The Journey From Engineer to Entrepreneur feat. Karen Crofton ’10

Season 1, Episode 3

Karen Crofton ’10 talks about her journey from engineering school to Rice Business to teaching entrepreneurship at the University of Colorado, as well as her role as an investor in data and financial technology startups.

Owl Have You Know

SEASON 1, EPISODE 3

Karen Crofton ’10 talks about her journey from engineering school to Rice Business to teaching entrepreneurship at the University of Colorado, as well as her role as an investor in data and financial technology startups.

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

You May Also Like

The Rice Report: Congratulations, MBA Student…and Family

Full-Time MBA Katie Chung's next column of the Rice Report dropped for Poets&Quants last night. Check out her latest advice about connecting with family and friends during your MBA journey.

Congratulations, MBA Student…and Family

Missing your friends and family? Here are some strategies to connect with loved ones left behind by the intensity of the MBA experience.

Embarking on an MBA journey as a full-time MBA student is a pathway to unparalleled personal and professional growth. Whether you’re pivoting careers like a seasoned performer transitioning to business, or simply elevating your existing skills, an MBA opens doors to vast new networks and opportunities.

This blog post was originally featured in Poets & Quants

I don’t know about you, but for me, going to business school was a huge decision. I am a career pivoter. And a big one at that! For context, just a few years ago I was performing in one of my final shows Off-Broadway. Days were devoted to dance classes, voice lessons and memorizing callback materials; my evenings were spent in full beat, wigs, and costume. Usually around 8:30 p.m., I was cartwheeling onstage for the next big musical dance number.

So, when I decided to switch gears from my BFA to an MBA, I wanted to get it right. I thought about everything from class size, to grocery store options near my apartment. No more NYC subway trips with multiple grocery bags for me, thank you! I did my research and created my own rubric. Decisions are not easy for me, so I took this on like the others. I gathered all necessary information and weighed each option very carefully, knowing the right choice comes from this detail-oriented process (For Brian, my significant other, my commitment to thorough decision-making is the bane of his existence since it applies to dinner decisions too).

What I did not think about was who was going to school with me – and who wasn’t. This may shock you, but your entire inner circle goes to school with you. That’s right, it’s not just the shining MBA student. It’s your family, your friends, your significant other, your kids, and your pets. In fact, I think my dog has gotten more swag this year than I have! Once at school, it struck me that it was almost a second job working to stay connected to the people I care about while also trying to be present for schoolwork, team meetings, and networking.

As we enter our two-year programs, we’re also presented with a new group of people who may soon enter that inner circle. My classmates were like-minded people with extremely unique backgrounds. I met a student who was simultaneously pursuing an Aeronautical and Astronautical Engineering degree with his MBA. In other words, he is a rocket scientist! I wanted to make room for all of this. Simultaneously, I was learning literally every foundation of business for the first time. My brain was slightly overwhelmed. How can one do it all?

I have my own perspective about family, friends and business school but I wanted to learn more about what my classmates went through. I spoke with two of my second-year classmates, Amie Uttecht and Kunal Shinde, who brought some unique perspectives. After both conversations, three themes really stood out to me: manage expectations, stick to a schedule, and find your tribe.

MANAGING EXPECTATIONS…WELL SORT OF

As I went into these conversations one of my prepared questions centered around how to set expectations for your family. Except, thinking back, I didn’t manage expectations at all because I had no idea what to expect. When I spoke to Amie, she told me about an experience she had early on.

“We had family in town and we were at dinner, I had to excuse myself to go do schoolwork and sometimes people can forget all the work that school entails, and I had to explain that I had to go write a paper. I probably didn’t do a good job of setting expectations in the beginning. I didn’t fully understand all school was going to encompass because I had been so far removed from academia.”

It is hard to think back and remember how many hours I’d spent in the library writing my thesis as an undergrad. Even though Amie and I did not set exact expectations, we found it naturally worked itself out. With loved ones, the only expectation I set was that school was a change I was making in my life and it was important to me. I am lucky that this was all I needed to do. My immediate family and my chosen family supported me; they understood that sometimes, like Amie, I would need to step away from a dinner or I wouldn’t make it to a family event because I had a team meeting or a final the next day.

That doesn’t mean it was easy. I live with Brian and I didn’t do a great job of setting expectations at the start with him. Our adjustment was more go with the flow, not really who I am at my core. Some Saturdays, the list kept adding up. I knew if I ran errands or went out to dinner, I would only be thinking of the finance practice problems I needed to work on. On other occasions, if I finished the short list, we would quickly make a reservation for dinner and enjoy a new restaurant. Brian was flexible and rolled with the punches. It was easier because we knew there was an end date to this.

Interested in Rice Business?

SCHEDULE, SCHEDULE, SCHEDULE

After speaking with my classmate Kunal Shinde, I am signing up for his future TED Talk on how to schedule effectively. After my go with the flow approach, the idea of more structure is extremely appealing. One of the themes that came from our conversation was the importance of writing critical items down and scheduling them in. Kunal moved to Houston from Pune, India and his family is still there. He was not only balancing this new school schedule and recruiting, but also working with a time difference when trying to connect with his wife, son, and new baby daughter. Kunal emphasized the importance of “being ruthless” with your time.

“Make sure you are not wasting your time,” he told me. “I block times for my classes and then I have my calendar filled with everything from family time to mealtimes because of the time difference. So, my family doesn’t have to wake up very early and I don’t have to stay up very late.”

Kunal talked about how prior to his MBA he found a sweet spot in work life balance; he figured out what worked best for his family. When he began b-school, he simply transferred this philosophy. One of the most meaningful nuggets of information he provided was the magnitude that quality over quantity has. If he was able to have a 10-minute conversation with his wife and kids, that helped refill his cup much more than 30-40 minutes of distracted time. It was important to him to mentally be there 100% for his family. And with these ideas in mind, he has been able to stay in quality touch with his family.

FIND YOUR TRIBE

After speaking with my classmates, one thing was clear, we found our tribe early. For Amie, it was another new mom in our cohort. Oh, did I not mention that Amie is a new mom? She started our intensive two week, 8-hour-a-day launch with a six-week-old baby girl, Stella. Talk about exciting new challenges!

“One of our classmates had also recently had a baby,” Amie explains. “We really bonded and created a support system for each other. Having a classmate in the same situation as me was crucial to my success getting through my first semester. It would have been a lot more challenging without that friendship.”

Kunal found his tribe through joining student run organizations. This gave him an opportunity to connect with and build relationships with the second years in our program.

“Talk to the second years because they have gone through this. Make sure you talk to many, as you will get a good idea of what you are doing and how you should approach your issue. Remember, any problem you are facing, it’s not the first time in the world that someone is facing this problem. No need to reinvent the wheel; people are really nice, and they are open to help you.”

As for me, well, I found out the people I sat next to on the first day of school happen to be my people. We were able to laugh together (and sometimes tear up) through the stress.

We spent hours studying together, talking through game theory, and served as each other’s wing person at networking events. And we were always ready for a wine night at the end of a hard week. I found that my friends from home were there anytime I called. While it may have only been at the end of first semester, they were there waiting to hear how the last three months had gone.

Brian, who is not in school, was always willing to talk things through with me as well. Sometimes, it was reading a networking email out loud to him and asking him 100 times if I should close with ‘Sincerely’, ‘Thanks’, or ‘Talk soon’. Other times, we figured out a math concept that neither of us had thought about in years. It was so helpful to just talk things out with someone I could say anything to, even if it was embarrassing!

What I found was that once people know how important things are to you, they support you. That’s true even if you don’t really know what you need. I found that once the stress of semester one was over, I was able to find more time to be there for those who needed me and reciprocate their support. Friendships and family move with the times. They ebb and flow, but they are always there when you need them.

Overall, it can be daunting to manage relationships while venturing into something new. One of the biggest misconceptions is setting expectations early on. Like Amie said, how do you set expectations when you don’t know what to expect? Let your inner circle know how important this change is for you and you really don’t know what to expect. They will always be there, in your corner, cheering you on.

Apply now and become part of our next cohort of dynamic full-time MBA students. You belong here.

You May Also Like

Keep Exploring

What’s in a Name? For CEOs, Strategic Distinction

Research shows that CEOs with distinctive first names are more likely to chart distinctive business strategies.

Based on research by Yan Anthea Zhang

Key findings:

- The more uncommon a CEO’s name, the greater a business’ strategic distinctiveness — that is, the degree to which its business strategy differs from that of its industry peers.

- A CEO with an unusual name is likely to be confident about creating a unique strategy.

- A CEO’s level of power strengthens the correlation between their uncommon name and their company’s uncommon strategies.

You probably know the names Steve Jobs, Bill Gates and Bob Johnson. But how about DeShuna Spencer? She’s the founder and CEO of the online streaming platform KweliTV. The platform’s broad array of movies, news and other programming features are all created by people of African descent. KweliTV (Kweli means “Truth” in Kiswahili) was recently ranked one of the 16 best movie streaming services of 2020 by PC Magazine.

This achievement is all the more distinctive considering Spencer competes in the same territory as billion dollar brands such as Hulu, Disney, Netflix and Amazon Prime Video – and has managed to do so without securing a single full seed investment. Today, 60 percent of KweliTV’s revenue returns to the pockets of its Black creators, who typically have limited distribution access.

What enabled Spencer to break out of the pack? Part of the answer could lie in her unusual first name, according to research by Rice Business professor Yan “Anthea” Zhang and David H. Zhu and Yungu Kang of the W.P. Carey School of Business at Arizona State University. In a recently published paper, the team explored the startling role a first name can play in CEO strategies.

While companies direct considerable resources — and lip service — toward innovation and better products, the team writes, they should also give special consideration to CEO candidates with unusual names. According to their findings, a CEO with a distinctive name is more likely to lead a distinctive company.

Past research has shown many links between organizations’ success and their leaders’ personal traits: temperaments, life experiences, personal values and demographic profiles. CEO names should be included in this list of variables, Zhang’s team argues.

That’s because people with unusual names see themselves as being different from their peers, studies suggest. The dynamic is unsurprising: Others often see the holders of unusual names as different. As a result, people with uncommon names internalize these impressions.

The feeling of difference can be excruciating, as anyone who has spent time in a schoolyard knows. CEO types, however, don’t have that problem. “Many people may not have the confidence to exhibit how unique they believe themselves to be,” Zhang’s team writes. “CEOs do – they are generally confident individuals.”

Armed with self-assurance, CEOs with rare names are at ease differentiating themselves in the workplace. Their leadership strategies, the researchers found, reflect that impulse. In other words, a CEO with a striking name is likely to build a striking business strategy.

To study these links, the team analyzed business strategies and other data from 1,172 companies between 1998 and 2016. Industries in the sample included mining, construction, manufacturing, transportation and public utilities, wholesale and retail trade, finance, insurance, service companies and real estate.

Then, to measure how common — or uncommon — a CEO’s name was, the researchers looked at naming records from the United States Social Security Administration between 1880 and 2016, controlling for ethnicity, gender and country of birth. James, John and Robert were among the predictable greatest hits. The most uncommon names included Phaneesh, Frits and Jure.

Among the researchers’ findings:

- The more uncommon a CEO’s name, the greater her firm’s strategic distinctiveness is likely to be.

- The more confident a CEO is, the stronger the correlation between her name’s distinctiveness and that of her company strategy.

- A CEO’s power also affects the correlation between her name’s distinctiveness and her likelihood of having a distinctive strategy. The greater the power, the stronger the correlation.

Overall, the researchers concluded, a CEO with an odd first name may be more likely to help a business rise from mediocre to revolutionary. Boards looking for this kind of transformation should consider CEOs with names that suit.

Recruiters are notorious for ignoring resumes and applications headed with ethnic names. Not only is this linguistic tunnel vision an engine of systemic racism, Zhang’s team found, it’s a strategic mistake.

Gravitating to a familiar face, race or name is human nature. It can also weaken a company’s talent base — and ultimately its own quest to be outstanding.

Kang, Zhu, and Zhang. “Being extraordinary: How CEOs’ uncommon names explain strategic distinctiveness.” Strategic Management Journal 42.2 (2020): https://doi.org/10.1002/smj.3231

Never Miss A Story

You May Also Like

Keep Exploring

Breakdown

Why did we stop taking breaks when we started working remotely?

By Jennie Latson

Why Did We Stop Taking Breaks When We Started Working Remotely?

“You’re on mute” might be the Zoom quote of the year, but on Slack — at least around lunchtime — it seems to be: “Grabbing a quick bite.”

That was the daily refrain I heard from colleagues at Rice University’s Jones Graduate School of Business, where I edit the school’s alumni magazine, after we started working remotely in March. And while we were all very busy doing very important jobs, it’s not like we were developing a coronavirus vaccine. Was our work really so urgent that we couldn’t afford to take more than a few minutes for the mid-day meal? And why were we all “grabbing” our lunches? Were we afraid that if we loosened our grip, someone might snatch them out of our hands?

This is how downtime feels in general these days: snatched away. While working from home has eliminated our commutes and given us the freedom to work in our pajamas, it’s also blurred the lines between work and life — and deprived us of the ability to leave the office behind, physically and mentally. A May survey by the career website Monster found that half of remote workers said they were experiencing burnout, but roughly the same number weren’t planning to take any days off to decompress.

That’s a big mistake, says Charlotte Fritz, a professor of industrial and organizational psychology at Portland State University. For one thing, she says, working remotely during a global health crisis is not the same as working from home under normal circumstances. There are additional demands at home — like educating your kids, if you’re a parent — along with heightened anxieties.

Even when we’re not in the middle of a deadly pandemic, Fritz says it’s crucial to our wellbeing to attain what she and other researchers call “psychological detachment” from work. “By ‘psychological detachment,’ we mean mentally letting go of work when we leave the workplace,” she says. “Currently, some of us have overlap between the physical workspace and home, and it might make it a lot harder to detach.”

Detaching requires us to take breaks, whether they’re multiple-day vacations or short moments of meditation or relaxation during the day. But the health crisis itself is making it harder to take the downtime we need to deal with the stress it’s causing. Fewer of us are planning vacations because we don’t feel safe traveling. And the economic uncertainties of the pandemic are adding to a sense of pressure to be a perfect employee: highly productive and always on.

Remote workers tend to take fewer breaks in general, in or out of a pandemic, in part because we can’t demonstrate our work ethic in the same ways from home that we could in an office, explains Minjae Kim, an organizational behavior professor at Rice Business. “Because our interactions are so limited, we have fewer opportunities to prove our commitment and our value,” Kim says. “One way to do that is to show that we’re working overtime, or by staying on Zoom all the time.”

The latter is more common in Korea, where Kim has studied workplace behavior. The pressure to demonstrate your commitment to your company — your willingness to make sacrifices for the sake of the organization — is greater in Korean workplace culture, and the pandemic has magnified that, Kim says.

“Since the pandemic began, people are pressured to keep their camera on all the time, even if they’re not in a meeting,” he says. “It’s a little more of an extreme setting, where signaling commitment is more intense.”

The problem is that changes to our work culture — including the “always on” mentality many of us are feeling now — have a tendency to become ingrained even after the crisis that provoked them has passed. That could mean that remote work sticks around long after the pandemic subsides, which may be a good thing overall. But it could also mean that if we let our lunch breaks slip from our grasp now, we’ll never be able to grab hold of them again.

Lunch breaks play a particularly vital role when it comes to maintaining our mental stamina, says John P. Trougakos, an organizational behavior professor at the University of Toronto Scarborough. In an aptly titled study, “Lunch Breaks Unpacked,” Trougakos and his colleagues found that being able to disconnect from work at lunchtime, for an activity entirely of your own choosing, was linked to a reduction of fatigue at the end of the workday and improved employee performance and wellbeing.

“We have a fixed amount of mental energy, just like we do physical energy,” he says. “When you don’t have a break, you become less and less efficient, and it becomes more stressful. That stress accumulates throughout the day, and it’s emotionally exhausting. If it accumulates day after day, week after week, that’s how you get burnout.”

Assuming remote work does linger after the pandemic ends, we’re going to have to find ways to make it sustainable — without burning out the workforce, Trougakos says.

“Remote work can be a huge benefit for people. We tracked 500 Canadian workers at the start of the pandemic for 12 weeks, and 83 percent didn’t want to go back to the way things were. They were adamant that ‘the way things were’ wasn’t working either,” he says. “Most people preferred a hybrid system where they had the freedom to go in some days and they could work from home some days.”

Luckily, there are ways to make remote work more workable, Trougakos says. “If remote workers structure their day well, they can find extra time for breaks. They don’t have their commute time anymore; they can use that time to take a walk or get some exercise. They have, in theory, more flexibility to plan out their best productivity windows. That could mean if you’re a night owl, you might schedule a block of work in the evening. But that doesn’t mean work your full workday AND work the night shift.”

Managers, meanwhile, should be firm about their expectations for the quality of work being done — and flexible about when it happens, he says.

“Are your employees getting the things done that they need to get done in a high-quality way? Then leave them alone and give them the freedom to make their own schedule,” he says. “Managers need to create some time for their employees to go offline, not just at the end of the day but during the day. Lunch is lunch; maybe you encourage coffee breaks in the morning and afternoon. If you’re really progressive, build in a half-hour nap break at 2 p.m. and watch them come back energized and productive at the end of the day.”

Managers can also encourage employees to take more downtime just by assuring them that they are valued and that their jobs are not in jeopardy, Kim says. Without that pressure to prove themselves, workers not only breathe easier but also perform better. And over time, as the workforce becomes increasingly remote, expectations will adjust and we’ll likely come up with new ways to demonstrate our commitment to our work — while still finding time for a leisurely lunch.

“It has to be managed, though,” Trougakos says. “We plunged into the pandemic with no preparation, no planning and no structure. It was chaos in a lot of ways. Now employers are seeing that there’s only so long you can maintain a feverish pace. As we come to a realization of what the new normal is, there will be issues that come up that maybe we didn’t expect, and companies will need to adapt.”

Jennifer Latson is an editor at Rice Business and the author of “The Boy Who Loved Too Much,” a nonfiction book about a genetic disorder that is sometimes called the opposite of autism.

Never Miss A Story

You May Also Like

Keep Exploring

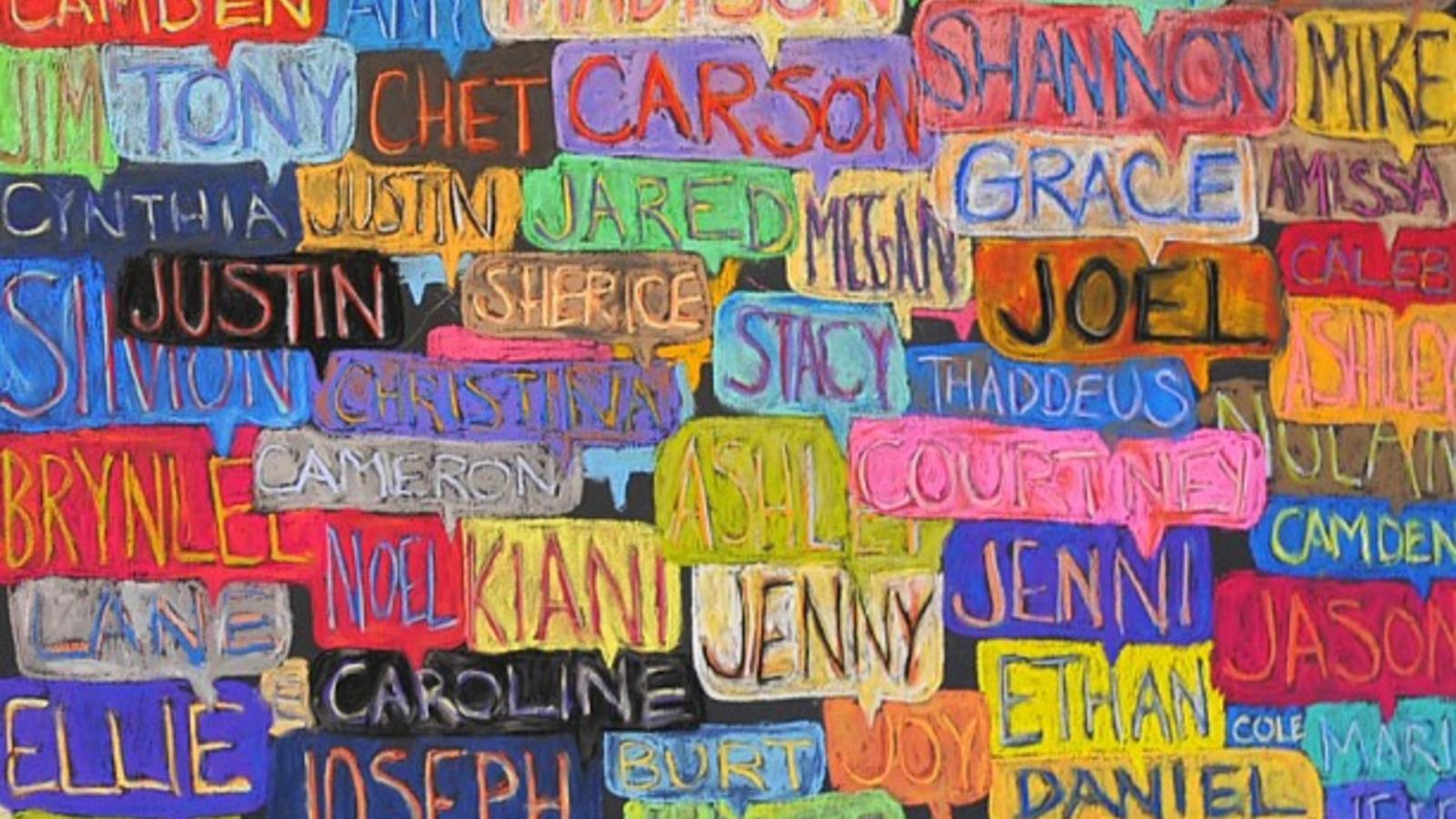

New GONZO247 mural revealed outside temporary classrooms at Rice

MBA student and part-time artist Frances Gallego pitched in to paint the campus mural alongside GONZO247, award-winning Houston muralist.

Students, alumni join Houston artist to create community project during Owl Together Week

Award-winning Houston muralist GONZO247 believes everyone has an inner artist — and the new 40-foot community mural he painted with Rice students and alumni is one way to bring out that artistic energy.

The new Rice-inspired public art project also served as a centerpiece of Owl Together Week — a virtual celebration that combined the annual homecoming and family weekends into one, big, mostly online event — and demonstrated the endurance of that creative spirit in spite of the pandemic.

Over the last week, volunteers from the Rice community signed up for slots to paint alongside GONZO247, three at a time, each person painting within one 10-foot section under a row of live oaks. Together, they completed a vibrant mural outside the Provisional Campus Facilities (PCFs) that was unveiled Nov. 1.

The final piece includes images of the Sallyport and Sammy the Owl among other Rice-related items, and is the work of dozens of Rice community members. The reveal included a virtual talk by GONZO247, real name Mario Figueroa Jr., the mural artist and founder of Aerosol Warfare Studios.

“I think deep down inside, every human being has this need to create and do something with that energy,” he said.

“If you just give them an opportunity, if you just give someone a space or a tool or something creative to do, most people will take you up on that offer,” he said. “And the idea with this mural is that we’re here to have fun. We’re here to put something together collaboratively.”

GONZO247 created the mural using ideas and input solicited via social media by the Alumni Relations office and submitted by the Rice community during a weeklong window in late September. Not surprisingly, Beer Bike, Valhalla and Willy’s Pub were also among the images students and alumni said best represented Rice.

Jones College senior Jefferson Ren has long followed the city’s active street art scene; he even wrote a paper about it for a course on the sociology of Houston. And as a big fan of GONZO247’s work, Ren was one of the first students to sign up for a mural painting slot.

“Gonzo is probably too humble to admit it, but I feel like he’s really been like a pioneer in the Houston mural scene,” said Ren, who worked on a section of the mural featuring the Sallyport. Although GONZO247 has designed iconic murals for downtown Houston, NRG Stadium, the George R. Brown Convention Center and the Saint Arnold brewery, this is his first mural at Rice.

“Having this is definitely a huge added benefit that makes me really happy about the campus,” Ren said. “I think it’ll be like a really great addition to the city.”

The slots to paint alongside GONZO247 went quickly as Rice students leapt at an excuse to spend time pursuing something creative, and outdoors to boot.

Frances Gallego is pursuing a Master of Business Administration degree at the Jones Graduate School of Business but she’s also an artist on the side, working mostly with wood and epoxy. Graffiti and street art are an important part of the culture in her hometown of Bogotá, Colombia, so Gallego was excited for the opportunity to add some color to the Rice campus too and signed up for a slot right away.

GONZO247, she said, “is a big part of Houston and making art a part of our everyday lives, and I wanted to add to that.”

Plus, Gallego said, “he’s so nice and so encouraging. It doesn’t matter what you’re doing on the painting, he’s like, ‘You’re doing a great job!’”

Even Rice President David Leebron and his family pulled on some gloves and picked up the paintbrushes one sunny afternoon.

“We’ve got a gorgeous day, perfect temperature, nice breeze blowing,” Leebron said. “It’s just a day where you can turn your thoughts away from both the cares of the world and maybe even the cares of your classes, and do something a little bit creative and a little bit spontaneous.”

This and other Rice Public Art installations that have already taken place, he said, are a great way to reflect the spirit of the campus and enliven it with novel projects — including one new, striking community mural in GONZO247’s signature tones of cheerful yellow and bright turquoise.

“This was a great idea,” Leebron said. “I can’t take any credit for it, but it was a great idea.”

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

Zoom CEO and founder Eric Yuan to speak at Rice’s Liu Idea Lab for Innovation and Entrepreneurship

Eric Yuan, CEO and founder of Zoom, will participate in a virtual discussion hosted by Rice University's Liu Idea Lab for Innovation and Entrepreneurship (Lilie) Nov. 10 as a part of the university's President’s Lecture Series.

Eric Yuan, CEO and founder of Zoom, will participate in a virtual discussion hosted by Rice University’s Liu Idea Lab for Innovation and Entrepreneurship (Lilie) Nov. 10 as a part of the university’s President’s Lecture Series. Yuan will share his entrepreneurial journey since 2011 leading the video communications company from startup to industry leader and discuss what’s next for Zoom’s role in education.

Rice is recognized as a hub for innovation in entrepreneurship education and has the No. 1 graduate entrepreneurship program in the U.S.

Registration for this free event is required at https://www.eventbrite.com/e/meet-zoom-ceo-and-founder-eric-yuan-tickets-124340613121.

| What: | Webinar with Zoom CEO and founder Eric Yuan. |

| Who: | Yael Hochberg, head of the Rice Entrepreneurship Initiative and Lilie and the Ralph S. O’Connor Professor in Entrepreneurship and Professor of Finance at Rice’s Jones Graduate School of Business, will lead the discussion with Yuan. David Leebron, president of Rice, will give welcoming remarks. |

| When: | 4 p.m. Tuesday, Nov. 10. |

| Where: | Via Zoom. Registrants will receive the Zoom link when they register via Eventbrite. |

The event is presented in partnership with Rice’s Chao Center for Asian Studies.

The President’s Lecture Series, which is sponsored by the Office of the President and supported by the J. Newton Rayzor Lecture Fund, was created to enrich the intellectual life of the Houston community by bringing to the Rice campus “celebrities of substance,” speakers of both high intellectual distinction and broad public appeal.

The World’s Best MBA Programs For Entrepreneurship In 2021

Poets&Quants and Inc Magazine release the second annual Best MBA Programs for Entrepreneurship ranking. The result of months of data collection and analysis, this year’s ranking attempts to measure what schools are providing ideal launching pads for entrepreneurial-minded MBAs.

Rice Business’ Diversity and Inclusion Conference goes virtual Oct. 30

Rice Business will host the fifth annual and first virtual Diversity and Inclusion Conference Oct. 30. With racial equity and social justice at the forefront of public discourse, this year’s conference provides a forum to discuss how these issues impact the workplace.

Rice University’s Jones Graduate School of Business will host the fifth annual and first virtual Diversity and Inclusion Conference Oct. 30. With racial equity and social justice at the forefront of public discourse, this year’s conference provides a forum to discuss how these issues impact the workplace.

The annual conference is designed to increase awareness, dialogue and skill-building around issues of diversity and inclusion as they relate to the business world, where consideration of diverse perspectives is a critical leadership skill.

This year’s conference includes a keynote address by Rice Business alumna Subha Barry, president of Working Mother Media; a panel of senior executives discussing how they lead in challenging times; and a panel of young alumni sharing how they are influencing change within their organizations.

Panelists will include Sonya Reed, senior vice president of human resources and corporate communications at Phillips 66; Donald Bowers, vice president at the Federal Reserve Bank of Dallas’ Houston Branch; Nick Tran, senior manager of corporate social responsibility at Schlumberger; Debra Langford, executive director of business development and advancing Black pathways at JPMorgan Chase; and alumna Julian Duncan, senior vice president and chief marketing officer for the Jacksonville Jaguars.

The virtual conference titled “Sparking Success: The Intersection of Business and Diversity and Inclusion” will take place 9:30 a.m.-2p.m. CDT on Friday, Oct. 30.

The event is open to everyone online, but registration is required.

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

2020 Most Disruptive MBA Startups: Women Offshore Foundation

"My biggest accomplishment so far with Women Offshore is operating a mentoring program that has grown from just a few mentors and mentees to 150 participants. This year, we expanded the capacity to 500 spots."