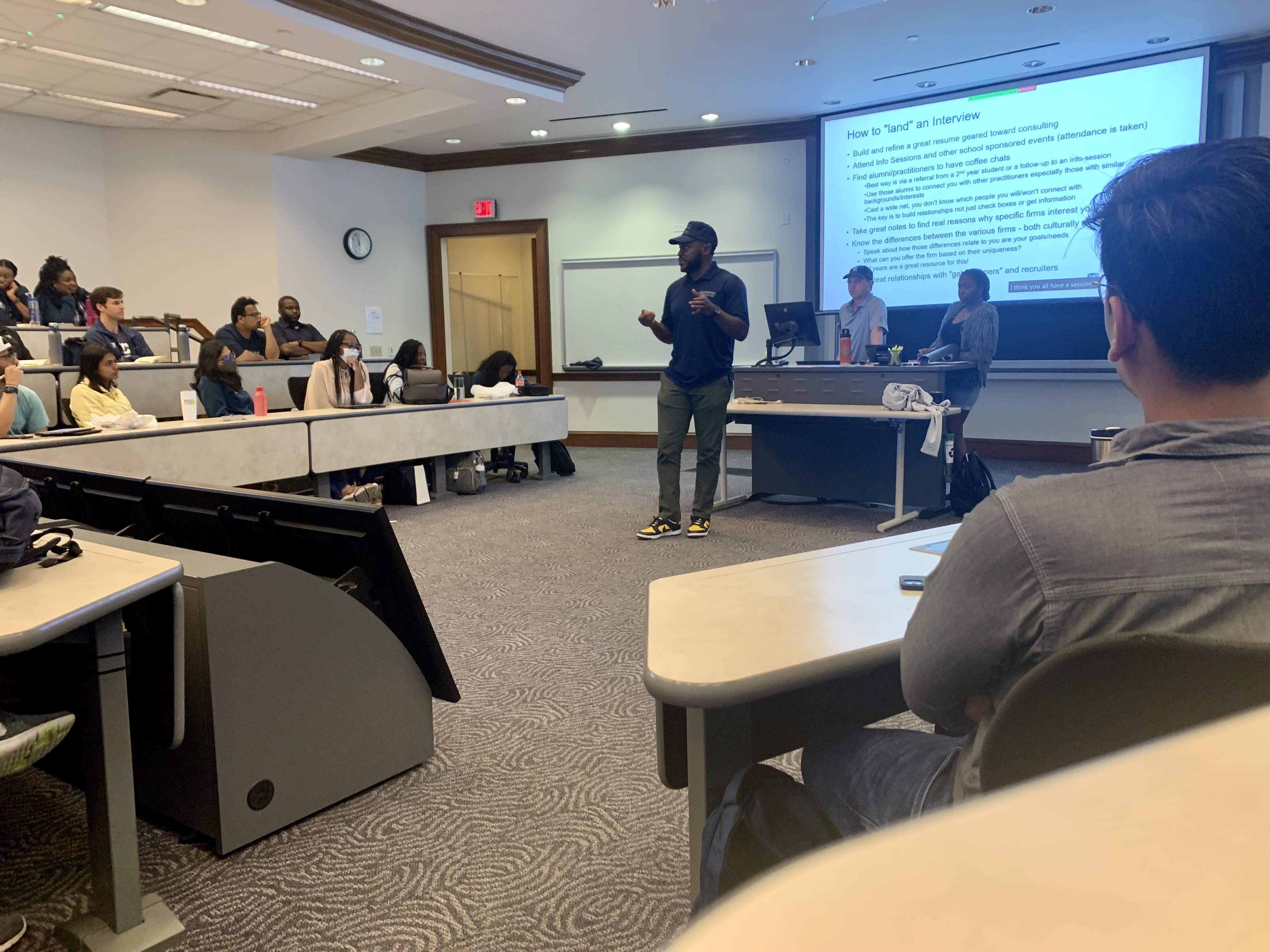

Meet Chikere Ogbonnaya, Professional MBA '23 and president of the Consulting Association

Why did you choose Rice Business?

While researching possible business schools, my top priorities were proximity to home, an exceptional network and reputation, and a nurtured sense of community. I wanted a top-ranked institution that had a relatively small class size to leverage interpersonal relationships with my professors and classmates. Those priorities landed me with a clear answer, which was Rice Business.

What are you most proud of from your time at Rice Business?

Though I relished getting to meet and learn from my extraordinary classmates and professors, I am most proud of successfully navigating a career pivot and leading the largest student organization at Rice Business. The consulting internship recruiting cycle is rigorous, it takes a great deal of preparation and networking. I landed an internship which led to a full-time offer with a Big Four firm. I leveraged my recruiting experience as an opportunity to pay it forward through leadership of the Consulting Association.

How has Rice helped you in your career?

In addition to making a career change, I gained the understanding of evaluating a business from the outside in. Rice allowed me to obtain an abundance of information on macro-business analysis. Foundational courses such as accounting, finance and strategy will play a major role in my career progression, as I plan to apply lessons learned from case studies and lectures. Additionally, Rice Business’ nationally ranked entrepreneurship program has increased my knowledge on how to effectively manage my business. Being able to interact with guest speakers who have created or led successful businesses was a highlight of my Rice experience. As the founder of DOCUMENTED.CO (a clothing and lifestyle company), I began my MBA seeking to learn more about scaling my business. Rice allowed me to gain fresh insights on ways I could improve my business operations, from pricing to marketing and much more.

What advice would you give prospective students who are considering an MBA?

Everyone will have a unique path leading up to the decision to earn an MBA. I would advise dedicating time to reflect on what you want out of an MBA program. Whether it is a career pivot, rising within your current organization or just gaining some necessary business skills for an entrepreneurial journey, you should have an idea of what you would like to gain from the program. Networking is a key component of the MBA program experience. The relationships you build as a student can last throughout your career. You may be seeking new career opportunities, in which your peers may become your future colleagues and your lecturers could become your references. I suggest taking time to get to know people who share your path.

What do you think organizations should do better to build a diverse, equitable, and inclusive organization?

Building an organization that promotes diversity, equity and inclusion starts with fostering a space that sees it as a strategic priority. Diversity of representation is shown to have a positive impact on a variety of areas, including innovation, employee satisfaction, and even the bottom line. The leadership team should make it a strategic priority with clear goals that are being reviewed regularly. An adjustment in hiring practices will have a positive impact in achieving a more diverse, equitable and inclusive organization. During the hiring process, a diverse slate of candidates is necessary, but an organization should consider maintaining a diverse hiring team to ensure an objective and fair process. Finally, the leadership team should be held accountable. Once an organization sets clear DEI goals and measures results against them, hold the leadership team accountable to those results.

What suggestions do you have to work with allies within the workplace or at school?

Working with allies ultimately means showing up consistently. Not once, twice, or just when it’s easy, but every time, until the workplace or school is equitable. Being open to learning is crucial when working with allies, as you will encounter situations where you may not be familiar with how to react. Being an ally means listening to what individuals in a marginalized community need and recognizing how you can be part of a positive change. Working with allies requires you to consistently evaluate your behaviors and biases to make sure your actions are aligned with creating a more equitable environment.

Do you have any other comments or anecdotes you would like to share?

Rice Business was recently ranked #5 as the best MBA for consulting by Princeton Review, moving up five spots from the 2022 ranking. This is an important moment for me as I conclude my MBA. Upon taking on the role as president of the consulting association in 2022, it was a goal of mine to get that ranking to the top five. I am grateful to the Career Development Office, my great leadership team and the second years that made this possible.

Photo credit: @riaotherworld on Instagram

Interested in Rice Business?

Xavaier Oliphant

Meet Xavaier Oliphant, Full-Time MBA, 2024

Why did you choose Rice Business?

Rice reminds me of home. In some ways, the community reminds me of Texas A&M, where I received my first master's degree. While at Prairie View A&M, I became accustomed to a small, close-knit community and was fortunate to find this at Rice University. Also, Rice is in Houston, where most of my network is based. Since I already have a vast community of people from my previous school, family and fraternity in the Houston area, who I know are very supportive, I knew Rice would provide the best opportunity to advance my career.

What are you most proud of from your time at Rice Business?

One accomplishment I am most pleased with is my ability to step out of my comfort zone and meet people with like-minded views. Rice taught me the principle of sharpening iron with iron by emphasizing the willingness to help others and the courage to seek assistance. As a result of this valuable lesson, I have encountered people willing to support others through difficulties in school and other life challenges. Thus, after my year at Rice, I know that courage and service are essential to winning. No one is an expert in everything; to win, we must work together.

How has Rice helped you in your career?

Rice's MBA program taught me how to overcome imposter syndrome. I started the program with doubts about what I could achieve and whether I was in the right place. It was undoubtedly a challenging path. However, over the past year, I have learned that discomfort is essential to growth. During my time at Rice, there were moments when the only options were to give up or to get strategic about how to succeed. With the proper support and lessons, I thankfully chose the latter option.

In addition, Rice has prepared me to be an effective leader by equipping me with practical skills and interpersonal knowledge. I understood that everyone is unique and comes with a different perspective, and I developed a skill that is essential for all leaders. I learned how to discover people's superpowers and utilize their talents to create masterpieces in the marketplace.

What advice would you give prospective students who are considering an MBA?

I encourage every prospective student to understand their "why." Why do you want an MBA? What drives you? Is this MBA going to make a difference in your career? If you want to take this route, you must answer all three questions. An MBA is akin to starting a new job; everything and everyone is unfamiliar. Also, you must start over without compensation to learn something that will advance your skill set in the long run! There are less challenging programs; however, they come with different and fewer benefits than Rice. This choice is what we call an opportunity cost in business. You have to give up something to gain another. Remember your why when things get tough in school. Be confident and trust in yourself to overcome all obstacles.

What do you think organizations should do better to build a diverse, equitable, and inclusive organization?

Diversity, equality and inclusion are necessary for the workplace and should be continually emphasized. One area most organizations can improve is providing mentorship to their minority employees. This mentorship should cover the training and coaching they need to climb the success ladder and eliminate the need to work ten times more than their counterparts to achieve the same results.

What suggestions do you have to work with allies within the workplace or at school?

My approach to working with allies at work and school is to be amiable, show your humanity, ask them how their day is going, and genuinely care to know. It is possible to open doors just by building a relationship with someone. Building a relationship can start as simple as asking them to grab a coffee or commenting on something about their work or something else that matters to them. Also, I value people's opinions, especially if they are an ally in a group setting. You can significantly impact others by listening more and talking less.

Do you have any other comments or anecdotes you would like to share?

There will be people who do not understand why you chose the path you did in life. There are times when people give you advice on what you should do. This uncertainty is scary for prospective students, but if you've been thinking about it for a while, go for it. As you build your network, don't be afraid to make a move if you believe it will benefit your family or community in the long run. Yes, dreams come true, but only when you get up and take action!

Interested in Rice Business?

Houston university's online MBA program rises in the ranks of newly released report

Rice University's online MBA program has something to brag about. According to a new report, the program has risen through the ranks of other online MBA curriculums.

A Rice MAcc Student’s Public Accounting Internship Experience

During the summer before the one-year Rice Master of Accounting program, Rice MAcc student Jasmine Lee interned with EY, one of the “Big Four” public accounting firms. She writes firsthand about her experience.

During the summer before the one-year Rice Master of Accounting program, Rice MAcc student Jasmine Lee interned with EY, one of the “Big Four” public accounting firms. She writes firsthand about her experience.

Initial Expectations

As a psychology major who had taken just three accounting courses by the time I completed my bachelor’s degree, I came into my summer audit internship at EY not knowing what to expect. Many of my soon-to-be coworkers had graduated as accounting majors, and a few of them had even previously completed other accounting internships. I initially wondered whether I was going to be behind, but my concerns disappeared as we began our training. Critical thinking, the ability to learn and adapt quickly, and an engaged mindset were really the core of what we interns needed to be successful. Once I understood this, I realized there was no reason to be afraid of falling behind or making a fool of myself. All I had to do was ask questions when I had them and stay engaged as I learned.

The Work Environment

When I started my EY internship, the other interns and I completed our training virtually. Nevertheless, we came into the office to meet with our teams for most of the week. I worked from home on Mondays and Fridays while commuting to the EY office or the client’s site for the remaining three days. This balance was amazing! Most public accounting firms are transitioning into this hybrid environment, and I believe it is likely to remain in the long run because employees have responded so well to it. I enjoyed the opportunities to work in-person with my team because it allowed me to build closer relationships with them and really experience what it is like to work as an auditor at EY.

I had two clients during my ten weeks, a technology company and an oil & gas company. Though my internship was during the summer, which is typically a slower season in the audit service line, I still learned a lot through my work. I sat in on update meetings, learned about the different steps in the audit process, and produced worksheets of my own that I got to sign off on at times! I appreciated feeling like my team trusted me to take on challenging tasks, especially when using database applications like PowerBI that I had never used before. I asked questions freely and made sure to take detailed notes whenever a “senior” explained a task to me.

Interested in Rice Business?

Plentiful Future Opportunities

Throughout the summer, EY hosted several networking events, including an international intern conference. The conference in particular allowed interns to get to know each other better, which I really appreciated because they are people likely to be my future coworkers. EY had a myriad of engaging speakers at the conference who demonstrated how versatile and expansive a career at a Big Four firm can be. It was eye opening. It struck me that as someone continues working, different experiences in different projects will present opportunities to pursue arenas that suit their strengths and interests.

By the end of my time with both client teams, I felt welcomed by everyone like I had been working with them for longer time than I had. I made wonderful friends and connections with not only my teams, but also with fellow interns! While I didn’t experience the most technical aspects of an audit in my summer internship, the environment that EY facilitated gave me insight into what it would be like to work at this firm. They provided the skills to succeed and the confidence to be ready for a full-time job. Beyond the professional aspect, I formed relationships I will rely on into the future. I know that many of my fellow interns had a similarly good experience, and I will be working with many of them at EY as staff after I graduate with my Rice MAcc degree!

EY extended Jasmine a full-time job offer at the end of her internship. She will start as an audit associate following her graduation from the Rice MAcc.

Interested in learning more about the Rice MAcc program or the career opportunities the Rice MAcc opens up? Visit our Admissions page or email us at RiceMAcc@rice.edu.

You May Also Like

Keep Exploring

MBA programs are nearly reaching gender parity with more than 41% women enrollment

Ashley Ward ’24, a fellow with the Forté Foundation, an organization focused on career development and business education for women, and Ashleigh Rogers ’24, talk about what it means to be a woman in business.

A DeSantis proposal parents agree on: banning cell phones in classrooms

Limiting cell phone use in classrooms may be one issue that can unite parents, school administrators and politicians from both sides of the aisle. Rice Business marketing professor Vikas Mittal contributes this opinion piece to The Hill.