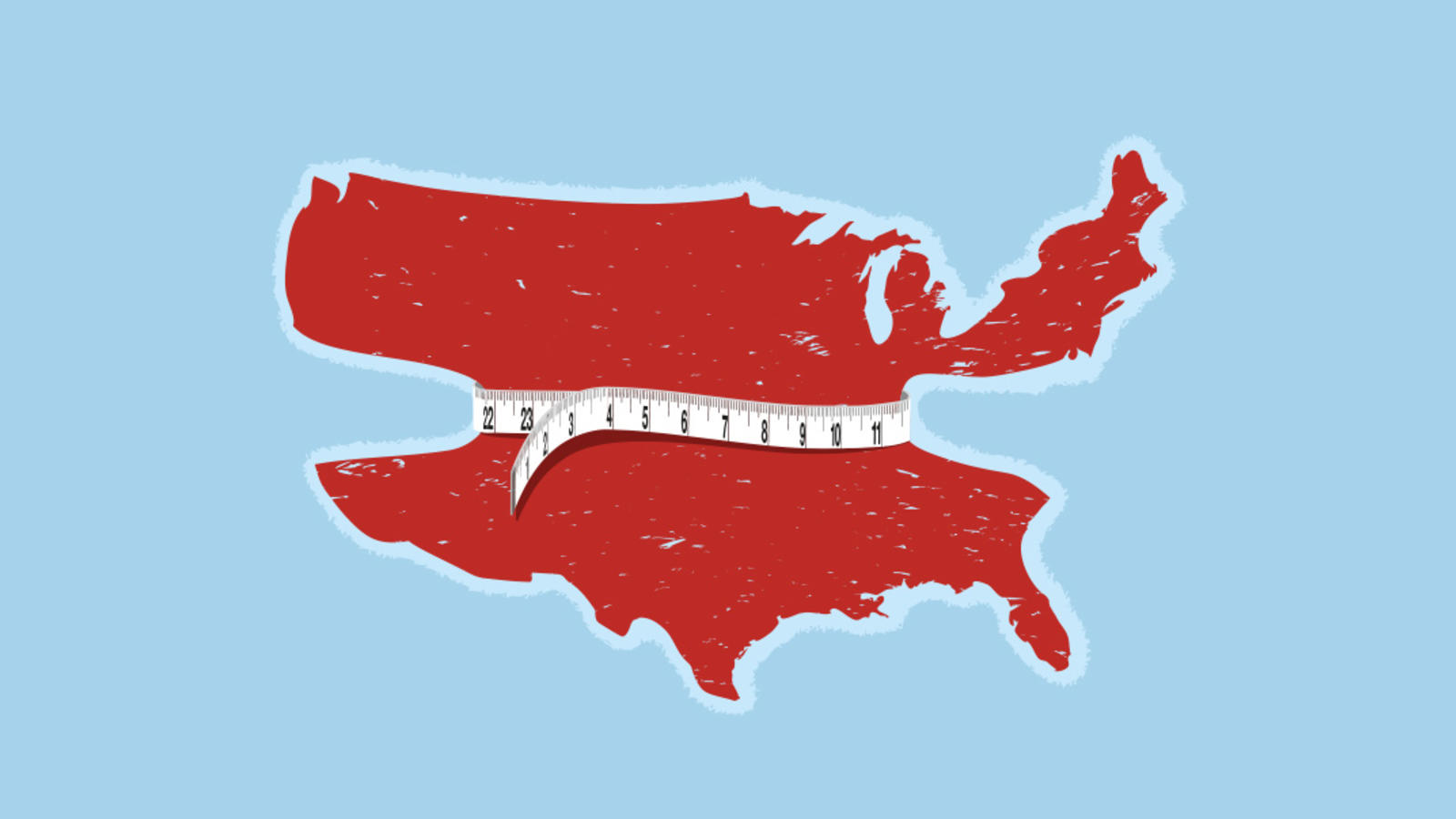

Thick And Thin

The Profit Potential Of Shrinking Markets Is Rooted In How Firms Respond To Competitor Actions In The Marketplace

Based on research by Amit Pazgal, David Soberman and Raphael Thomadsen

The Profit Potential Of Shrinking Markets Is Rooted In How Firms Respond To Competitor Actions In The Marketplace

- Shrinking markets don’t necessarily mean shrinking profits, and growing markets don’t necessarily mean growing profits.

- Game theory and competitive analysis indicate that if market shrinkage is gradual and predictable, managers can boost profits by raising prices for committed customers.

- So, managers would be better off focusing on retaining committed customers who sit at the core of market demand.

In large measure, executives are judged by whether they make strategic decisions that, over time, increase profit. Imagine this: Your next promotion depends on how accurately you assess the attractiveness of different market opportunities. Would you rather compete in a growing market or a shrinking market? What if you were sure that no rivals would enter or exit, regardless of the market that you select? Are you certain which market would better fatten the coffers of your firm?

If you think that a growing market is always the safer bet, then think again. In certain conditions managers could be better off in a shrinking market – where consumers are exiting – than in a growing one according to findings presented in a study done by Amit Pazgal, Rice Business marketing professor, and co-authors David Soberman, professor of marketing at Rotman School of Management, and Raphael Thomadsenunder, professor of marketing at Olin Business School. What’s the rub?

On the one hand, the advantage of shrinking markets is rooted in understanding the behavioral responses of different segments of consumers. In essence, when customers withdraw from the market because they are dissatisfied with competitive offerings, they are often part of the segment of consumers least committed to the category in the first place. In contrast, the segment of consumers who remain in the market because they see value in the offerings is one willing to accept sufficiently higher prices that can compensate for volume-related losses firms would suffer due to the market shrinkage.

On the other hand, the profit potential of shrinking markets is rooted in understanding how firms respond to competitor actions in the marketplace. Pazgal and his co-authors use game theory and competitive analysis to develop three analytical models that demonstrate how profits can grow when markets shrink gradually and predictably. They develop three key assumptions to help clarify the matter.

First, they assume that two price-competitive firms offer differentiated products such that there is at least some degree of price elasticity of demand for each product. Second, they assume that individuals fall into one of three categories: (1) core consumers (i.e. those devoted to the product category and willing to accept higher prices); (2) edge consumers (i.e. those less committed to the category and more likely to exit the market); and (3) non-buyers (i.e. those who choose not to buy from either firm in the market). Third, consistent with how marketplaces actually evolve, they assume that each firm is located closer to core consumers than to edge consumers.

Regardless of whether edge consumers or even some core consumers leave the market, each model reveals sufficient conditions for profits to increase in shrinking markets. For example, in one model firms are presumed to compete on price in order to attract edge consumers to the market and to attract some core consumers away from the competition. However, after edge consumers leave the market, both firms are expected to raise prices for remaining core consumers and yield greater profits. What drives competitors to respond with industry-wide price hikes in the midst of market shrinkage?

As prices rise, each firm loses fewer consumers because edge customers have already jumped ship and the remaining core consumers are on deck and willing to accept the price hike because they perceive value in the offerings. In other words, the benefit of higher prices for devoted, core consumers outweighs the loss associated with serving fewer customers overall. As the market shrinks over time, price hikes have an increasingly negative effect on profits. In the bigger scheme of things, the growing absence of edge consumers in a shrinking market reduces competitive tension that would otherwise motivate firms to undercut each other’s prices. Under these conditions, instead of downward price pressure, the shrinking market actually encourages industry-wide, non-collusive price increases that generate greater profit for all competitors.

This market shrink-profit growth spiral has been observed in industries where health concerns, coupled with the addictive properties of products, allow for a predictable but gradual decline. Take manufacturers of cigarettes and sugary, carbonated beverages, for example. While the sale of cigarettes declined gradually and predictably starting around 1982, the profits of cigarette manufacturers grew significantly through 1990. Also, while consumption of carbonated beverages declined 16 percent between 1998 and 2011, beverage companies increased profits by raising prices on consumers who remained devoted to the category.

Pazgal and his co-authors also show that in markets that grow gradually, late-entering consumers are less committed to the category. So a downward price spiral may ensue as firms compete for their wallets. In the end, prices plummet (think HDTVs) and gains from growth in demand are reduced.

While there is a limit to the number of customers who can leave (or enter) a market while firms continue to enhance (or shrink) profits, findings from the research are clear: Sometimes competing in a shrinking market can pay off, and growing markets are not always the best indicator of future profits.

So when your customers leave, think twice before you chase them with price incentives. Declining markets are not always unattractive: New competitors are unlikely to enter and remaining, committed consumers are willing to accept higher prices. When certain customers go away, profits can go up.

Amit Pagzal is the Friedkin Chair in Management and Professor of Marketing and Operations Management at the Jones Graduate Business School at Rice University.

To learn more, please see: Pazgal, A., Soberman, D., & Thomadsen, R. (2013). Profit-increasing consumer exit. Marketing Science, 32(6), 998-1008.

Never Miss A Story