Top Feeder Schools To The Consulting Industry

As B-schools begin to release employment reports for the Class of 2021, Poets&Quants takes a last look back at the data from the previous year. Rice Business leads all schools with 62% growth in consulting hires out of its full-time MBA program.

Team-building? Science says pick some moody pessimists too

Conducted as a joint international effort between Rice University, the University of Western Australia, the University of Queensland, and Bond University, this research is among the first to investigate how temperamental diversity influences team creativity and cohesion.

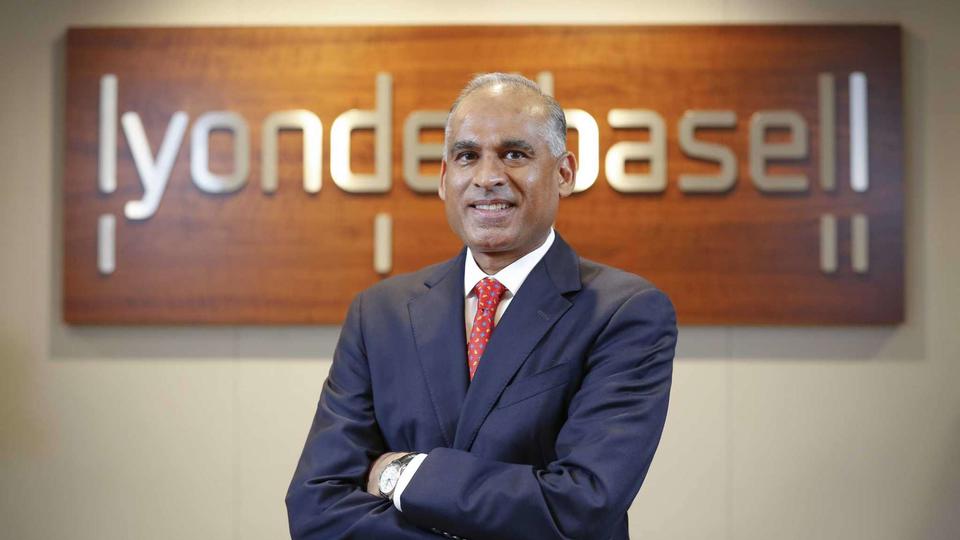

LyondellBasell CEO Bob Patel to retire at end of year

Rice Business professor Yan Zhang says she believes that Patel’s departure is tied to the July 27 chemical leak. "The company has to pick somebody to be responsible. In this situation, making a clear cut between the CEO and the company is a smart move from the company’s perspective.”

Covid Live Updates: Rice University Delays In-Person Classes as Virus Surges

Rice University temporarily turns to online classes as the virus surges across Texas. New York Times updates live.

Giant sculpture of Aztec god makes a big statement about Mexican identity

In Mexico City, a little-known Diego Rivera sculpture honors the partnership of government, art, history -- and science. Rice Business Wisdom editor Claudia Kolker tells the story for National Geographic.

The Best Online MBA Real Estate Programs

The Rice Business Online MBA is ranked by Poets & Quants as the third-best MBA Program for Real Estate. The course offers real estate electives in Capital Markets, as well as in Development and Disruption in Commercial Real Estate.

Study: Use your team’s emotions to boost creativity

If you’re putting together a team for a project, you might be inclined to pick people with optimistic dispositions,but a new management study co-authored by Rice Business professor Jing Zhou indicates your team might also benefit from people who are exactly the opposite.

If you’re putting together a team for a project, you might be inclined to pick people with cheerful, optimistic dispositions and flexible thinking. But a new management study indicates your team might also benefit from people who are exactly the opposite, according to experts at Rice University, the University of Western Australia, Bond University and the University of Queensland.

The study, co-authored by Jing Zhou, the Mary Gibbs Jones Professor of Management and Psychology at Rice’s Jones Graduate School of Business, investigates the effects of “team affective diversity” on team creativity. The paper published in the Journal of Organizational Behavior is among the first research to reveal how, why and under what condition teams’ “affective diversity” promotes team creativity.

Team members with what researchers call “negative affect” exhibit critical and persistent thinking that allows them to identify problems needing solutions, as well as to search out and critically evaluate relevant information. On the other hand, team members with “positive affect” engage in broad and flexible thinking that expands their range of information and helps them see unusual and creative connections, the researchers say.

“At any given point in time, some team members may experience positive affect such as joy and inspiration, whereas others may experience negative affect such as frustration and worry,” Zhou said. “Instead of trying to homogenize team members’ affect, teams should embrace affective heterogeneity.”

When a team experiences a high level of this “affective heterogeneity,” what Zhou describes as “dual-tuning” leads to greater creativity.

The researchers tested their hypotheses among 59 teams working on a semesterlong project in an undergraduate management course at a university in Hong Kong. Each team developed a business plan, which involved designing a new product and differentiating it from potential competitors in the market.

Zhou stresses that a team’s “affective heterogeneity” can serve as a resource for team creativity. This unique type of diversity facilitates team creativity, provided the teams have a strong so-called “transactive memory system.”

“Our study suggests that teams may be aided in using their affect heterogeneity via interventions that focus on building the team’s transactive memory system, which can be accelerated when team members spend time together, share goals, receive information about member specializations and train on the task together,” Zhou said.

Zhou co-authored the paper with March To of the University of Western Australia, Cynthia Fisher of Bond University and Neal Ashkanasy of the University of Queensland.

For a copy of the study, “Feeling differently, creating together: Affect heterogeneity and creativity in project teams,” email jfalk@rice.edu.

For more information about and insights from Rice Business faculty research, visit the Rice Business Wisdom website, https://business.rice.edu/wisdom.

You May Also Like

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

Essay: Check the fridge, check on each other - tips on returning to the office

Nearly 18 months after saying goodbye to cubicle life, many workers are trickling back to the office, but the transition hasn’t been easy for everyone. Rice Business editor Jennifer Latson writes for the Houston Chronicle about ways to make it smoother.

Now Available: A New Ranking Of Online College Degree Programs

Academic Influence, the company that uses artificial intelligence to arrive at its rankings, has applied its unique methodology to generate its first-ever rankings of dozens of online degree programs. The online MBA at Rice Business come in at number 5 in the nation.

Rapid Micro Biosystems Announces Appointment of Melinda Litherland to Board of Directors

“I am excited to join the board at Rapid Micro Biosystems at an energizing time in the company's growth,” Litherland said. “As the company pursues its vision, I welcome the opportunity to share my experience.” Litherland has a BA in Economics from Rice University and a Master of Accounting degree from Rice Business.