Can Your Employer Require You to Get a COVID-19 Vaccine? Here’s What to Know

The Equal Employment Opportunity Commission updated its guidelines recently to address this specific question—but there are still some exceptions to the rule. Rice Business adjunct professor Larry Stuart weighs in: "It is not illegal to require employees to get a vaccine as a condition of employment."

Breaking the "Non-Traditional" Label

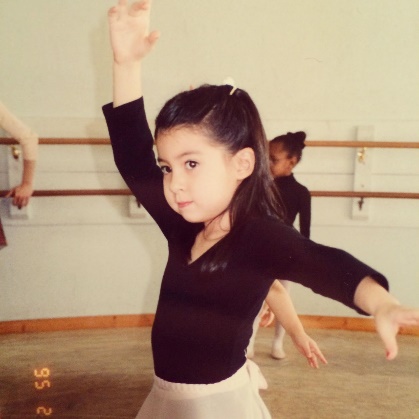

Check out Full-Time MBA '21 Katie Chung's advice about the importance of refusing to let preconceptions and labels define you on your journey to reach your full potential.

This blog post was originally featured in Poets & Quants. Updated from original post that was published on 6/4/2021.

Non-Traditional: New and different from an established norm, custom or method.

Sounds like an advantage. But why did I feel this label – Non-Traditional MBA student – held me back?

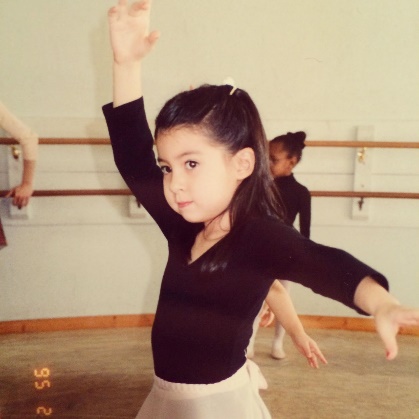

Let’s back up. Three years ago – and it’s crazy how much the world has changed since then – I was beginning the recruiting process for business school. I was a woman with a BFA who had danced her way through New York City. I was also a woman ready to be challenged in a different way. With my degree, there wasn’t a clear transitional path to another career. I couldn’t see where I could go. And honestly, not a lot of hiring managers could either.

I knew I could learn quickly, work really hard, and eventually excel in whatever was put in front of me. But it quickly became clear: without more formal education in business, I would likely be spending my entire day proving myself to my team. I knew I needed more education and a bit of credibility. So, I went for an MBA.

Going into the recruiting process, I already knew I was different from most other applicants. I am a woman. I am half-Asian. I am a performing artist who took one Econ class in undergrad. I was taking a risk. Even though I knew I had had a track record of doing what I set out to do, I found myself asking others to take a risk on me. In so many conversations, I heard these exact same sentences: "You will bring such out-of-the-box ideas to the table," or "You would think it's the finance people who go so far but it's always the artists who surprise everyone." Before I even began my education, slight justifications were already being made for my differences, as if I had to be the exception to the rule to succeed. From day one of recruiting, there was a little crutch being built underneath me.

I was inspired to think about this subject after reading a recent quote from Elon Musk. Many of you may know the quote, but here’s a recap if you don’t. Elon said: “I think there might be too many MBAs running companies.” My first thought was, YES! We are future leaders of business. But then I thought about it a little deeper. What does he mean? The article goes on to talk about how Elon wants more business leaders out of the board room and on the factory floors. It made me think about the MBA I was receiving. What was I getting from my education?

Interested in Rice Business?

I can’t speak to what an MBA used to be. As a recent graduate, I can attest to the well-rounded education I received. I learned about the importance and necessity of customer engagement. I was trained how to think like an entrepreneur and the steps that go into acquiring a business. I was immersed in the history of ESG, and how companies are positively and actively moving forward in our ever-changing world. I also learned the importance of a balance sheet, how to calculate WACC (although that was almost two years ago), and the history of major financial crises. As someone who stepped into the MBA program knowing that my path was going to look a little different than the norm, I left with an education that will equip me with the tools I need – no matter the direction of my future endeavors.

Most importantly – and I can only speak for myself here – I learned not only from the professors but I learned from my classmates. I learned from my finance-focused classmates, veteran classmates, and artist classmates alike. I drilled in some hard skills (shoutout to my classmates who tutored during core finals)! I also practiced soft skills. And I didn’t categorize my classmates into traditional and non-traditional boxes, either.

One of the biggest lessons I learned was from my core teammate, Yiming. He was an engineer before b-school. Yiming taught me the importance of asking questions. It can be hard in a room full of really smart people to stick your neck out and ask your question – especially if it’s a subject that is new to you. But Yiming was never afraid to ask and keep asking. He was not afraid to speak up or go back a step, to really understand what was being taught. As my core teammate, this quality kept our team on our toes. I learned so much from his questions and sometimes I was even able to answer one – which helped my learning even more!

Once we got into the classroom the professors didn’t divide us up either. They didn’t know our backgrounds and they did not have our resumes. We all entered on a level playing field. Our tough finance professor showed no mercy to those who didn’t have finance backgrounds. He just expected us to study harder. We took all the same tests and did the same case write-ups – some of us just had to study a couple dozen hours longer. From my class alone, we have future tech leaders, future people officers, finance wizards, and clean energy experts all with ‘non-traditional’ backgrounds.

So, who is this “non-traditional” label for? In the classroom, we were all students – students taking time to grow and learn. Outside of the classroom, I was still constantly defending my background. In interviews, coffee chats, and conversations with alumni, I found myself defending my diverse background. But, why?

Just look at some MBA class profile statistics for insight into what’s really going on. 44% of Stanford’s Class of 2022 have undergraduate degrees from Humanities and Social Sciences. Kenan-Flagler’s Class has 57% non-business background in its class. At Rice, roughly 40% of my graduating class came from non-business backgrounds.

In other words, being a non-traditional student is the norm in business school, not the exception.

So here is my ask: Let’s drop the labels. We are all business students, period. We all bring unique experiences and stories to the table. The ‘non-traditional’ label only says, ‘You did great…for a performer or a non-business person.’ In reality, it says the same thing as everyone else: ‘You worked really hard and succeeded because of the work, time, and commitment you put in.’ As classes continue to diversify and more people are introduced to the business world, let’s welcome them. Let’s welcome our newcomers with open arms and simply start by learning about who they are and what inspired them to come to the table. Let’s show the MBA naysayers like Elon Musk what an MBA truly is.

For me, the MBA helped me look at the world in a new way: an eyes-wide-open, 360-degree, open-minded view. It’s with this view that we will grow with our teams, innovate, continue to learn, and become the leaders of the future.

_________________________________________________________________________________

If you're considering an MBA, but are worried about fitting into the traditional mold, we invite you to explore our inclusive programs. From admission to graduation, non-traditional MBA students at Rice are provided with the tools and opportunities necessary to succeed. Begin your journey by requesting more information today.

You May Also Like

Keep Exploring

Lightening the Load

How the science of possessions can help foster care kids

Essay by Rice Business Wisdom contributor Deborah Lynn Blumberg with commentary from Jaeyeon (Jae) Chung

How the science of possessions can help foster care kids

This article originally appeared in The Houston Chronicle as "Essay: Foster children face a tough journey - but one simple, household item can make it better"

In his nearly 17 years in foster care in Houston, David Daniels never had a suitcase, even though he lived in eight homes and three shelters.

Daniels entered foster care after parting with his biological parents who struggled with substance abuse. During the many moves that followed, he remembers placing his pajamas, underwear, a Yolanda Adams gospel CD and a Harry Potter journal in two black trash bags, cinching them shut, then slinging them over his shoulder.

That lack of luggage “made me feel unstable,” says Daniels, who happens to be a successful flight attendant now, interacting with his and other people’s luggage daily. “You feel like the throw-away kid, unwanted. Quality luggage is essential to a person’s life journey. It says: I matter, I’m important.”

Across the country, children in foster care often transfer their clothes and personal items like Daniels did, in big trash bags or even flimsy plastic grocery sacks. The problem isn’t trivial, even considering the other, monumental challenges these children face. The impact of this seemingly small indignity can be profound. It can exacerbate, or confirm in a child’s mind, the feelings of instability, powerlessness and even worthlessness.

Those feelings are especially concerning these days. During COVID, the number of children without placement across Texas reached an all-time high of 200, Lisa Bourgoyne, program director for The Children’s Assessment Center, says. Many children spend days in CPS office spaces with their caseworkers and nights in temporary placements until a suitable foster care home can be found. Each time they move between these temporary spaces, they have to pack up their belongings. The crisis has only sharpened the need for individual, decent luggage to help ground them emotionally.

“The commonly occurring moves from place to place are difficult enough for children,” Bourgoyne says. “Kids often come to us broken, and we want to bring hope and healing so that they can grow up to live healthy, productive lives.”

In fact, research has shown that the simple routine of being forced to transport worldly belongings in a trash bag can have far-reaching implications for foster youth, from their development, interpersonal relationships and even future success in life. On the other hand, research has shown that the simple act of supplying a child with a $20 suitcase sends the message that the child and his or her belongings have value in this world.

People often link their self-value to their possessions, particularly young children, who still see their cherished possessions as a representation of the self, says Rice Business professor Jaeyeon Chung. In a recent paper, Chung found possessions not only affect how we see ourselves, but also how we end up performing across various tasks.

The symbolism of the trash bag might lead children to wonder, “Am I a person of a less value? Or, is my cherished doll or toy just trash?”

Business owner Aprili Amani, now 33 years old, grew up in foster care both with family and non-family in Indiana. The one move to a relative’s home in which she had to use a trash bag still haunts her. She describes it as “one of the most embarrassing moments of my youth.”

“It did strike me, even in my youth, that we didn’t have the basic needs fit for moving — as were seen in commercials on TV, or what we would see around us,” Amani says. “It felt like people were looking at us and judging our worth based on what we used to move in to the next place. This is pretty sad for me to recall.”

Those types of thoughts and feelings only add to the number of challenges the country’s some 424,000 children in foster care each day already face as they enter the system. The average age of children entering care is eight, and many come from homes marked by domestic violence or drug use. One third of kids entering U.S. foster care in 2019 were young people of color.

Of Texas’ some 32,000 youth currently in foster care, nearly 6,000 live in the Houston area. Houston kids spend more time in care and have more placements than other kids in the state, says Arnold Valdez, director of family care services at Houston’s DePelchin Children’s Center. The distinction, he says, stems from the urban make-up of the area and the high number of custody cases languishing in court.

Moves for these children are often fraught with both emotional and developmental challenges. Departures from unsafe homes are many times rushed, and they can be dramatic. Children may have just five minutes to grab a few of their belongings before rushing off with an investigator from Child Protective Services.

“They’ve just lost everything that they know, sometimes even their siblings,” Valdez says. “It’s incredibly traumatic. That transition is something that a child never, ever forgets and that will affect them for the rest of their lives.”

Subsequent moves to different foster care homes due to space constraints take an even greater toll. Each time a child moves, they’re set back an estimated four to six months both academically and developmentally. “The move triggers previous trauma,” Valdez says, “and it becomes increasingly difficult for them with each subsequent move.”

In this environment, a trash bag sends a terrible message to children already at a low point that, “your whole life is trash,” Valdez says. DePelchin sources donations to make sure every child they place leaves with their own new suitcase or duffel bag. This small gesture ultimately has a huge impact.

Luggage, and essentials like deodorant or toothpaste, boost children’s sense of self-worth and self-esteem. “And it’s incredibly important for them to establish their self-worth,” Valdez says, “because there’s a stigma with being in foster care.”

For foster care kids, knowing they have value is far more than a state of mind. While it can help them establish healthy relationships later in life, it helps fortify them more immediately against bullying.

Without a positive sense of self-worth, foster kids are at deep risk of experiences such as those of Daniels, the flight attendant: “I was suicidal at 15 because I felt unloved and unwanted,” he says. “With this cycle of bouncing around from group homes to shelters, it’s hard for us foster kids to know who really cares about us.”

Though the challenges of Houston’s foster children can seem overwhelming, city residents can actually have an important impact “resetting the tone” for them by donating luggage at a difficult time. “It is possible that these kind gestures can make a positive impact on how children see themselves and how they perform in life,” Rice University’s Chung says.

After a major luggage drive last year, DePelchin received an outpouring of new suitcases. But they still need help during National Foster Care Month this month, and beyond. And while replacing a garbage bag with a decent suitcase may have the starkest symbolism, new children’s clothing, including pajamas and underwear also are in high demand, DePelchin officials say.

Gift cards — evanescent as they are — are also a powerful form of donation. That’s because it’s profoundly empowering for foster kids simply to be able to choose their own luggage or clothing, Valdez says. “Choices help give them a sense of power and control.”

For former foster child Daniels, with a job that takes him all over the world, every day is a reminder of the way physical objects can represent a feeling of home. A simple suitcase with one’s name on a luggage tag resonates emotionally over a lifetime, says Daniels, who now advocates for other children.

“It’s symbolic,” Daniel says. “It’s these small things that really do matter.”

Jaeyeon (Jae) Chung is an Assistant Professor of Marketing with the Jesse H. Jones Graduate School of Business at Rice University.

Blumberg is co-president of the Texas chapter of the American Society of Journalists and Authors.

Never Miss A Story

You May Also Like

Keep Exploring

Fed should talk about taking foot off policy pedal: Kaplan

Rice Business External Relations hosted a conversation with Dean Peter Rodriguez, Robert Kaplan and Bobby Tudor '82, on the economy and monetary policy.

The Explorations of an Industry-Agnostic Alum feat Matthew Marand ’20

Season 1, Episode 20

This episode is part of a set of short interviews which were recorded during Alumni Reunion Week 2021. Be sure to listen to the other two Alumni Reunion Week episodes. Matthew Marand ’20 joins host David Droogleever in the Owl's Nest.

Owl Have You Know

Season 1, Episode 20

This episode is part of a set of short interviews which were recorded during Alumni Reunion Week 2021. Be sure to listen to the other two Alumni Reunion Week episodes. Matthew Marand '20 joins host David Droogleever in the Owl's Nest.

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

You May Also Like

Meet Steve Jimenez, a 40 Under 40 honoree who used his veteran experience to found Hives for Heroes

Rice Business alum Steve Jimenez struggled with transitioning back to civilian life after leaving the Marine Corps. But he used that experience to form Hives for Heroes, a nonprofit that focuses on honeybee conservation, suicide prevention and a healthy transition from service.

The Rice Report: Breaking The “Non-Traditional” Label

"For me the MBA helped me look at the world in a new way: an eyes wide-open, 360-degree, open-minded view. It’s with this view that we will grow with our teams, innovate, continue to learn, and become the leaders of the future." Written by Katie Chung, Rice MBA '21.

Essay: Foster children face a tough journey - but one simple, household item can make it better

Rice Business Professor Jaeyeon Chung says people often link their self-value to their possessions, particularly young children, who still see their cherished possessions as a representation of the self.

How an MBA Can Help You Advance in Your Field

Heidi Pozzo, an MBA alumna of Rice Business, says the B-school experience involves constant networking, since students frequently collaborate with their classmates while completing assignments. "If people are leveraging their network well, it can lead to opportunities in the future."

Research: Rice professor reports on the impact of personalized health care marketing

- Read more about Research: Rice professor reports on the impact of personalized health care marketing

In an award-winning paper, Rice Business Professor Vikas Mittal and colleagues developed new algorithms indicating that targeted, personalized outreach can increase screenings among at-risk patients. "Outreach marketing" was a powerful motivator for patients to get screened.