How To Prep for the MBA Interview and Essays

Ready to prepare for your Rice MBA interview and essays? It’s time to practice, review and research so you can tell your best story and get into a top MBA program.

Preparing to apply for the Rice MBA can feel both exciting and overwhelming. The interview and essays are your opportunity to tell your story beyond test scores and resumes — sharing where you’re headed, what your goals are and why an MBA is the right next step.

Whether you’re applying to a full-time MBA program or a part-time program as a working professional, it’s important to dedicate time to practicing, refining and submitting your best application.

Here are some practical tips you can use to master the MBA interview and essays.

Top MBA Interview Tips

The MBA interview is your chance to put context around your application and share your story in your own words, face-to-face. Thoughtful preparation can help you approach the conversation with confidence and make a good first impression.

Approach the Interview With an Open Mindset

MBA interviews are meant to be open conversations, not interrogations. Our admissions team wants to understand your motivations, experiences and aspirations — so go in prepared, listen closely and respond thoughtfully.

Come Prepared

Be ready to discuss your background, career path and long-term goals clearly and concisely. Before the interview, reflect on why you’re pursuing an MBA now and how Rice Business fits into your professional journey. It’s also a good idea to familiarize yourself with your program of interest.

Bring Thoughtful Questions

Strong interviews are two-way conversations. Asking informed questions shows genuine interest and curiosity, while also helping you evaluate if the program is the right fit. Consider asking about the student experience, career support or opportunities to apply learning beyond the classroom.

Dress Professionally

Whether your interview is virtual or in person, professional attire makes a positive first impression. Dressing polished and prepared signals that you take the opportunity seriously and respect the process.

Practice, but Stay Authentic

Practicing common MBA interview questions can help you feel more comfortable, but avoid memorizing rigid, scripted responses. The strongest interviews balance preparation with authenticity — aim to speak clearly and confidently, but let your personality come through.

Interested in Rice Business?

How To Approach MBA Essays

In addition to your interview with a Rice Business recruiter, MBA essays offer space to reflect on your goals, experiences and motivations. Strong essays are clear, focused and grounded in genuine self-reflection.

Start Early

Like all of your best writing, your MBA essay will benefit greatly from reflection. Start early to give yourself time to think about your experiences, values and goals — as well as drafting, revising and refining without unnecessary pressure.

Answer the Prompt Directly

Every essay question is intentional. Stay focused on what is being asked and make sure your response clearly addresses the prompt. This helps Rice MBA recruiters to better understand your perspective and priorities.

Use Specific Examples

Concrete stories bring your application to life. Draw from experiences that highlight your growth, leadership, challenges or decision-making skills. Specific examples make your essays more engaging and credible.

Have Someone Proofread Your Work

Recruiters notice attention to detail. Before submitting, ask a trusted colleague, mentor or friend to review your essays for clarity, grammar and flow. Feedback can help ensure your message comes through clearly while staying true to your voice.

More MBA Application Tips

Ultimately, strong MBA interviews and essays are less about perfection and more about preparation and authenticity. When you’re applying to a top school like Rice Business, each piece of your application should work together to tell your unique story and goals.

If you’re ready to begin your journey, read more application tips from our Recruiting and Admissions Office, take a look at our MBA Admissions Guide, or reach out to a recruiter directly to have your questions answered.

You May Also Like

Keep Exploring

Why Are Rice MBA Programs Popular For Career Growth?

Discover why Rice MBA programs attract ambitious professionals seeking career growth, leadership development and long-term ROI.

Career growth is a top priority for those considering business school, and Rice MBA programs are designed with that goal at the center.

Whether students want to accelerate in their current field or broaden their opportunities across industries, the Rice MBA offers them a curriculum built around leadership, strategic thinking and real-world decision-making — and a strong ROI that pays off for years to come.

Strong Outcomes Backed by Top Rankings

Every student’s path is unique. That’s why we offer five different MBA programs to meet professionals on their path: Full-Time, Professional, Hybrid, Executive and Online MBA.

Rice University’s MBA programs are consistently ranked among the best in the country, due to our rigorous academics, strong employment outcomes and tight-knit community.

Our graduates regularly land competitive roles across consulting, finance, energy, technology and healthcare. Rice Business is proudly home to the #1 MBA in Texas (Financial Times, 2023-24, based on global rankings) and the #13 Best Part-Time MBA (U.S. News and World Report, 2025) — and the career outcomes of our graduates proves why.

Long-Term ROI on Your Rice MBA

Salary growth is a leading consideration for many applicants, and Rice MBA graduates often see immediate increases in earning potential. Full-Time MBA graduates see an average starting salary of $150,000 and a $33k average signing bonus, according to career outcomes from the Class of 2024.

MBA tuition is an important factor for prospective students — but it shouldn’t make the decision. An MBA from Rice pays lifelong dividends, and graduates see a return on their investment fairly quickly.

See how the numbers add up with James Weston, senior associate dean for degree programs and Harmon Whittington Professor of Finance:

Plus, the combination of transferable skills, strategic thinking and access to top employers is immediate, long-lasting and invaluable.

Interested in Rice Business?

The Rice MBA Opens Doors

Houston’s position as one of the most globally connected business hubs gives students proximity to a wide range of industries, including energy, healthcare, finance, innovation and international trade. That proximity translates into direct access to companies that actively recruit on campus, giving Rice MBA students regular, relationship-driven touchpoints with employers across Houston’s most influential industries.

Pivot, Climb and Grow at Rice Business

The Career Development Office helps students build relationships with leading employers through events, alumni networks and project-based learning, and we’re intentional about fostering strong connections. That’s how approximately 70% of our Full-Time MBA graduates accept job offers from right here within the Rice Business community.

Many Rice MBAs also attend business school with one goal in mind: pivot. From our Professional MBA Class of 2024, 33% of graduates changed employers, while 24% made a strategic shift into a new industry.

Whether your goal is to launch your career, level up or enter a new field, Rice Business provides a unique foundation for career growth in Houston and beyond.

Support at Every Step

For prospective MBA students seeking career advancement, meaningful support and long-term opportunity, Rice offers a powerful environment to take the next step with confidence.

And that support doesn’t end at graduation. Our alumni remain closely connected to Rice Business throughout their careers, with lifetime access to professional and educational resources, alumni networks across the country, and a community of more than 60,000 Rice University alumni around the world.

Connect with an MBA student ambassador to hear how the Rice MBA makes an impact on your career, immediately.

You May Also Like

Keep Exploring

Industry Weeks: How Rice MBAs are Exploring New Careers

In our inaugural Industry Weeks Series, Rice MBA students got an in-depth look at four major sectors — energy, healthcare, tech and real estate — through fireside chats, career treks and high-level networking.

This fall, our Career Development Office rolled out four Industry Weeks throughout the semester, each one week long. In addition to the recruiting activities that already take place, this new series adds focus and structure to recruiting, especially in industries where the process may be less structured.

The first Industry Week Series offered immersive events helping Rice MBA students explore major sectors, make meaningful connections and gain career insights.

The series drew 34 companies and more than 250 student attendees, with especially strong engagement from our Full-Time MBA program. Across four themed weeks — energy, healthcare, tech and real estate — students connected with alumni, executives and recruiters through dynamic, informative events.

Week One: Energy

Inside Houston’s Energy Hub

Houston’s position as a global energy hub made Energy Week central to the series. Students participated in alumni-led recruiting panels, fireside chats with senior leaders and networking sessions exploring diverse energy careers.

Rice MBA students heard recruiting tips from Nikki Beittenmiller ’24 of Quanta Services, Juno Lee ’23 of Grid United, Diana Martinez-Prieto ’23 of Urban Grid and Christian Okolski ’19 of Engie. Later that week, Nancy Fischer ’09 (Constellation Energy) and Tatiana Chavanelle ’09 (Phillips 66) also discussed leadership and industry evolution in a fireside chat.

A career trek to Phillips 66 and NRG gave students firsthand insights on how energy companies balance current operations with innovation in refining, midstream, renewables and emerging technologies.

Week Two: Healthcare

Exploring the Texas Medical Center

Healthcare Week immersed students in Houston’s fast-paced healthcare sector. With the Texas Medical Center just minutes from Rice campus, students gained premier access to industry leaders and innovations. Programming opened with a conversation hosted by the Healthcare Association featuring Kyle Stanzel, COO of Houston Methodist West.

The week continued with a thoughtful examination of career pathways, challenges facing the industry and the role of innovation in healthcare by panelists Bill Atkinson of MD Anderson, Sarah Gelb ’17 of Johnson & Johnson and Kathleen Reiter ’25 of McKesson.

Students visited MD Anderson for a strategy case study, presenting recommendations directly to healthcare executives.

Interested in Rice Business?

Week Three: Tech

Tech Innovation and Transformation in Texas

Tech Week brought alumni and recruiters to McNair Hall for two days of panels on recruiting strategies and tech sector transformation.

Students were joined by panelists Will Coblentz of Salesforce, Eileen Ramirez of Infosys, Thiago Silva ’21 of C3AI, Alice Wen ’23 of Dell and Marcus Wade ’23 of HP, who shared insights on breaking into tech roles and navigating fast-moving careers. A fireside chat with Boyd Skelton ’09 of Westwood Global Energy Group, Aaron J. Knape ’08 of sEATz and Alex Saab ’18 of Microsoft explored leadership, product strategy and the evolving landscape of AI and cloud technologies.

Rice MBAs visited HP and HPE during the Houston Tech Trek to explore digital transformation and learn how Houston’s tech community drives innovation and career opportunities.

Week Four: Real Estate

Career Connections Across Houston and Beyond

The final week highlighted Houston’s strong real estate market and growing student interest. Rice Business hosted the Mortgage Bankers Association’s Commercial Real Estate Finance (CREF) Program, bringing executives from CBRE, PNC, Greyston and Berkadia to campus. The forum and career fair, open to students from neighboring schools like the University of Houston, Texas Southern University and Prairie View A&M University, covered industry entry, trends and career success.

Students heard from alumni Zach Dobin ’20, Lauren Gagetta ’21 and Carter Dowd ’23 during a panel on transitioning into post-MBA careers and visited Hines for an inside look at the global real estate firm.

“Hines is a staple of Houston,” says Hector Ibarzabal '27. “Being able to get close to a group that shapes the land with concrete impact across geographies is a worthy experience.”

What’s Ahead From the CDO?

Beyond Industry Weeks, the CDO hosts year-round programs connecting Rice MBAs with professionals across industries, including:

Through Industry Weeks and ongoing programming, the CDO connects students with Houston’s business community while empowering them to discover and achieve their professional goals.

You May Also Like

Keep Exploring

Rice Business Research in 2025

Check out some of the biggest Rice Business research insights from 2025.

Rice Business faculty have had a banner year for research, publishing award-winning work in top academic journals on a wide range of critical topics — from crisis stockpiling to reputation management, from disclosure clarity to product adoption.

While these studies vary in context and methodology, they share a common thread: they reveal how decision-making works in practice across business and policy environments.

Check out some of our biggest research insights from 2025!

6 of the Year’s Biggest Research Insights

Google search trends can predict retail sales up to three quarters ahead.

GenAI tools can boost workplace creativity, but only when employees use them strategically.

Advance selling can help some businesses survive demand shocks during a major crisis.

Corporate activism tends to follow social change, emerging only after an issue is settled legally or politically.

“Look-ahead bias” can inflate returns in research that real investors can’t replicate.

Consumer shopping data can expand lending access to borrowers with no credit history.

Thank you for reading Rice Business Wisdom this year!

Never Miss A Story

You May Also Like

Keep Exploring

What Really Drives Data Center Location Decisions in the U.S.?

A new study shows a divided geography: some facilities cluster in cities for speed and access, while others move to rural regions in search of scale and lower costs.

Based on research by Tommy Pan Fang (Rice Business) and Shane Greenstein (Harvard)

Key takeaways:

- Third-party colocation centers are physical facilities in close proximity to firms that use them, while cloud providers operate large data centers from a distance and sell access to virtualized computing resources as on‑demand services over the internet.

- Hospitals and financial firms often require urban third-party centers for low latency and regulatory compliance, while batch processing and many AI workloads can operate more efficiently from lower-cost cloud hubs.

- For policymakers trying to attract data centers, access to reliable power, water and high-capacity internet matter more than tax incentives.

Recent power outages and the surge in AI-driven computing have made data center siting decisions more consequential than ever, especially as energy and water constraints tighten. Communities invest public dollars on the promise of jobs and growth, while firms weigh long-term commitments to land, power and connectivity.

Against that evolving backdrop, a critical question comes into focus: Where do data centers get built — and what actually drives those decisions?

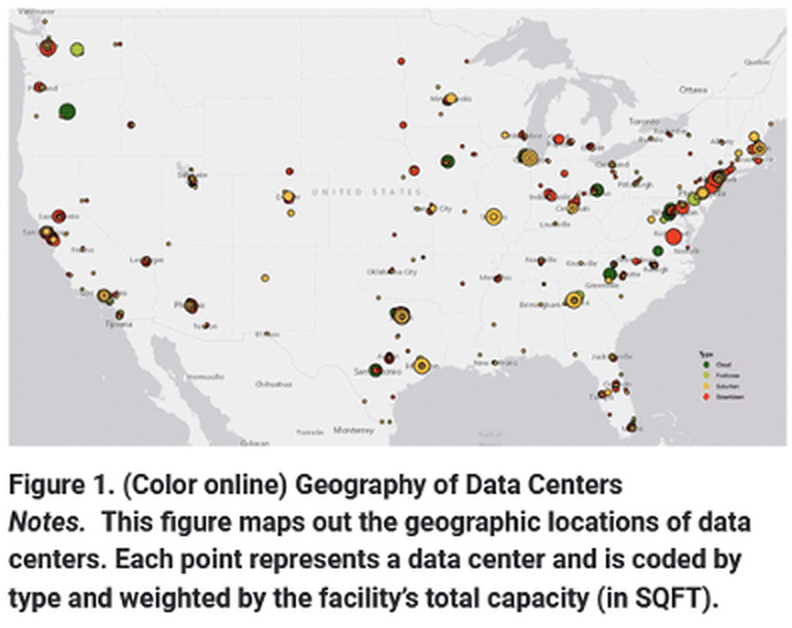

A new study by Tommy Pan Fang (Rice Business) and Shane Greenstein (Harvard Business School) provides the first large-scale statistical analysis of data center location strategies across the United States. It offers policymakers and firms a clearer starting point for understanding how different types of data centers respond to economic and strategic incentives.

Published in the journal Strategy Science, the study examines two major types of infrastructure: third-party colocation centers that lease server space to multiple firms, and hyperscale cloud centers owned by providers like Amazon, Google and Microsoft.

“The cloud feels weightless,” Pan Fang says, “but it rests on real choices about land, power and proximity.”

What are the two main data center location strategies?

The study draws on pre-pandemic data from 2018 and 2019, a period of relative geographic stability in supply and demand. This window gives researchers a clean baseline before remote work, AI demand and new infrastructure pressures began reshaping internet traffic patterns.

The findings show that data centers follow a bifurcated geography:

- Third-party centers cluster in dense urban markets, where buyers prioritize proximity to customers despite higher land and operating costs.

- Cloud providers, by contrast, concentrate massive sites in a small number of lower-density regions, where electricity, land and construction are cheaper and economies of scale are easier to achieve.

Third-party data centers, in other words, follow demand. They locate in urban markets where firms in finance, healthcare and IT value low latency, secure storage, and compliance with regulatory standards.

Using county-level data, the researchers modeled how population density, industry mix and operating costs predict where new centers enter. Every U.S. metro with more than 700,000 residents had at least one third-party provider, while many mid-sized cities had none.

This pattern challenges common assumptions. Third-party facilities are more distributed across urban America than prevailing narratives suggest.

Customer proximity matters because some sectors cannot absorb delay. In critical operations, even slight pauses can have real consequences. For hospital systems, lag can affect performance and risk exposure. And in high-frequency trading, milliseconds can determine whether value is captured or lost in a transaction.

“For industries where speed is everything, being too far from the physical infrastructure can meaningfully affect performance and risk,” Pan Fang says. “Proximity isn’t optional for sectors that can’t absorb delay.”

Why does distance matter for cloud data center costs?

For cloud providers, the picture looks very different. Their decisions follow a logic shaped primarily by cost and scale. Because cloud services can be delivered from afar, firms tend to build enormous sites in low-density regions where power is cheap and land is abundant.

These facilities can draw hundreds of megawatts of electricity and operate with far fewer employees than urban centers. “The cloud can serve almost anywhere,” Pan Fang says, “so location is a question of cost before geography.”

The study finds that cloud infrastructure clusters around network backbones and energy economics, not talent pools. Well-known hubs like Ashburn, Virginia — often called “Data Center Alley” — reflect this logic, having benefited from early network infrastructure that made them natural convergence points for digital traffic.

Local governments often try to lure data centers with tax incentives, betting they will create high-tech jobs. But the study suggests other factors matter more to cloud providers, including construction costs, network connectivity and access to reliable, affordable electricity.

When cloud centers need a local presence, distance can sometimes become a constraint. Providers often address this by working alongside third-party operators. “Third-party centers can complement cloud firms when they need a foothold closer to customers,” Pan Fang says.

That hybrid pattern — massive regional hubs complementing strategic colocation — may define the next phase of data center growth.

Looking ahead, shifts in remote work, climate resilience, energy prices and AI-driven computing may reshape where new facilities go. Some workloads may move closer to users, while others may consolidate into large rural hubs. Emerging data-sovereignty rules could also redirect investment beyond the United States.

“The cloud feels weightless,” Pan Fang says, “but it rests on real choices about land, power and proximity.”

Written by Scott Pett

Pan Fang and Greenstein (2025). “Where the Cloud Rests: The Economic Geography of Data Centers,” Strategy Science.

Never Miss A Story

You May Also Like

Keep Exploring

Building a Career One Flight at a Time feat. Liam Morris ’23

Liam reflects on United’s customer-centric transformation and how the Online MBA gave him the flexibility and confidence to grow as a leader.

Owl Have You Know

Liam Morris ’23 manages one of the most complex corners of United Airlines — airport operations quality control across more than 80 stations spanning Latin America, Central America and the Southwest U.S. In this conversation, he shares how early travel experiences opened the door to a career in aviation, the path that led him from loading bags in El Paso to overseeing global safety audits, and what it takes to lead with precision, clarity and calm under pressure.

Liam also reflects on United’s customer-centric transformation, the moments that shaped his commitment to the industry, and how the Rice Online MBA gave him the flexibility and confidence to grow as a leader while navigating an ever-moving, always-on operational world.

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

Episode Transcript

-

[00:00]Brian Jackson: Welcome to Owl Have You Know, a podcast from Rice Business. This episode is part of our Flight Path series, where guests share their career journeys and stories of the Rice connections that got them where they are.

Today, we’re joined by Liam Morris, a graduate of the online Rice MBA program and aviation operations leader at United Airlines. As manager of airport operations quality control, he oversees safety and regulatory compliance across more than 85 stations in Latin and Central America and the Southwest U.S.

In this episode, we dig into how Liam found his way into aviation, what drew him to United, and how he’s grown to leadership roles that require clarity, precision, and calm under pressure.

Liam, it is great to have you as a guest on the Owl Have You Know podcast.

You're in aviation, which I think is really the most complex industry out there. I'd love to know about your role, your responsibilities at United Airlines. And if you had a typical day, I know that's probably not what we would use the word “typical,” but what that would look like.

[01:07]Liam Morris: Yeah. So, right now, I'm a regional manager for airport operations quality control, and that's in our safety and regulatory compliance world. So, essentially, I have about 70, 80-plus airports that feed into my team of auditors, where we ensure that those airports are operating at FAA standards, based on what we've agreed to with the FAA.

So, the best way I can describe it, everything in our industry is super, super regulated, right? So, when it comes to, even how we bring in an airplane to how we load bags in the cargo pit of the aircraft, it's in a manual and the FAA approves that manual, right? So, everything's written down specifically to be done. And every airline has their own manual.

Sometimes, the processes are very similar or the same. Sometimes, they're very unique. You know, United have a very unique process compared to one of our competitors.

So, my job is to ensure that our employees in the airport space are doing what we said we’d do in the FAA service manual that we've created and agreed with them. So, we'll go out and audit the Latin Central America region that I'm specifically responsible for. But there's stuff globally that my team deals with. So, there'll be times where I'll be traveling overseas and stuff to go conduct an audit or perhaps provide a second set of eyes to one of my peers, et cetera.

So, we really try to maintain that integrity of our audit as well. But that's my current role. You know, started way back in the day loading bags and cleaning planes while I was an undergrad. So, it's been a great progression.

[02:23]Brian Jackson: No kidding. So, are people happy when they see you? You're the audit guy. Like, do they like it? I mean, are they smiling? What's the environment?

[02:31]Liam Morris: It depends. Like, I can say I have risen to a level of LinkedIn fame for United. So, people will be like, “Oh, you're that guy. Hey!” Like, some are really excited and some are like, “Be fair and let us know how we're doing, but don't be too fair, you know.” So, it depends. But, you know, for the most part, I'm really thankful for the safety culture we have that actually, like, really welcomes us. I can see that other corporations, the auditor comes in, it's like, “Oh, no.” But, for the most part, I've been in this role for a year and I've been really welcomed in a lot of the stations and meeting the general managers and directors and VPs.

It's really cool to actually see that people are really actually happy that we're there and are willing to say, “Lay it on us, let us know what's going on and don't hold back. We want to make sure we're running a good, safe operation.”

[03:09]Brian Jackson: Well, I'm a recovering attorney, so people weren't always excited to see me. And that's okay. You know, not everyone's going to love you, but we're doing good work, right?

[03:17]Liam Morris: Yeah.

[03:18]Brian Jackson: So, you already alluded to, but you've been in the airline industry for a while. And you've had a lot of different roles. But what really brought you to it in the first place? What drew you in?

[03:27]Liam Morris: I think, since I was a little kid, I really loved traveling. I was fortunate enough to have parents that would take me and my brothers traveling and around the world. And I remember being, like, eight, 10 years old flying on Southwest and American and all these different airlines out of El Paso.

And it was just so cool to me to be in the environment of the airport and just see, like, how all these moving parts come together to achieve this really organized chaotic sequence of events to get an aircraft out, even from a young age.

So, I've always been interested in the industry. And I think, when I became older in high school going into college, I thought, man, I really want a job where, not only am I having the ability to travel, because I didn't know you get free flights before, but now, I'm like, “Oh, you know.” When I got older, I'm like, “That's a great perk, right?”

But I wanted the ability to be in an industry where, like, I'm a part of something bigger, right? And being a part of an airline, it’s really cool because even though, you know, my work now may not directly affect a flight leaving on time out of here, but it does affect the customer experience in some way.

So, I just wanted to be a part of a really, really big machine that gets people where they need to go. And of course, the traveling and having no limits, my first manager in United told me, you know, “Hey, the world is your playground.” And that always stuck with me. My first week working with him is, like, I want the ability for the world to be my playground, where if I want to just go for a weekend trip to another country, I want to just be able to do that, or even a day trip. And I had plenty of those stories. So, yeah, just that freedom and the ability to affect a big organization and help people is really what drew me there.

[04:49]Brian Jackson: You know, when you go to airports, it's like the one place where you realize how much we rely on other people in our lives to do what we do, you know. Like, I need to fly to Chicago for this big important meaning. Well, for that to happen, it took, you know, TSA, bag check, all these things to get me there. And it really dawned on me the last time I went to Bush to fly out, where the TSA agents were being paid. And they were there doing their work. And it was like, thank you. Like, thank you so much, because, like, without them, I couldn't do what I do.

[05:20]Liam Morris: Yeah. During COVID, that was, like, one thing we learned. You know, I remember. I'll never forget I received this letter. All of us got this letter from our VP of HR. And it was like, critical infrastructure in unrestricted access to any airport in United facility. And it really dawned on me, like, how important, like, our work was. I mean, we were transporting vaccines and ventilators. We were one of the only ones doing it. I remember the first shipment of ventilators coming off the United flight to Newark and we were there and we had no flight activity, but we were just all in the office airplane. Just ventilators going straight to Manhattan.

So, really, really cool to see that part of the business, see that you don't typically see or you don't really know what's happening. Like you said, you're sitting, you know, in 5A, your seat, but underneath there's life saving medical equipment going to another country or another city.

So, that's a really cool part to see.

[06:05]Brian Jackson: Yeah, or it's a doctor in 5B sitting next to you for an important… like, you never know. But it's, like, that level of interconnectivity and how we're all supporting each other to make everything happen. The airport, it can either be the loneliest place in the world when you're leaving a place you don't necessarily want to, or it can be exactly like this collective community building moment.

[06:22]Liam Morris: Yeah. I had those experiences, too, like, even working. I've had some great flights and some not so great flights where I'm going for good reasons and not good reasons, you know. But, I 100% agree with you.

[06:32]Brian Jackson: So, your role, you manage across, what, 80 stations?

[06:35]Liam Morris: Around 80 stations, depending on what we have open in the region, yeah.

[06:38]Brian Jackson: And you were saying Latin America. And is it North America as well?

[06:39]Liam Morris: Latin, Central, and in the southwest United States, yep.

[06:45]Brian Jackson: So, how do you manage across all those time zones? I can barely do Pacific through Central through Eastern. So, how does that work?

[06:53]Liam Morris: You know, it's funny, I've actually had several people ask me this question lately, how do I deal with the time, the jet lag? And honestly, I believe it's mainly a mental game. When I go international, specifically those trips, I have to get really mentally focused to say, “All right, we're not going to let this get to us, because if we do, it hurts.”

And one of the ways that I get over it is I actually don't take a rest day when I travel. I like to travel the same day and work straight through. You know, recently, I was in Frankfurt and London and same thing, I landed the day that I worked. So, I flew overnight eight hours and I worked my whatever eight hours that day, because you're really tempted to get to your hotel room at 11:00 or 10:00, you're just taking a nap if you're tired. But when you're, kind of, forced to work through, it helps a lot.

So, that's my way, is just to really power through. And some individuals like to take that day and they'll take a nap. But for me, I just find that if I land and work straight through and just push through it, it's the easiest way to get at least somewhat acclimated.

[07:46]Brian Jackson: You're right. I used to travel to Indonesia in the 12-hour time difference. My trick was always just if you can make it through a full day.

[07:54]Liam Morris: Yeah.

[07:55]Brian Jackson: You know, and, like, an eight to five-day, get through, have a dinner. And if it's, like, 7:00, 8:00 at night and you go to bed, it's early, that's fine.

[08:01]Liam Morris: Yeah, nothing wrong with that.

[08:03]Brian Jackson: Either makes or breaks it.

[08:04]Liam Morris: I 100% agree. And that's why I always say we got to push through the first day. And luckily, my peers are on board when I'm flying with monitors. They'll come with me and we just work through that first day and it's all better after that.

[08:15]Brian Jackson: So, airlines, everyone always has a favorite. I was a Delta guy for a while and, you know, now I've switched over to United and I'm working my way up status. I'm a lowly silver elite. Maybe this podcast gets me to gold. We'll find out. But why United? What's your favorite thing about it?

[08:33]Liam Morris: So, you know, before United, so, I took a bit of a break between high school and college, took about a three-year break. And in that three years, I actually ended up working for Chick-fil-A as a cashier. And then my owner operator found out I wasn't going to school and put me in this program that allowed me to travel and open up new restaurants.

I was more excited for the flights then, like, the actual Chick-fil-A, I'm not going to lie. But, you know, Chick-fil-A's an Atlanta-based company. So, we flew Delta a lot. And I can say, you know, before I worked for United, I was a huge Delta fan, too. I thought they were the best. You know, I had status with them. It was, you know, a great experience flying with them. I would go outta my way to fly with them.

And then when I decided to leave Chick-fil-A and go to college, back home, the only airline I could get into was a contractor for United. And, you know, I was like, “That's fine because United's a great airline, too. You know, there was nothing wrong with them.”

Started with them. And I just began to see this culture shift, even from the contractor perspective, that, we went from a culture of, didn't really feel like the airline knew what they were going. They had gone through a lot with the merger Continental, and it was just, like, kind of, messy still. It wasn't a consistent product like Delta. It wasn't, you know, or other airlines even. But there was a lot of purpose into what we were trying to achieve, which was a unified culture between employees and contractors and business partners. And then a goal to really become the best.

And I think, you know, when I started with, actually, United in 2019, right before COVID, we just started implementing so much for the customer. I mean, our app, our technology, the investments we do, you know, I could sit here and talk all day about what we're doing. You know, we have a connection saver. We have an algorithm that purposefully delays flights every day, all day to get people connected that are running late. We'll text them that we're holding the flight for them, all kinds of stuff, right?

So, we started to go into this really customer-centric environment. And then, during COVID, we took full advantage of the low in travel. And financially, we were very stable. And we invested. I mean, you know, we have Starlink wifi on over 200 aircrafts now. And it's going to all of our fleet. You know, we have TVs. We're bringing them back into all of our planes, overhead bins, all this investment.

Right now, we are the flag carrier of the United States. We fly more globally than any other airline.

So, we've done so much investment over the last several years to get us where we are. And we're not even finished yet. So, being where we are now, seeing the company culture, the employee culture, you know, the business resource groups that we have employees, all the opportunities that we give and stuff, you know, to advancement for growth, these career development sessions that we fly, management over, you know, at, the company's expense for development, it's just, like, again, there's so much happening for the customer and for the employee that makes us as employees proud to be here. But then also that translates down to the customer, right? Basic business. If you take care of your employee, you take care of the customer, and it's showing.

So, all the little stuff we're doing, it's just when you have a leadership team that's focused on doing the right thing, when we say, “Good leads the way,” which is our current marketing slogan, it's a true thing. We're doing things that are right for the customer. We're making good decisions that affect the customer in a positive way and affect our employees in positive ways.

So, that's why, you know, I'm thankful to be here. I want to be a part of what we're doing to become the biggest and the best.

[11:32]Brian Jackson: What's really great, and being customer-centric's everything. I feel like, with airlines and flights, everyone loves to talk about their worst flight ever, right? And I have plenty of those. I've had some really dog of flights. I've got bad luck, I think. But tell me your best flight story. What's the best route experience you've ever had?

[11:52]Liam Morris: Man, that's easy. So, that would be my very first international business flight. And it was on United. And, you know, it was to see family in Australia that I hadn't seen in ages. I remember, I was 22. My first standby flight just started six months earlier with the contractor. And just the whole flight experience, you know, just from getting onboard the aircraft, a really long 16-hour flight, and then getting to experience, kind of, like, you know, when you say experience your product, you know, it's one thing to work the product. Here I am boarding air aircraft as an agent, loading bags. But then to actually experience a product and see, like, what are my customers experiencing, it's really, really cool.

So, that was my best flight ever, I have to say, was going down to Australia and just experiencing firsthand what it was like to fly United long haul. And we're a leader in Australia. We have the most flights of any airline to Australia from the United States. So, being a part of that and just seeing, like, other people from Australia.

And, you know, I'm a very observant person. I love to be in the airport. And I typically have my AirPods on, but on transparency with no music. I love to hear what people are saying as they get on. You know, I was on a Starling flight recently and just hearing everyone say, “Wow, this is so fast. This is super cool,” to when we got off the aircraft and the terminal and everyone forgot to turn off airplane mode because they were on the aircraft wifi. And usually, the first thing you do is turn off airplane mode, but they were so engaged in the wifi, they forgot to turn off.

I love listening to that. So, that flight is listening to customers, you know, make little comments about how good the food is or the service. That was really cool for me. And it was an eye-opener to say, “Hey, even though I'm, you know, a contractor in El Paso, Texas, like, here I am in Sydney, Australia.”

[13:16]Brian Jackson: So, you know, you've said, I think, a few times to folks where you never planned on grad school. What made you change your mind? What opened that door for you?

[13:25]Liam Morris: Yeah. I mean, you know, I think I'll take it a step further. When I was in high school, I was very lazy, didn't study.

And that's, kind of, what drew me to not want to go to college right away. I thought, “I don't need that.” But when I worked at Chick-fil-A and I, kind of, saw, like, you know, I was working 60, 80 hours a week at these restaurants, sometimes even 100 to open them. And as an 18-year-old, yeah, that's really good money, right? But something clicked in me when I was 20, 21. One common denominator here is that everyone who owns a Chick-fil-A restaurant has a degree. At the time, that was all I knew, was, like, progression within Chick-fil-A was to own one one day. It's, like, the ultimate goal.

But it wasn't what I wanted to do, right? So, I was like, you know, “I need to go to school.” So, I went to undergrad and I really applied myself and I went from being, probably, the worst high school student to almost a 4.0 in undergrad. And I fell in love with school. I fell in love with learning. I love the challenge. You know, especially, I worked full-time throughout all undergrad and undergrad school. And I love that. I just loved being busy and keeping my mind active.

So, I'll never forget, you know, I was graduating undergrad. It was, kind of, COVID season, so it was all online. And I got invited to a United event. One thing United really does well is they bring employee social media individuals who post a lot. They fly them out to all kinds of stuff. I have a box of Winter Spice Sprite that was sent to me yesterday because we're about to serve it on… We're serving it onboard starting this month. So, they're really good at getting employees to talk about the airline, right?

So, in 2020, 2021, they asked, “Hey, do you want to fly out to New York, New Jersey? We're going to make a big announcement.” And that's where we announced that we were ordering all these planes and putting high speed wifi. And we made a huge announcement called United Next, which is our five-year growth plan to become the biggest and the best.

And I'll never forget, I met so many executives at that event. I was on the plane on the way back. I'm, like, scrolling through LinkedIn and I'm noticing, man, every single one of these executives that I met had a master's degree. And I thought to myself, you know, I just finished undergrad. I was on a cool down, like, oh, man, finally, I'm done.

I mean, two weeks here, I was like, “All right, I'm, like, you know, no grad school.” And down that flight home, it just, kind of, struck to me, like, “Hey, right now, we're still coming out of COVID. We're not super busy. What's stopping me from going straight into grad school?” And it was the best decision I probably could have ever made because I think, as my industry came out of COVID, having the circle of individuals in my MBA class to, like, bounce ideas off of and just learn from, right. Because I was pretty young. I think I was, at the time, what, 25, 26 applying for grad school. So, I had the work experience, but because I worked straight from 18, right? But I mean, I'm in class with, as you know, really, really distinguished individuals, right?

And it was more, like, I'm going to learn a lot from both the professor, the curriculum, and my peers. Like, it was just, like, something to soak up constantly. So, yeah, I made that decision based off of just seeing what the future could look like for me. And not that, you know, hey, I wouldn't have gone to grad school later. I probably would've still, right? I could've waited, but it just seemed like the right time because there was so much advancement happening to recover from the pandemic. And also, I was in school mode 100%. I didn't want to end it. I loved it. I wanted to keep on learning.

So, that's what really drove me to make that decision. And it was one of the best decisions I could have ever made. Looking back, I'm so thankful I did it. A lot of sleepless nights and stress. I was an operational manager at the time, so I was working night shifts, overnight sometimes. I remember I got home at 6:00 a.m. and I was finishing essays to submit before 8:00.

I remember I was taking final exams in my office because I would get off at 8:00 or 9:00 and it was due at midnight and I just hadn't had time the whole week. And I would just sit in my office and finish the exam before going home. So, you know, it was a lot, but it was a great decision overall and one of the best things I've ever done in my career.

[16:45]Brian Jackson: And it's something we have in common. We both did the online program. And I think the big thing with it was the flexibility, right? We could keep our careers going, we could keep maintaining our day jobs, but then at the same time, yes, we have those few minutes in the evening, and that's class, and it's homework.

The one benefit to it, too, is you're working and you're learning things. And you're going through case studies and you have professors working through different scenarios. And the next day you go to work and, hey, you can apply it.

[17:12]Liam Morris: Yeah.

[17:13]Brian Jackson: Did you ever have those instances?

[17:15]Liam Morris: All the time. I think, for me, I brought in as much into the class, I feel, through my experiences, and I took as much out at the same time. You know, we talk about corporate strategy. My role at that time was fully strategic. So, making those decisions. But it wasn't even, like, oh, we set an example in the class, or the asynchronous material had something that, like, I'm going to use that exact scenario at work.

But it also more so challenged me to think in a long-term perspective on how a decision that I could do in an operational environment could affect the company's bottom line, customer experience. So, it was almost like you have to take yourself out of it. Sometimes, you want to put yourself into the examples or the case studies and say, “Oh, that's me.” But no, it's not really you. But what's happening in that case study, you can apply the functions or the results that were achieved or whatever was executed in your work. So, you almost had to take a third-person step back. I would, a lot of times, reread the case studies. And instead of putting myself in the position, just think of, like, what if I was an outsider seeing what happened? Because it's so easy to get immersed.

But yeah, I found myself so many times applying the case studies that I would read. And I was off Tuesday, Wednesday. I didn't have a traditional schedule. Those were the days that I always had class. I actually went to campus often and just studied there all day because I had to get out of the house.

I would get up at 8:00 or 9:00, drive to the Rice campus and just sit in the library for eight, 10 hours. But I remember there's multiple instances where, on a class Tuesday night, I'd used an example from the night prior that I did at the airport, some sort of operational example of how I solved the problem or something and brought it into the class.

So, it was really cool to give and take. And again, I think it's important that, although I was soaking in so much from my peers and the professor, I also wanted to give, because there must have been someone else in my class that was intrigued by the work I do or maybe that the work that they do is very similar to what I do and maybe with examples that I gave, help them, right? So, it went both ways and it was great.

[19:04]Brian Jackson: Well, and I mean, in your industry, too, like, specifically, things change minute by minute. And so, you're trying to make decisions quickly. And the best way to make a decision sometimes is based on an example of another scenario that's similar and you can draw on that experience to then quickly go, “Okay, this is what we're going to do.”

[19:21]Liam Morris: Yeah. Yeah.

[19:22]Brian Jackson: I guess, from that, you know, is there a skill or maybe a habit mindset, something you developed during your MBA that you maybe didn't expect, but now you're finding that you rely on? You know, is there anything you could pinpoint?

[19:34]Liam Morris: I think, for me, it's to think outside the box and come up with solutions that are really not conventional, per se. And that's another thing why I like United so much, too, is the culture was, hey, if you have an idea and it's something we haven't done, let's try it. And it was really supported.

And I think my MBA really helped me with that because I had to figure out… There was a lot of things that I wasn't necessarily exposed to over years or I was really new to, a lot of classes that I was really new to. And I had to figure out ways to get immersed in these classes and learn or respond to the professor, to my peers in our working groups, in our quizzes, and our assignments.

I had to learn how to respond in ways that I maybe didn't know because I didn't have a whole lot of, other than the async material, I may have never actually experienced it in the business world. So, I think, for me, the biggest takeaway from the MBA program was just learning to respond to things unconventionally, come up with different solutions that maybe either you've never done before or you've seen before, but you've changed them. And don't be afraid to apply them. Don't be afraid to execute on them. That's the biggest thing that I took away from the MBA, coming back to the airport after I graduated, you know. I say come back full time because my head was finally all in the game.

I was in both, but man, I was, like, everywhere during the MBA. But coming back and saying, “Hey, you know, we're going to solve problems, but let's find different ways to solve problems that we've never thought before.” And I think, the MBA really helped because under pressure, under time constraints. So, I think again, just that unconventional idea and execution of those ideas is what my MBA really gave me. I didn't think it would, you know. I learned a lot more about finance than I probably known before in undergrad, and it's great. But just that last minute, how do we do this? How do we achieve this? How do we get it done? And how do we do it differently and be okay with it? That's what I took away the most from the MBA, is pivoting and changing.

[21:16]Brian Jackson: So, at work, I mean, you're growing as a leader. When you were doing the MBA at Rice program, you also served in the MBA Rice Student Association as a treasurer. Were there any kind of leadership growth moments there that you took back and apply back to work?

[21:31]Liam Morris: Yeah. So, you know, being a part of that, it was relatively new. It was still being developed.

[21:35]Brian Jackson: Started it after I was done.

[21:37]Liam Morris: Yeah, we did. I think we’re the second group to have it. But, you know, it's funny, I was debating whether or not I should join or not join. I have so much on my plate, right? And I said, no, I want to join because, you know, even if I could contribute a little bit, that's okay.

But I think that really taught me that, despite what we all have going on in our individual careers, it’s super important to come back together on one page. So, when we would meet, like, it was frustrating. Sometimes I couldn't meet, sometimes others couldn't meet. And I'll be honest, sometimes we were meeting and I'm so exhausted. I got class tonight. I've been working all week. But it really, really taught me to make time and space because what we were doing was not for us, it was for other people to have a great experience at Rice and to, kind of, experience a little bit more about the online program.

I think, when I first started the online program, I was in Dallas for a few months before I moved down here. And it almost felt like I was a little disconnected. And when I moved here I was like, there's no excuse to not be connected into Rice. But because you're online, you might tell yourself, “Well, I can't get connected because I'm online.” Like, that's, I don't go to the campus. And I think one thing that we really did well, and I'm thankful, is that I learned, like, we could get people to come to campus and show that they are a part of Rice. That they're not just on a computer, they're not just on a Zoom session.

And that's translated to my career today. Like, you know, I talk about United's business resource groups. Well, we have, I think, about a dozen resource groups. You know, United for Veterans and Gen Trend, which I'm a part of, which is young leaders. I took what we did there and actually helped start the Houston chapter for Gen Trend, which we have about 2,000 members in our employee group.

And from what I learned in that season of leading and being in that business association, the student association, I brought over to our business resource groups. And, you know, I'm the chief of staff, so I handle the finances. Like, I was the treasurer at Rice.

And it's all about, again, creating experiences for our employees. You know, we'll do stuff like tours at the airport or tours of the early baggage system, because there's so many employees that don't work at the airport. They don't see what we do. We'll have lunch-and-learns sponsored by the company. We'll bring in executives or other guests from other companies to speak.

So, you know what I learned… and our student association was really cool to bring over here and to help start a chapter for young professionals. So, I would say, if someone's considering doing that, 100%, dude, it's the best experience you can have because it's all about giving back to your peers and then you never know when it's actually going to help you later.

[23:46]Brian Jackson: That's a great point. I think, like, professional school and, like, MBA-specific, it's a playground. Like, if you feel like you need to expand the muscle of leadership, there are opportunities to do it. If you, you know, want to grow as a finance expert, there are opportunities to do it. Like, you just need to seek them out and then place yourself in the room to be there to have that experience.

My plug is always selfishly, like, alumni, be an engaged alumni of the school you graduate from. I have had more opportunities for growth as an alum than I think I ever expected I would. But it's that opportunity to be in those spaces.

[24:24]Liam Morris: Yeah. I think imposter syndrome does sneak in quite often and say, “Well, I don't belong here, or I shouldn't be a part of that.” Like, you have to get rid of that. You got to get rid of that because that's going to absolutely stunt any sort of growth or development. Sometimes, it tries to sneak in with me, too. I'll be in a room with high-level leaders. I'm thinking, “I shouldn't be here.” And I'm like, “No, I should be here because this is my job and I'm able.”

[24:42]Brian Jackson: They wouldn't have invited you if you weren't supposed to be there, Liam.

[24:45]Liam Morris: Exactly, you know, exactly. But it sneaks in and it gets the best of us, right? So, it's important to recognize that and be like, “No, I'm not going to let that have anything to do with where I'm at. I'm supposed to be here.” So, same thing with our Rice MBA program and alumni. Don't feel like you don't belong. You do belong. Like, I get those emails sometimes and I think, “Oh, that's a cool event.” And I'm like, “Oh, I don't think I should go to that event.” Like, but no, I'm a Rice alum. I have every right to be there and I should take advantage of those opportunities. So, I will say, don't let that sneak in.

[25:12]Brian Jackson: Don't at all. And I mean, I feel like campus is like a clubhouse that we are all so lucky to have the key to. Gorgeous, great spots. I mean, Brochstein Pavilion to go for coffee. Like, it doesn't get any better than having that, so take advantage of it.

So, okay, you've wrapped up your MBA.You are, you know, in a leadership role now. What's next? What's the big goal for you? It could be professional or personally.

[25:33]Liam Morris: So, you know, I will say I never, ever envisioned that I would be where I'm at now. And I can honestly say from when I was a business partner with United, cleaning aircraft and loading bags for another company, right, but working in the United product, I never had a plan to get to where I was.

My internship with United came up out of nowhere. And I moved to Jersey and then midsummer, I got a full-time offer to stay and I transferred schools, you know, the very last minute went up to Rutgers from UT El Paso. And then an opportunity came to transfer to Dallas. And then there I ended up, you know, our CEO lives there. Ended up meeting him and a lot of executives all the time. And my name got out there really great. And then I came down to Houston to go to Rice and as an assistant manager here in the airport. And then finished my MBA, went into the current role that I'm at, which is safety and regulatory.

I can honestly say I never really had a plan to get where I was, but I'm thankful that I was always willing to walk through the door, because every single opportunity that I've had, both promotion and a lateral, was a great move. And it was such an instrumental pivotal move.

Like, even now being in safety and regulatory, I honestly don't really know what the next step is. But I do know, I'm certain of a few things, right? And that's definitely stay with United. I'm very proud of the work we're doing. I love the culture here. I love what I do. And just look for opportunities to get out of my comfort zone.

You know, one thing that I often tell myself is, like, okay, like, when I see a job posted on United's internal system that I'm like, “Man, I don't really know anything to do with that role, but hey, I got a Rice MBA. You know, like, I'm qualified. I got years in this operational experience, in this role, in my current role, right?”

So, I think, being flexible and pivoting and being really open to anything is the best thing that one could do. And that's, kind of, where I'm at right now, is, like, hey, if there's a role that opens up that either I'm asked to apply to or that interests me and that I don't know about, I'm not afraid to do it. I'm 100% there to hit the Submit button. I love living in Houston, but if it's in another city, too, I'm open to that as well, right?

So, I think what's next for me is just continuing to know where I want to be, which is here. And then continuing to be willing to have that door and walk through whichever door opens, even if I'm not comfortable or know what it is. But I know it's going to be here, because of… Where we're going as a company and what we're doing an airline is exciting. So, I'm here for the long haul, for sure.

And as that most are, in the airline industry, that's a long tenure. I will say this one day, the executive C-suite would be great because I feel like there's so much that I would love to lead our teams into, whether that's a COO role or chief customer role, any sort of role within United. I know I could take our organization there.

[27:58]Brian Jackson: Yeah, and I think I just saw too that y'all have a new route to Bangkok, right? Bangkok, Thailand.

[28:03]Liam Morris: Yeah.

[28:04]Brian Jackson: Maybe you could work on that route somehow. I've Lived in Thailand. You would love it, Liam.

[28:09]Liam Morris: You know, it's funny, I've been here now, what, eight years of flight benefits. And there's so many places on my list, still. And you'd be surprised how many people work here that worked here for 25 years that haven't visited the most simple places. But that will be on my list, 100%. I'm thankful that we fly there. And I think we're the only U.S. airline flying there.

[28:25]Brian Jackson: You are. I'll be doing that at some point. That is on my to-do list. So, after you've done it, I'll ask for all your tips and tricks.

Okay. So, you spend a lot of time on airplanes, so I bet you have probably the best answer for this. What is the best seat on the aircraft?

[28:40]Liam Morris: Ah, man. So, there's a certain aircraft type that we have, where there's like no seat in front of you. So, it all depends on the plane, right, in each plane.

[28:48]Brian Jackson: Let's say a triple seven.

[28:50]Liam Morris: A triple seven is 31L, and it's the window exit row. The exit row on the triple seven is a massive door. So, it's not like the little over wing doors, right? So, what I'll do is, you know, you put yourself up for takeoff, but after takeoff I'll bring my backpack down and just put my feet on top there. And I have, like, almost a 90-degree angle and I'm just chilling. That's the best seat for me.

If not that plane, I would say I am an exit row, window kind of person. I love being able to sleep on the window. But also, the exit row has so much space where I can, like, lean forward and sleep on the tray after I've wiped it, of course, with one of our United wipes. But that would be the best seat, I would say.

[29:28]Brian Jackson: Okay. Noted. I'm going to steal those. You're going to have competition now next time you're checking in. What's something about airline travel that most people don't know but you do because of your experience?

[29:40]Liam Morris: I would say it's probably underneath you that you don't really realize what's traveling with you. And it's nothing like… I'm not saying like snakes on a plane, nothing like that, right? But in the cargo compartment, there's some pretty wild stuff. There's, like, lobster, live lobster. There's flowers from South America going to Canada. There's some really cool stuff. So, I think the most interesting part that people don't know is that it's not just bags underneath you. A lot of time, it's a lot of cargo. It's a lot of freight. And there's some really interesting cool things that get sent via airlines in the cargo pit that are traveling with you.

So, I always tell someone, if you're sitting in a window seat, take a peek outside while they're loading or unloading. And you'll see some really… because we label it, right? You'll see some really cool stuff coming on, in and off the plane big time.

[30:25]Brian Jackson: Okay, next time I'll be looking for my oysters from Prince Edward Island. Hopefully they're riding home with me.

[30:30]Liam Morris: You know, in Newark, I kid you not, there's a restaurant, I don't know if they still do this, but this is pre-pandemic, that would get their sushi fresh off our Tokyo flight every day. They would get their tuna and all the fish would come out. Like, literally, they had a specific box that was loaded, a cargo box of fresh fish from Japan every single day.

And it was sent to that restaurant. We had a partnership with that restaurant. And they would make fresh tuna from that flight every morning when it would land, fresh sushi, everything. So, yeah, you never know.

[30:58]Brian Jackson: Yeah, that's cool. Okay. One. silly question, just for my own edification. Let's say you own a nicer luxury piece of luggage, a Rimowa, that's a hard case, are you intentionally rough with cases like that when you're loading in baggage?

[31:13]Liam Morris: Absolutely not. I will say, I think, if you have the chance to go on YouTube and look at these baggage sorting systems, it is a maze of conveyors, it is a organized chaotic mess in our bag rooms. So, sometimes, unfortunately, the bags do get scuffed a little bit, but I would say, to be honest, the level of human interaction with bags has gone down so much with this automation that we've introduced.

Like, Houston has the first early bag sort system in the United States where it's a huge building that went up in terminal E and we actually store bags in, like, trays, Amazon style. So, if you have a long connection in order to avoid congesting the bag room area, we actually store it. So, all the bags get stored individually, and then as the flights are getting closer to departure time, the bags will drop onto the belt and come down to be loaded on the aircraft.

So, it's actually really wild. The days of handling bags by hand really have gone down. Most of it's so automated. There's only a couple of points where your bag is touched, and that's when someone puts it on the belt when you drop it off. Then someone puts it in the cart and then someone puts it on the plane. And someone takes it off the plane and puts it back on the belt.

It's barely touched anymore like it used to be. So, it's all automated now.

Only a few more years until all of our planes have big bins. So, hopefully, we'll avoid checking the bags in. Just give us a couple more years. We're still retrofitting everything, I promise.

[32:26]Brian Jackson: It's a nightmare dealing with people's luggage in the bins on the plane. And they're trying so hard to put bags that are obviously not going to fit.

[32:33]Liam Morris: Yeah.

[32:34]Brian Jackson: It just drives me nuts.

[32:35]Liam Morris: This is my public service announcement. Please, your backpack goes under the seat in front of you. It doesn't go in the overhead bin. Overhead bin's only for the big bag. Please, after takeoff, you can move your backpack behind your legs and stretch out. But please, put your small item underneath the seat in front of you. Everyone, a favor. No jackets. Keep that with you. That's my biggest PSA, is, you know, take care of each other, take care of your fellow business travel and person leisure travel. Like, we're all in this tube for the next three hours. And most of us don't really want to be there. We want to get to where we're going. So, PSA just do everyone a favor and look out for each other. That's the nicest thing I can say to anyone who likes to use the up all the overhead bin space.

[33:13]Brian Jackson: And do not stand up before the plane has stopped taxiing.

[33:18]Liam Morris: Yes. Correct. No, take care of your fellow travelers, y'all. Just be nice to everybody.

[33:26]Brian Jackson: Hey, Liam, this has been so much fun. Thank you for joining on this episode of Owl Have You Know.

[33:33]Liam Morris: Thanks, Brian. It was great to be here.

[33:38]Brian Jackson: Thanks for listening! This has been Owl Have You Know, a production from Rice Business. You can find more information about our guests, hosts, and announcements on our website, business.rice.edu.

Please, subscribe and leave a rating wherever you find your favorite podcasts. We’d love to hear what you think. The hosts of Owl Have You Know are myself, Brian Jackson, and Maya Pomroy.

You May Also Like

Audit or Tax: Where Will the Rice MAcc Take You?

Interested in pursuing a career in audit or tax? The Rice Master of Accounting consistently places students in both fields, allowing them to explore opportunities and build their network along the way.

Choosing a path in public accounting is an exciting decision for future professionals entering the field. For many students in the Rice Master of Accounting program, that decision often centers on one key question: audit or tax?

Both offer strong demand, meaningful client impact and long-term growth. At Rice Business, students receive the guidance and preparation to discover where their strengths align — and where they want their MAcc to take them.

Common Roles in Public Accounting

Incoming public accounting professionals commonly choose between careers in audit and tax.

Tax vs. Audit: What’s the Difference?

Auditing focuses on verifying financial information, assessing controls and ensuring compliance with accounting standards — helping organizations operate transparently and ethically. As an auditor, you may collaborate closely with clients across industries and around the country.

“My audit internship at PwC gave me the opportunity to explore accounting for various industries and work closely with diverse clients and teams,” says Hannah Zhang, MAcc Class of 2026. “I enjoyed helping with the early stages of the audits, from fraud inquiries and risk assessments to testing internal controls and acquisition valuations.”

Audit can be a strong fit for MAcc students who like structured problem-solving and seeing how businesses operate from the inside.

Tax work centers on compliance, planning and advising clients as regulations evolve, and students drawn to tax often enjoy technical, analytical work. The field has seasonal peaks but offers consistent variety through diverse projects and advisory opportunities.

“My experience as a tax intern at Deloitte offered hands-on experience with tax compliance for multinational corporations, record keeping for complex partnerships, and small projects in individual and international taxation,” says Max Melton, MAcc Class of 2026. “I also assisted with client outreach and improved my Excel skills.”

Both audit and tax require analytical thinking and sound judgment, but each offers a different pace, environment and type of client work.

Career Growth in Tax and Audit

Both fields offer clear promotion cycles — typically every two to three years — and strong career mobility, or “exit strategies.” Many audit professionals transition into careers in finance, consulting or corporate accounting, while tax professionals often move into corporate tax leadership, advisory roles or specialized technical areas.

In both areas, the combination of foundational training, professional discipline and client exposure sets Rice MAcc graduates up for long-term success in public accounting and beyond.

Interested in Rice Business?

How the Rice MAcc Prepares Students

The Rice MAcc is built to help students thrive in both audit and tax. Our curriculum builds strong foundations in accounting, analytics, communication and professional judgment — skills essential across both fields.

Rice Business MAcc students also benefit from integrated CPA exam preparation, personalized career guidance and strong mentorship from our world-class faculty and alumni professionals, helping students enter the field prepared from day one.

Deciding Your Best Path

Choosing between audit and tax is ultimately about understanding yourself — and recognizing the environment you’ll thrive in. MAcc students should ask themselves questions such as:

- Do you prefer team-based client interaction or independent analytical work?

- Are you more energized by fast-paced problem-solving or deep technical research?

- What type of work environment motivates you long-term?

The Rice MAcc program gives students space, support and exposure to explore these questions through coursework, workshops, networking events and hands-on guidance from faculty and career development staff.

Where Will Your MAcc Take You?

With factors like tech, generative AI and expanding regulations continually affecting both fields, today’s accountants need digital fluency, technical expertise and strong analytical skills — qualities strengthened by the forward-looking coursework of the Rice MAcc.

Whether our students intend on pursuing audit or tax, they step into their post-MAcc profession ready to make a meaningful impact and thrive wherever they go.

You May Also Like

Keep Exploring

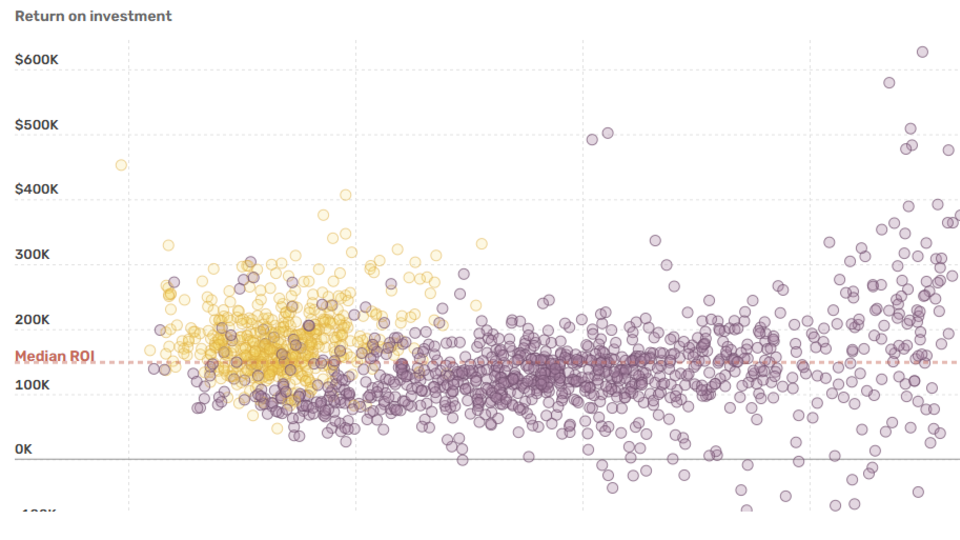

Which Texas colleges are the best investment? Here’s how they compare to other schools

Rice University ranks first in Texas for 10-year return on investment, with alumni seeing roughly $334,000 in gains. Its strong earnings outcomes keep Rice at the top of both short and long-term ROI comparisons statewide.

Rice MBAs Share Their Favorite Classes

Rice Business offers a rich variety of courses across its programs, including 100+ electives for Full-Time MBAs, allowing students to dive and excel in topics they’re passionate about. Here are some of our students’ favorite courses.

There are many reasons Rice Business is considered one of the top business schools in the country, and of them is our commitment to helping students personalize their MBA. At the end of the day, your MBA should reflect you — your interests, passions, and personal and professional goals.

Rice Business offers a rich variety of courses across its five MBA programs, including 100-plus elective choices. Our dedicated faculty and extensive curriculum work together to make sure our MBA students graduate not only with a strong foundation, but the insights and tools to excel on their unique path.

We asked students: What has been your favorite class in your Rice MBA program?

Second-Year MBA Course Favorites

Applied Finance has easily been my favorite class — it made corporate valuation come alive through real company cases. It completely shifted how I analyze businesses and helped me understand how managers think about investment decisions.

Jack Berry, Professional MBA ’26

My favorite class is the M.A. Wright Fund. It’s an incredible experience because we actually get to make real investment decisions that the fund acts upon. It’s a perfect mix of teamwork, accountability and hands-on learning.

Sindhura Cheruku, Full-Time MBA ’26

Instead of one favorite class, a blend of courses has really defined my MBA experience at Rice Business. From “Geopolitics of Energy” to “Tech Product Management,” my courses have significantly shaped my post-MBA vision of working at the intersection of energy, technology and finance.

Veronika Burobina, Full-Time MBA ’26

Two favorites have been “New Product Development” and “E-Lab: New Enterprises.” Both courses are hands-on and application-based, allowing me to immediately practice what I learn in the classroom.

Lipi Gandhi, Full-Time MBA ’26

Interested in Rice Business?

First-Year MBA Courses With Impact

My favorite class has been “Organizational Behavior.” The material is applicable to all aspects of life, and Professor Marlon Mooijman is knowledgeable, approachable and engaging. This course is definitely a first-year favorite.

Madeleine Allocco, Full-Time MD-MBA ’27

My favorite MBA class so far has been “Strategic Business Communication I.” The tools we’ve learned have been immediately useful in presentations, recruiting and real-world conversations, and I’ve become a better communicator.

Miles Moscariello, Full-Time MBA ’27

I’ve enjoyed Organizational Behavior, because I was able to apply the content from each class immediately after learning it.

Maggie Bokros, Professional MBA ’27

I have been impressed by Professor Alan Crane and his core finance course. Coming from a military background, I didn’t have much in the way of financial acumen, and this class has been instrumental in bringing me up to speed.

Stephen Fialko, Full-Time MBA ’27

My favorite class at Rice has been “Leadership,” taught by Professor Brent Smith. From the very first session, the course pushed me to pause, reflect and examine not just how I lead, but who I am as a leader.

Cherrice Browne, Executive MBA ’27

Learn about Professor Brent Smith and his cutting-edge insights on the science of leader development:

Want to find out how the Rice MBA curriculum and broad elective courses can fuel your growth? Continue reading about how Rice empowers you to make your MBA your own.

You May Also Like

Keep Exploring

Bringing AI to All feat. Allison Knight ’10

Allison chats about selling her first venture, Rebellion Photonics, to Honeywell in 2019 and how she's codifying blue collar genius through Alaris AI.

Owl Have You Know

As the youngest founder in her Rice MBA cohort, Allison Knight ’10 knows a thing or two about blazing a trail.

At just 24 years old, she co-founded Rebellion Photonics, which used cutting-edge technology to identify and quantify gas leaks on oil rigs, preventing catastrophic explosions. Knight went on to sell Rebellion Photonics to Honeywell in 2019, and is now codifying blue collar genius through Alaris AI.

In this episode, Knight joins host Brian Jackson ’21 to discuss how Rebellion Photonics used early AI technology to improve hyperspectral imaging and revolutionize gas leak detection. She also opens up about her experience as a young woman founder in a predominantly male industry, her role as an adjunct professor at Rice Business and why she believes blue collar work is the next frontier for AI exploration.

Subscribe to Owl Have You Know on Apple Podcasts, Spotify, Youtube or wherever you find your favorite podcasts.

Episode Transcript

-

[00:00]Brian Jackson: Welcome to Owl Have You Know, a podcast from Rice Business. This episode is part of our Flight Path series, where guests share their career journeys and stories of the Rice connections that got them where they are.

Today, we're joined by Allison Knight, an entrepreneur, AI innovator, and Rice Business alum whose career spans deep tech and multiple startup ventures. At just 24, Allison co-founded Rebellion Photonics, the imaging startup behind the world's first real-time gas cloud detection system, technology that reshaped safety standards in the energy industry, and was later acquired by Honeywell.

Today, she's the founder and CEO of Alaris AI, bringing practical AI tools to blue-collar trades. In this conversation, we get into what it was like to be a young founder in a high-risk industry, her drive to expand access to technology, and the mindset that's helped her take bold risk, build teams, and redefine the playing field at every stage of her career.

Hey! Good morning, Allison. I'm so happy that you're joining me on Owl Have You Know.

[01:05]Allison Knight: Hello. Yes. Good morning to you.

[01:08]Brian Jackson: Good morning. Allison, you were the youngest founder in your cohort, at 24, with Rebellion Photonics. You know, what was the mission? And ultimately, what happened to the company?

[01:18]Allison Knight: Sure. So, Rebellion Photonics, what we specialized in is the ability to identify and quantify gas leaks on oil rigs, refineries, and pipelines before they caused explosions or unnecessary emissions. So, before Rebellion Photonics, believe it or not, oil and gas companies, upstream and downstream, used detectors pretty similar to, like, the fire smoke detectors in your house. We call them point detectors. Like, the smoke has to come to the detector, kind of, linger there. And they would put fancier versions, but they would put those out around refineries and such, like, on the fence in there, as if a methane emissions cloud hung out at six-feet tall on a clinic fence. But I think, to be fair, that was the best they had. And they put them everywhere.

But the gas clouds, in the real world, don't behave in the wind. And at some point, detectors are not ideal. So, really, the way, you know… we were specialists, like, you could see in our videos, oh, for the first time, you could see the gas leaks and not just see them. You could see the quantity. Like, we would do a false color image show. It was, like, bright red and a deep red there were most stents. And then you'd see videos of, like, your workers, like, standing near a gas cloud. And that’s, you know, that's a cortisol spike right there.