What Are the Prerequisites To Get Into a Top MBA Program?

Every MBA app looks different. If you want to get into a top-ranked business school, here are some tips from the Rice Business admissions team on curating a strong application and standing out.

If you’re considering pursuing an MBA, you may be wondering: What does it take to get into one of the top business schools?

There’s no one way to submit a perfect MBA application, but there are key qualities that most successful candidates share — and that top admissions committees search for. Here are some tips from the Rice Business admissions team on curating a strong application and standing out to top-ranked business schools.

How To Stand Out

Top schools aren’t just looking for applications with all the boxes checked off. They want to see candidates going above and beyond — demonstrating leadership, passion and vision for the future.

Here’s what can really set your Rice MBA application apart:

- Interview Prep. If you’re invited to interview, it means the committee sees potential in you. Use this opportunity to reinforce your goals — displaying confidence, clarity and purpose behind your decision for pursuing an MBA.

- Professional Certifications. Credentials like the CFA and PMP can strengthen your profile, especially if they align with your career goals or show technical expertise.

- Career Progression. Clear, steady advancement shows commitment, capability and a track record of results — evidence that you’re ready to take the next leap in your career.

- Demonstrated Leadership. Through community involvement, entrepreneurship or mentorship, strong leadership is a universal differentiator.

- Quantitative Readiness. Courses like accounting, statistics or data analytics can demonstrate preparedness, especially if you waive test scores.

- Strong GPA. A high undergraduate GPA shows you can handle the academic rigor of graduate-level coursework. If your GPA is lower, other elements like test scores or professional achievements can help balance it out.

- GMAT, GRE or EA. Even when tests are optional, submitting a competitive test score can boost your application, as it signals readiness for the MBA’s analytical demands.

- Authenticity. Be yourself! Admissions teams want to get to know the real you — your goals, your story and what drives you to pursue an MBA.

If you’re aiming for Rice Business or another top program, make sure to strategically display your strengths in your MBA application to show your commitment.

Interested in Rice Business?

MBA Application Basics

While every MBA program has its own criteria, these core components are expected by most top-tier Full-Time MBA programs, including Rice Business:

- Bachelor’s Degree. All accredited MBA programs require a completed undergraduate degree from a recognized institution.

- Professional Experience. Most students bring two to five years of work experience. Schools aren’t just looking at what you did — they want to see your career progression and impact.

- Resume. A clear, concise resume highlights your professional trajectory, achievements and extracurricular involvement. Think of it as a snapshot of your career story.

- Letters of Recommendation. Strong recommendations from supervisors or mentors provide a third-party validation of your abilities. The best letters share concrete examples of your teamwork, leadership and problem-solving skills.

- Personal Essays. Essays are your chance to tell your story: why you want an MBA now and why that school is right for you. Authenticity matters more than perfection.

For professional applicants looking to apply to a part-time program like the Rice Professional MBA, Hybrid MBA or Executive MBA, requirements can vary. For example, an executive program may prioritize work experience over test scores or education history. Be sure to check the Rice MBA application requirements for your specific program of interest ahead of time.

If you’re considering graduate school, it’s a good idea to start preparing these materials early — no matter when you intend on applying.

Missing Something? Here’s How To Bolster Your Application

Don’t panic if your profile isn’t perfect — many admitted students don’t check every box. What matters is how you tell your story and balance your strengths.

For example, if your GPA isn’t as strong as you’d like it to be, consider using essays to highlight your professional achievements or quantitative experience. If you have less professional experience, you might emphasize leadership in volunteer roles or entrepreneurial ventures. Many early-career applicants are still competitive if they demonstrate leadership potential, internships or entrepreneurial experience.

Our admissions committee, like many others, evaluates applicants holistically. Top programs are looking for evidence of potential and passion, not perfection. Show them how you’ve grown, what you’ve learned and where you’re headed.

Looking for More Application Tips?

If you’re looking for more insights on how to present your best self, check out our guide on MBA application tips — including strategies for crafting your story, preparing for interviews and getting involved in the community early.

Curious if you belong at Rice? Contact our admissions team or attend an event to learn more about our top-ranked MBA programs.

You May Also Like

Keep Exploring

Rice Business’ Rodriguez named Poets&Quants Dean of the Year

Peter Rodriguez, the Houston Endowment Dean of the Jones Graduate School of Business and the Virani Undergraduate School of Business at Rice University, has been named the 2025 Poets&Quants Dean of the Year, a national honor recognizing visionary leadership and outstanding contributions to business education.

Peter Rodriguez, the Houston Endowment Dean of the Jones Graduate School of Business and the Virani Undergraduate School of Business at Rice University, has been named the 2025 Poets&Quants Dean of the Year, a national honor recognizing visionary leadership and outstanding contributions to business education. The award was presented last night at Poets&Quants’ annual awards ceremony in Toronto.

Since his appointment as dean in 2016, Rodriguez has guided Rice Business through a period of extraordinary growth and innovation. Under his leadership, the school has grown in enrollment, faculty and staff. He doubled the MBA enrollment and launched new programs, including the university’s first online graduate degree program, MBA@Rice, as well as the hybrid MBA and the undergraduate business major at Rice. He also ushered in a new name for the undergraduate programs in honor of Houston community and business leaders, Asha Virani ’89 and Farid Virani.

This past spring, the Rice Business alumni network grew to more than 10,000. To support the school’s growing programs and student body, Rodriguez is overseeing the development of a new 112,000-square-foot facility adjacent to McNair Hall. Scheduled to open in 2026, the building will serve as a hub for business education, innovation and community engagement in Houston and beyond.

“Peter Rodriguez’s optimistic, forward-looking leadership has elevated Rice Business among the nation’s top business schools and opened the opportunity of a Rice Business degree to undergraduate and many more graduate students,” said Rice University Provost Amy Dittmar. “His vision for accessible, high-impact business education continues to inspire faculty, students and alumni — and this recognition from Poets&Quants is well deserved.”

In his nearly 10-year tenure as dean, Rodriguez has seen Rice Business climb in the national rankings, including the No. 3 spot for Best MBA in Finance from The Princeton Review. In recent years, Rice Business has also been ranked No. 5 for Top Online MBA program (2025) by The Princeton Review and No. 1 MBA in Texas (based on global rankings) by the Financial Times (2023-2024). In addition, Rice Business has been ranked the top graduate school for entrepreneurship by The Princeton Review and Entrepreneur magazine for the last six years.

Rodriguez joined Rice Business following more than a decade at the Darden School of Business at the University of Virginia, where he served as senior associate dean for degree programs and chief diversity officer. He holds a doctorate in economics from Princeton University.

In the Media

Rice University’s Jesse H. Jones Graduate School of Business today announced the launch of its Graduate Certificate in Healthcare Management program, a 10-month, credit-bearing professional credential designed for current and aspiring leaders seeking deep expertise in the business of healthcare.

Poets&Quants’ Dean Of The Year In 2025: Peter Rodriguez Of Rice Business

In less than a decade, Rodriguez has transformed Rice Business in nearly every dimension. Beyond creating a thriving undergraduate offering, he has overseen a 192% increase in student enrollment. The growth stems from a doubling of MBA students and the launch of an online MBA—the university’s first online degree—along with a hybrid MBA option.

The Right Choice

Carlos Macias, Master of Accounting '25

For Houston native Carlos Macias, earning a Master of Accounting (MAcc) at Rice University wasn’t just a hometown advantage — it was a smart move toward a successful career in finance.

Drawn by Rice Business’ strong reputation and close-knit community, Carlos knew the MAcc program was the right fit. In this collaborative environment, students challenge, support and inspire one another, bringing fresh perspectives to every class.

Keep Exploring

Professor and Peer Support

Candis Damtse, Master of Accounting '25

What sets the Rice Master of Accounting program apart? For Candis Damtse, it was the welcoming community and the accessibility of the faculty that made her feel like she truly belonged. Beyond rigorous coursework and career development opportunities, Rice Business creates space for students to connect — with social events like Partio, the beloved “party on the patio” tradition at McNair Hall.

Keep Exploring

Pivot to Accounting

Chloe Kinnebrew, Master of Accounting '25

Coming from an economics background, Chloe Kinnebrew didn’t know exactly what to expect from a Master of Accounting (MAcc) program. At Rice Business, she found a welcoming community, a buildable curriculum and career resources that supported her every step of the way.

Designed for students from any academic background, the 10-month Rice MAcc follows a lockstep, cohort-based model that builds tight-knit, lasting connections. Outside the classroom, career development opportunities — from recruiting events to networking sessions — help students get exactly where they want to go.

Keep Exploring

Americans Are Changing Their Salary Expectations

Rice University professor Mikki Hebl says job seekers’ willingness to accept lower pay and roles reflects a softer labor market and shifting values toward flexibility, balance, and meaningful work.

Why Rice MAcc Graduates Land Jobs and Keep Rising

The Rice MAcc program offers the best of both worlds: quick career results and a foundation for long-term success.

No matter the industry or economy, accounting is the backbone of business. Companies rely on accurate financial information to make decisions, maintain compliance, and build trust with investors and customers.

That makes accountants essential — and consistently in demand.

“Everyone needs an accountant,” says MAcc student Josue Gonzalez. “It’s one of those jobs that’s unlikely to go anywhere anytime soon. That’s why for me, the MAcc was the perfect mix of passion and opportunity.”

What sets accounting apart from other career paths is how its versatility grows over time. While some fields force you into narrower lanes as you advance, accounting expertise becomes broader and more powerful the longer you practice.

Immediate Results: Job Placement You Can Count On

For multiple consecutive years, our Master of Accounting program has achieved a 100% job placement rate within three months of graduation.

That record of success comes from more than academics. It’s fueled by career coaching, recruiter relationships and a curriculum aligned with industry needs.

“What really stood out to me was how much exposure I got to the Big Four companies,” says alumna Chloe Kinnebrew. “Throughout the program, there were so many recruiting events, which really helped my search for a job in auditing.”

Interested in Rice Business?

Where MAcc Graduates Go

Most recruiting begins at the Big Four — Deloitte, EY, KPMG, PwC — in audit or tax. These firms provide unmatched training and exposure. But Rice alumni also take their skills into industries like corporate accounting and finance, consulting, investment banking, nonprofits and government, and entrepreneurial ventures.

After landing jobs, Rice MAcc alumni also grow into leadership. Graduates have become CEOs, CFOs, audit partners, executive vice presidents, controllers and managing directors. Their careers show how a MAcc can be both a launchpad and a ladder.

“I’ve seen multiple people go through the MAcc program and end up super successful in their business careers,” says alumnus Carlos Macias. “That was a sign that this was the right step for me and a good way to start my career.”

A Future You Can Trust

Certainty is hard to find in today’s economy. But with a Rice MAcc, you gain both stability and flexibility: a degree that helps you land your first job and sets you up for the roles you’ll want five, ten or twenty years from now.

“The MAcc degree opened the door to public accounting, enabled me to succeed there and helped me pivot into corporate finance. To me, the MAcc degree’s greatest strength is that it combines technical knowledge and development of soft skills that allow us to succeed in whatever career path we choose to pursue.” —Matthew Hrncir, Rice MAcc Alum

Ready to explore the next step?

Learn more about Rice MAcc admissions or connect with our team to see if this program is the right fit for you.

You May Also Like

Keep Exploring

The New Compass for Customer Success

Hiring a dedicated customer liaison can steer teams toward stronger collaboration and higher product adoption.

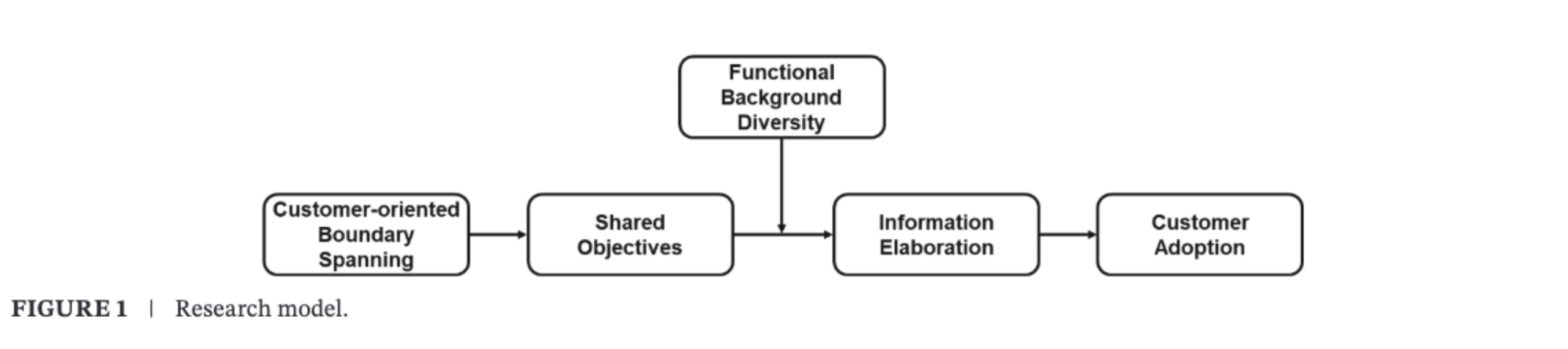

Based on research by Daan van Knippenberg (Rice Business), André Wagner (Drexel University), and Lauren D’Innocenzo (Drexel University)

Key findings:

- When companies add the role of “customer-oriented boundary spanner” to their team, product adoption increases.

- The effect is even stronger when teams include employees with diverse functional backgrounds.

- The strategy delivers measurable results, boosting customer usage and driving investment.

If customers don’t fully use the products they purchase, companies can sell a lot and still fail. When the problem customers want to solve persists, the product often gets blamed — leading to cancellations and lost contracts.

A new study from Rice Business tested a simple fix: give customers a dedicated team liaison — a compass within the team, someone whose job is to keep everyone pointed toward the customer’s true north.

Published in the Journal of Organizational Behavior and co-authored by Daan van Knippenberg, the Houston Endowed Professor of Management, the research found that a “customer-oriented boundary spanning” approach increases the likelihood that customers will fully adopt products — especially if company teams are made up of people from different professional backgrounds.

“Subscription customers can turn off products very easily if they’re not happy,” says van Knippenberg. “So, customer adoption is critical for business success. Looking through the lens of the customer helps to bring the team together in pursuing a shared vision and objective.”

Embedding a “Customer-Oriented Boundary Spanner”

The authors ran a large-scale field experiment — one of the most rigorous methods in organizational research — and their findings reveal a powerful way for businesses to boost customer adoption.

The field experiment took place at a global company that provides customized IT solutions — a business that’s prone to “churn,” wherein customers fail to renew their subscriptions, in part because they haven’t fully adopted their purchased products.

The researchers added a team member trained in customer engagement — what they call a “customer-oriented boundary spanner” — to around half of the 144 teams they followed over a six-month period. These team members actively gathered customer feedback through an interactive assessment, and then they brought customer concerns to meetings to make sure their needs were represented in team discussions.

The assessment covered 10 core areas (e.g., how helpful solutions are, how the client gets service and support, etc.) from level 1 — not a significant factor — to level 6 — having a strategic relationship based on trust.

Teams were also measured for their professional diversity, allowing the researchers to see whether a mix of perspectives can make the boundary spanner role even more effective.

“You need to get into this ongoing mode of operation of how you work with the customer, whether it’s a weekly or monthly customer business review. It’s about developing an ongoing dialogue.”

Customer Liaisons Boost Adoption and Drive Investment

The study found that teams with a dedicated liaison who championed the customer’s perspective worked more effectively and delivered solutions that customers were more likely to adopt — especially when the teams brought together people from different professional backgrounds.

At the IT company where the experiment took place, customer usage rose by 12% after the role was introduced (from 44% to 56%), while teams without a customer liaison saw a slight decline in product adoption (-1%, down from 45% to 44%). In response to these data, the company invested more than $50 million in the approach and hired over 200 boundary spanners worldwide.

Like a compass guiding a group of travelers, the liaison kept diverse experts oriented toward the same destination: solving the customer’s problem. By breaking down silos and ensuring that varied expertise was integrated into practical solutions, the compass role made it far more likely that customers would fully adopt the product.

“We saw much better customer adoption of team outcomes with those that had that role in place versus those that didn’t,” van Knippenberg says. “And background diversity of team roles then worked as an accelerator. It’s this interaction of diversity combined with boundary spanning that’s the real catalyst.”

It’s Alignment, Not Just Adoption

The study offers practical takeaways for companies across industries looking to increase product adoption. To begin with, businesses should structure teams to stay connected to the customer from the start.

Firms can create a designated role within their customer engagement teams to advocate for the customer’s perspective. And to accelerate adoption, managers can work to make their customer engagement teams more functionally diverse.

Critical, however, adds van Knippenberg, is for teams to weave this customer focus into the very core of how they operate. A compass doesn’t just get checked once at the start of a journey — it’s a constant point of reference. In the same way, customer liaisons ensure the team keeps recalibrating to the customer’s needs over time.

“You need to get into this ongoing mode of operation of how you work with the customer, whether it’s a weekly or monthly customer business review. It’s about developing an ongoing dialogue.”

Not all teams are customer-facing, the researchers acknowledge. However, the study’s implications extend far beyond teams that primarily interact with customers.

Their findings suggest any force that can better align teams around a shared goal can help them put their collective knowledge to work, leading to stronger outcomes.

When companies embed the voice of the customer into the heart of teams, they’re far more likely to create solutions that customers will adopt.

Written by Deborah Lynn Blumberg

Wagner, van Knippenberg, and D’Innocenzo (2025). “Customer-Oriented Boundary Spanning, Functional Diversity, and Customer Adoption,” Journal of Organizational Behavior.

Ph.D. Area Advisor - Organizational Behavior

Never Miss A Story

You May Also Like

Keep Exploring

5 Reasons These Full-Time MBAs Chose Rice

From our career outcomes and alumni network to Houston hub and curriculum, here are five reasons our Full-Time MBA students chose Rice Business.

Choosing where to pursue your MBA is a big decision. It’s where you’ll invest your time, energy and potential for two years — and begin your next career journey.

For MBA students at Rice, that decision often comes down to more than rankings or reputation. It’s about finding a place that feels like home, challenges you to grow and connects you to opportunity.

Here are five reasons Full-Time MBA students in the Class of 2027 chose Rice Business.

Strong Career Outcomes

Rice MBAs land top roles in investment banking, consulting and beyond, thanks to personalized career support and strong partnerships with employers and alumni. And whether our students are looking to go further in their current function or pivot into a new role, Rice Business delivers.

“I knew I wanted to transition into investment banking and stay in Houston,” says Michael Miller. “Rice Business stood out, given its strong track record of placing students in the IB industry.” For Ivan Tapia, the school’s proximity and recruiting reputation made Rice a top choice. “I intend to stay in the energy industry,” he says. “Rice is a target school for big energy firms, which was a key factor in deciding which business school to attend.”

Tight-Knit Community

At Rice Business, a strong community isn’t just a perk. It’s at the heart of everything we do.

“Rice Business stood out because of its tight-knit community,” says Michael Stallworth. “I wanted a program where I wouldn’t just be another student in the crowd but part of a collaborative environment where relationships matter.”

“When I was deciding where to attend business school, the biggest factor for me was culture. I wanted to be in a place where collaboration, support and strong relationships were at the center of the experience, not just competition,” says Lotanna Ohazuruike.

Interested in Rice Business?

Big City, Big Impact

As the energy capital and a growing hub for healthcare, tech and innovation, Houston offers endless ways to apply what you learn in the MBA — and make an impact the second you begin classes at Rice.

“Houston is the energy capital of the world, which means studying sustainability at Rice puts me at the epicenter of the industry that's defining our collective future,” says Kathryn Caudell.

“Rice Business is such a prestigious university in the South with an incredible network of down-to-earth leaders and innovators,” says Taylor Smith. “There’s nothing like Southern hospitality!”

Dedicated Alumni Network

From your first semester, you’ll feel the strength of the Rice Business network. Our alumni are supportive and deeply connected across industries — not just in Texas, but around the world.

“Rice also has a fantastic alumni network, especially in Houston, that is eager to recruit and mentor students,” says Leighton Douglass.

Miles Moscariello also expresses appreciation for alumni mentorship: “The program’s strong network and resources allow me to connect with people who share my passion for building, managing and investing in real estate.”

Specialized Curriculum

With access to expert faculty, hands-on learning, rigorous courses and more than 100 electives, each diploma is uniquely tailored to the Rice MBA student who earned it.

“Rice Business creates a collaborative classroom environment,” says Caudell, “where professors know their students personally and peers drive meaningful academic discussions.”

For students like Douglass, the Full-Time MBA program stood out for its many specialization areas and elective offerings. “With a background in architecture, I wanted a curriculum that allowed me to explore real estate courses, which Rice has a degree specialization in,” she says.

“Plus, Rice Business is home to the No. 1 Graduate Entrepreneurship Program in the nation!” says Smith.

For Full-Time MBAs in the Class of 2027, choosing Rice meant choosing more than just a business school — it’s joining a supportive community, learning from the best and making immediate impacts.

Featured Students