When Are Venture Capitalists Likely To Replace a CEO?

When a VC firm can’t watch a startup closely it’s more likely to change unseasoned leadership.

Based on research by Yan "Anthea" Zhang and Salim Chahine

Chaotic as it might seem to swap horses midstream, replacing a CEO for one with more experience and education correlates to a better valuation of the public offering, the researchers found.

Key findings:

- Venture capitalists have a huge stake in ensuring the firms they fund are run efficiently.

- Venture capitalists also tend to have more IPO experience than your average entrepreneur.

- Venture capitalists who can closely monitor a startup may tolerate CEOs with less experience.

- But when a VC firm can’t watch a startup closely it’s more likely to change unseasoned leadership.

Consider the 21st century’s most storied CEOs: Steve Jobs, Bill Gates, Jeff Bezos. All have one thing in common – not only did they run their companies, they founded them.

Each of these corporate leaders, in other words, had to deal with venture capital firms to find critical resources for their firm’s success. And it didn’t always end well. Jobs was famously fired when Apple’s board replaced him with the former CEO of a soft drink company – a disaster from which Apple took years to recover.

Even if changing CEOs doesn’t always work out, however, it often does. And when VCs invest heavily in a company, they are proactive in making their investment pay off. Uber founder Travis Kalanick, for example, who cofounded the ride-sharing app Uber, was pressured to step down in 2017 after the company was rocked by scandals that included reported sexual harassment.

Though Kalanick’s flameout drew global attention, being swapped out is actually commonplace for CEOs of startups, according to Rice Business Professor Yan “Anthea” Zhang. In a new study coauthored with Salim Chahine of the American University of Beirut, Zhang examined data on 1,156 venture-capital-backed U.S. initial public offerings between 1995 and 2013. Out of this sample, they found that 472 firms, or 40.8 percent, changed CEOs between the first round of venture capital financing and the IPO.

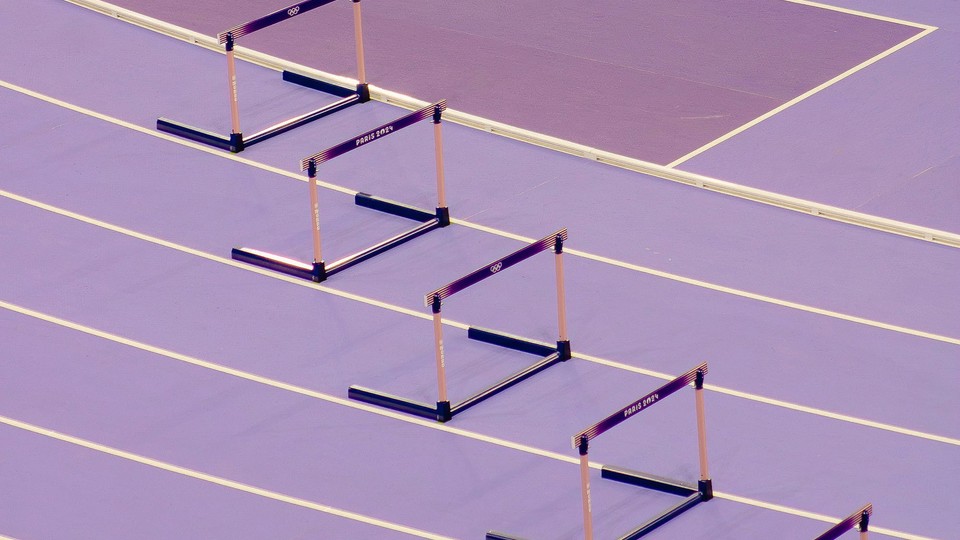

Venture capitalists often have strong reasons for swapping a CEO out, Zhang notes. Guiding a company from its startup phase to the initial public offering requires a huge learning curve. Attention must be paid to human resources, efficiency, public relations – hurdles that can stymie even the most successful startup leaders. Just as in public companies, CEO deficiencies in these areas can harm a company’s IPO success and its stock value after the IPO.

A range of other factors, some subtle, lie behind VC decisions to change startup leadership, the researchers found. Distance between the startup and the venture capital firm’s headquarters is one such factor. If a New York VC firm funds a company in Nevada, monitoring the day-to-day work of the startup is more difficult and costly than if the venture capital firm is based in California.

A CEO directly appointed by a venture capitalist is more likely to be seen as the venture capital firm’s agent, allowing the VC firm to directly control the startup, the researchers write. Overall, VC firms unable to closely monitor the startups they funded were more likely to look for new leadership.

The CEO’s past experience, described by the researchers as “human capital,” is also pivotal. A CEO who has successfully led a prior IPO is much less likely to be replaced than one who hasn’t been through the experience, Zhang’s team found. Similarly, a CEO with finance/accounting experience, an MBA, or a graduate level degree is likely to be seen as more credible than one who lacks such experience or degree.

Chaotic as it might seem to swap horses midstream, replacing a CEO for one with more experience and education correlates to a better valuation of the public offering, the researchers found.

These findings are particularly timely now, in the era of COVID-19. As businesses turn to Zoom and other remote techniques, VCs may be questioning more than ever how well they can monitor their investments without frequent site visits and in-person meetings. Building a company has always been a heavy lift. When your funder can only measure your work through a screen, surviving as a startup CEO may be tougher than ever.

Chahine, S. & Zhang, Y. A. (2020). "Change gears before speeding up: The roles of Chief Executive Officer human capital and venture capitalist monitoring in Chief Executive Officer change before initial public offering," Strategic Management Journal. 41(9): 1653-1681.

Never Miss A Story