Rice Business launches deferred enrollment program

Rice Business has launched a deferred enrollment program that enables undergraduates to gain admission to Rice’s Jones Graduate School of Business’ MBA program and obtain career experience before they attend. Deferred enrollment programs are increasingly popular at top universities.

Rice Business has launched a deferred enrollment program that enables undergraduates to gain admission to Rice’s Jones Graduate School of Business’ MBA program and obtain career experience before they attend.

Deferred enrollment programs are increasingly popular at top universities. The deferment allows students to secure highly coveted spots in a decreased competition pool and gain experience in their careers — experience that can provide the opportunity to solidify or change individual career goals before attending graduate school.

With the MBA Early Admit Program, students apply to the Rice Business Full-Time MBA during their final year of college and reserve their spot two to five years after graduation. Eligible students must be employed during the interim years to hold onto their spaces.

The Jones School is adjusting some of the application requirements due to closed standardized testing sites during the COVID-19 pandemic. Applicants for the MBA Early Admit Program, which has a June 30 deadline, may provide ACT or SAT scores instead of the normally required GMAT or GRE. Those interested in applying can join one of the Jones School’s weekly online chats or connect with a recruiter today to learn more.

International students and all majors are welcome to apply; the program uses the same Rice MBA requirements and application but without the application fee. This new program is now available to Class of 2020 graduating seniors from Rice as well as other universities.

“With this program we’re doing all that we can to make it easier for those students to plan for the next phase of their careers and education while they’re still undergraduates,” says Peter Rodriguez, dean of the Jones School and professor of strategic management at Rice. “It also frees them to pursue any job they want in the years between graduation and the start of their MBA program. It’s much easier for them to apply in their senior year than later and will deliver a fantastic career platform. They can take a great first job, earn a Rice MBA and launch a new career within four years of graduation.”

When you can't go outside, go inside

I’ve studied creativity for more than two decades, and my research shows that times of disruption and upheaval can lead us to new insights and nudge us to innovate in ways we’d never have considered before. In many ways, it’s an opportunity in disguise.

Minorities At The Top 25 U.S. MBA Programs

The school with the highest proportion of minority MBA students in 2019 was Rice University Jones Graduate School of Business, the No. 25-ranked school, with 35%; only four schools have 30% or more.

How the COVID-19 crisis will make us more resourceful

As an organizational psychologist and business school professor at Rice University, I’ve been studying resourcefulness for nearly 20 years, both in times of crisis and times of prosperity. The scientific evidence on resourcefulness shows that constraints activate the flexibility and creativity we need to overcome hard challenges.

Oil firms were confronting climate risks. Then the virus hit

Bill Arnold, a former Shell executive who teaches energy management at Rice University, reckons Occidental and many of its peers face a fight for survival. Occidental's focus now will be on managing its remaining capital. But the oil crash is not without its silver linings, Arnold noted. As drilling slows, industry executives will have more time for strategic planning.

Texas Companies Are Repurposing To Help Fight COVID-19. Here’s How.

Vikas Mittal, a marketing professor at Rice University, said repurposing operations during a crisis can help businesses in the long term in several ways, including boosting a brand’s reputation and recognition, and improving employee morale.

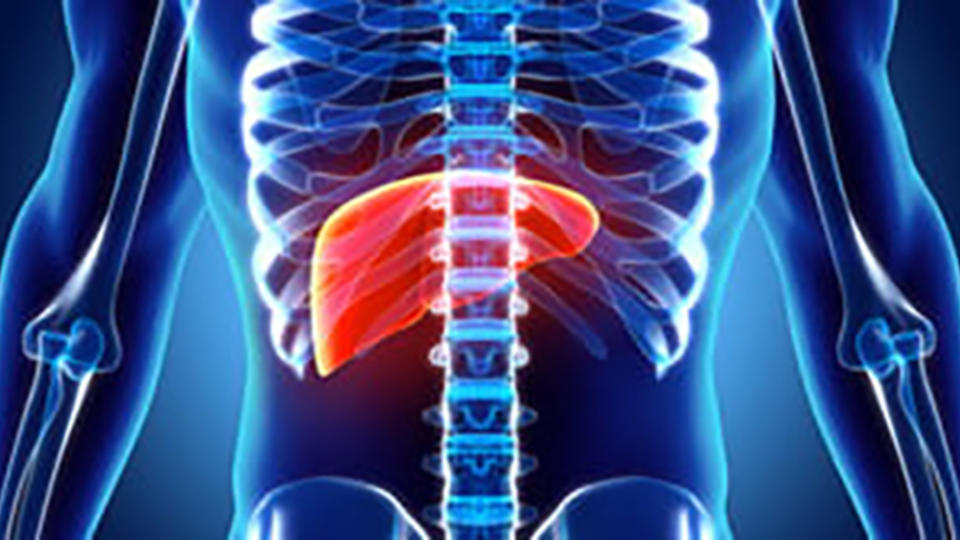

Machine learning can help increase liver cancer screening rates, says Rice U. expert

- Read more about Machine learning can help increase liver cancer screening rates, says Rice U. expert

Targeting patients with machine learning can increase the number of people getting liver cancer screenings, according to a National Institutes of Health-sponsored study by a research team from Rice University, Texas A&M University, Iowa State University and the University of Texas Southwestern Medical Center.

Targeting patients with machine learning can increase the number of people getting liver cancer screenings, according to a National Institutes of Health-sponsored study by a research team from Rice University, Texas A&M University, Iowa State University and the University of Texas Southwestern Medical Center.

Regular and timely health screenings save lives through early detection, which can reduce symptoms and enable cheaper and more effective treatment during early stages of cancer. Yet screening rates remain dismally low. For example, just 4.2% of patients in the United States who are at high risk for lung cancer get screened. According to the Centers for Disease Control and Prevention, screening rates for cervical, breast and colorectal cancer fall short of Healthy People 2020 targets.

The authors of the study used a multiperiod, randomized field experiment involving 1,800 patients of a large hospital system in the greater Dallas area. Each patient was randomly assigned to one of three scenarios: “usual care,” where physicians offer preventive care recommendations at their discretion during a patient’s usual care visits; “light touch,” where patients receive outreach mail and standardized follow-up calls; or “patient navigation,” where patients receive the same outreach mail and follow-up calls along with motivational education. The research team observed screening rates for 18 months. They then used machine learning to maximize screening rates by developing an algorithm that matched outreach intervention to the right patients.

Without personalized targeting, outreach interventions increased screening rates to 25%, the researchers found. However, targeting with machine learning increased screening rates to about 45%-49%. “The best part of this personalized approach to targeted screening is that it is based on information already available in (patients’) records,” said Vikas Mittal, a professor of marketing at Rice’s Jones Graduate School of Business.

For example, Hispanic females who were relatively healthy and who received health care through charitable providers such as Dallas’ Ryan White HIV/AIDS Care Program were more likely to get screened if they received a letter in the mail advertising availability. In contrast, older Hispanic females who lived in high-income neighborhoods and had better access to clinics were more likely to get screened if they received a letter in the mail and a personalized phone call and assistance.

Implementing this approach could increase financial savings to the hospital system from $2.1 million to $3.7 million, or 74%, the research showed.

The study, “Improving Cancer Outreach Effectiveness Through Targeting and Economic Assessments: Insights from a Randomized Field Experiment,” is published in the Journal of Marketing.

To schedule an interview with Mittal or to request a copy of the study, contact Jeff Falk, director of national media relations at Rice, at jfalk@rice.edu or 713-348-6775.

Follow the Jones Graduate School of Business on Twitter @Rice_Biz.

Follow Rice News and Media Relations on Twitter @RiceUNews.

Related materials:

Mittal bio: https://business.rice.edu/person/vikas-mittal.

Republicans more likely to invest in stocks during coronavirus market crash, says Rice U. expert

The downturn in the stock market has rattled most investors but also created unprecedented long-term investment opportunities, according to Rice marketing scholar Vikas Mittal and colleagues. So how are ordinary, everyday investors likely to approach the stock market?

The downturn in the stock market has rattled most investors but also created unprecedented long-term investment opportunities, according to expert at Rice University’s Jones Graduate School of Business.

So how are ordinary, everyday investors likely to approach the stock market? Republicans are more likely than Democrats to invest in stocks, especially when confident about their investing ability, according to research by Rice marketing scholar Vikas Mittal and colleagues.

“Though the coronavirus crash has created an opportunity to invest in the stock market, not everybody will take advantage of it,” said Mittal, who is the J. Hugh Liedtke Professor of Marketing at Rice Business. “Our research suggests that, among everyday ordinary investors, Republicans who are confident in their investing ability will be more likely to take advantage of this investing opportunity.

“A person’s political leanings affect the societal goal a person wants to achieve,” he said. “With a goal of improving their standing in society, Republicans with more confidence prefer investing in stocks over less risky options. Ultimately, confident Republicans are more likely to believe that increased financial standing through stock investing will also improve their social standing. Especially in an American context, it is easy to imagine the link between a person’s financial and social standing.”

One study conducted by Mittal and colleagues in 2015 provided two investing options to 199 participants: a bank account offering a guaranteed return of 4% and a a stock fund that provided a similar return but with higher variability (a 45% chance of generating a return of 16%, a 10% chance of generating a return of 4% and a 45% chance of incurring a loss of 8%). They found that those who said they would vote for Donald Trump in the 2016 presidential election and had confidence in their investing ability were more likely to invest in the stock fund than those who said they would vote for Hillary Clinton; among potential Clinton voters, there was no change in investing behavior depending on investing confidence.

These results were confirmed in several other studies and a large-scale analysis of 14,945 U.S. households from different states. The results spanning decades showed the same pattern: Republicans were more likely to invest in stocks as they became more confident in their investing ability relative to Democrats.

In another study with 450 participants, the researchers found this happens because Republicans have a higher social dominance orientation, meaning a desire to increase their social standing. “Believing that increased financial success will help increase their social standing, conservatives are more likely to invest in stocks than cash, believing stocks will provide a higher payoff in the long run,” Mittal said. These results were tested in six studies with more than 16,000 participants and a variety of methods such as surveys, secondary data and randomized experiments.

To schedule an interview with Mittal, contact Jeff Falk, director of national media relations at Rice, at jfalk@rice.edu or 713-348-6775.

Related materials:

- Research paper: https://doi.org/10.1177/0022243718813331

- Mittal bio: https://business.rice.edu/person/vikas-mittal

8 Things You Can Do If You Feel Helpless During The Coronavirus Pandemic

“When we lose control over any significant aspect of our lives, as is happening right now, it is natural to want to find opportunities to exert control over something else,” Utpal Dholakia, professor of marketing at Rice University’s Jones Graduate School of Business, told HuffPost. “Doing so makes us feel less helpless.”

Want People To Follow the Rules? Stop Explaining Them

The more perceived distrust people feel, the less likely they are to follow the rules.

Based on research by Marlon Mooijman, Wilco W. van Dijk (Leiden University), Eric van Dijk (Leiden University) and Naomi Ellemers (Utrecht University)

Key findings:

- When authorities enforce rules and penalties, they convey mistrust for the people they are attempting to control.

- Perceived distrust has a negative effect on rule-following.

- The less legitimate an authority figure is perceived to be, the less likely people will obey the rules enforced by that authority.

It’s one of our first human experiences: the smell of something sweet in the air followed by the overwhelming desire to gobble it. Imagine now that you’re six years old, and your dad is taking warm chocolate chip cookies out of the oven. Not one nibble before dinner, he says, otherwise you’ll lose your appetite. Then, before dashing out for a meeting, he gives a warning: “If even one cookie is missing, no TV for a week.”

What will you do? Dutifully wait? Or grab a cookie regardless of the threats?

Rice Business professor Marlon Mooijman and colleagues Wilco W. van Dijk and Eric van Dijk of Leiden University along with Naomi Ellemers of Utrecht University studied 883 people to understand the links between deterrence, threats and rule-following. In layman’s terms, they wanted to see how policies and punishments affected the choice to steal cookies. To reach their conclusions, they conducted a series of games in which participants reported or hid taxable income depending on whether they were threatened with fines, fined with an explanation, or fined with no explanation.

With adults as with children, the researchers found, threats and punishments often backfire. This is because they signal distrust by the authorities of the very people they're supposed to control. Often, the response to that distrust is rebellion. The more perceived distrust people feel, the less likely they are to follow the rules.

So if your dad simply tells you to lay off the cookies — that is, deterrence but no justification — you won’t assume he distrusts you. If, on the other hand, he says, “Don’t eat those cookies before dinner because you’ll spoil your appetite” — offering justification — or “If one cookie’s missing, no TV for a week,” you’re inclined to think he doesn’t trust you. Human nature being what it is, that feeling may send you straight to the cookie sheet as soon as he turns his back.

The perception has become a self-fulfilling prophecy. If your dad doesn’t have faith in you, who cares about disappointing him?

In general, the researchers discovered, justifications and threats of punishment leave a bad taste. Instead, we respond better to rules with no justification.

At the same time, the authority who is making the rules is important. What happens when an older sister or babysitter lays down the law? Authorities who want subordinates or constituents to follow their rules, Mooijman and his colleagues found, need to be seen as legitimate: that is, possessing the right to govern and to have others comply with their rules.

In our family scenario, this might mean that once your mother gets involved, the fun and games are over. Because you believe she’s legit, you’re more likely to follow her rules. Your older sister might have rank because she is older, but she’s not a parent, and you know she’s likely to sneak a cookie or two along with you.

Even so, you might be more prone to listen to her than to the babysitter. Your parents don’t know that the babysitter spends most of her time on the phone with her boyfriend while watching reality TV and periodically raiding the fridge. You have little respect for her; as an authority, she is illegitimate. If she instructs you not to eat cookies, they’re as good as gone.

Our first contacts with authority, legitimacy and deterrence usually occur at home. But the same principles apply in adult organizations, from education and penal correctional systems to finance, judicial and legislative bodies to the corporate world. Regardless of industry, if you want subordinates’ to keep their hands out of the cookie jar, don’t try to justify your rules. Just tell them what not to do.

Emphasize, though, that these rules are spelled out for wrongdoers, not the conscientious individuals who might hear them as well. Finally, sprinkle a little sugar on top. For best results, always sweeten new rules and procedures with assurances of trust.

Mooijman, M., van Dijk, W., van Dijk, E. & Ellemers, N. (2016). “On Sanction-Goal Justifications: How and Why Deterrence Justifications Undermine Rule Compliance.” Journal of Personality and Social Psychology, 112.4: 577-588. https://doi.org/10.1037/pspi0000084.

Never Miss A Story