News & Events

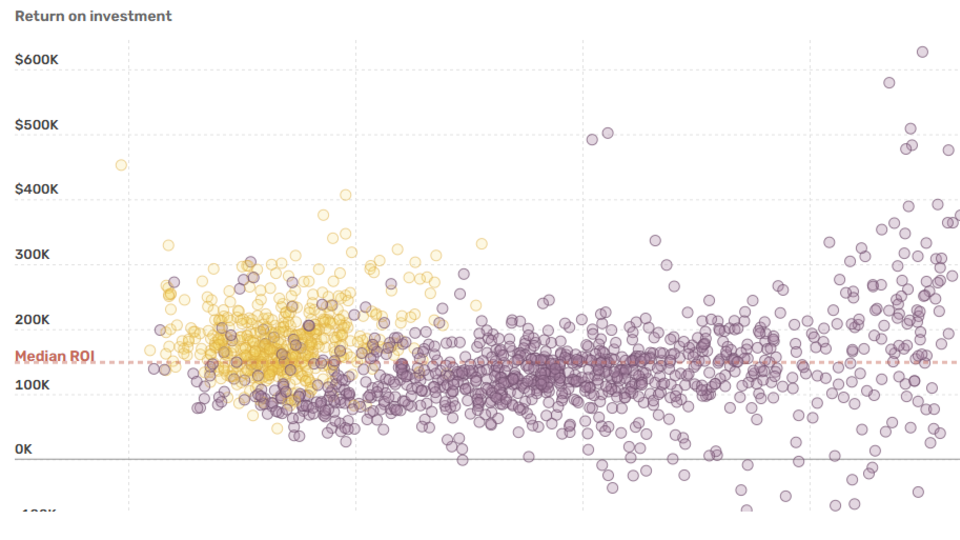

Rice University ranks first in Texas for 10-year return on investment, with alumni seeing roughly $334,000 in gains. Its strong earnings outcomes keep Rice at the top of both short and long-term ROI comparisons statewide.

-

In The Media

Rice Business professor Mijeong Kwon finds that viewing passion for work as a moral virtue can harm employees and teams, leading to guilt, burnout and biased treatment of colleagues who are seen as less passionate.

26 Nov -

In The Media

Rice Business professor Mijeong Kwon argues that moralizing a love of work can undermine workplace well-being. Her research shows that treating intrinsic motivation as a virtue fuels guilt, burnout and biased judgments that disrupt team dynamics.

25 Nov

Filter

Recruiting Leader Steve Summers talks about the Professional MBA program at Rice Business, addressing everything from applying knowledge in global field experiences and capstones to time management and changing career paths.

Over two-thirds of all mergers fail, with the failures blamed on post-merger issues such as execution gaps, lack of cultural alignment and integration problems. Closer scrutiny of failed mergers and acquisitions in the oil and gas industry paints a different story. It appears CEOs and board members often create the conditions for failure by ignoring the most critical stakeholder, the customer, and instead focusing on cost cutting and efficiency as the primary source of shareholder value.

Robert Kaplan, president and CEO of the Federal Reserve Bank of Dallas, and Peter Rodriguez, dean of Rice University’s Jones Graduate School of Business, will conduct an hourlong conversation about the Texas economy, the energy industry and other timely economic issues.

Major oil companies are seriously looking into low-carbon energy sources, said energy management professor Bill Arnold at Rice University. And it’s no longer just for PR reasons like in the past. “Developing wind power, electric vehicle recharging stations,” Arnold said. “But I think what they try to do is to say where do we actually have known skillsets right now and how can we apply them that’s compatible with this new interest.”

The stock market has a measurable influence on how people who own shares vote — potentially a big one — according to a new study by finance experts at Rice University and the University of Pittsburgh.

Utpal Dholakia, the chair of marketing at Rice University who specializes in pricing strategies, noted that analyzing tweets about crypto to invest in crypto could contribute to a cycle, making it easy for traders to drive up prices.“Crypto are niche markets, they are made up of a specialized group of investors and participants,” he said.

In a new study from Rice University, researchers found the outcome of presidential elections at the county level from 1992 to 2016 were directly influenced by stock market performance. The researchers unearthed this gem of a stat: a one-percentage-point higher dividend income ratio is associated with an increase in incumbent vote share by 2.4 percentage points.

New academic research finds that the market has a measurable influence on how people who own shares vote -- potentially a big one. The study, which compared electoral preferences with levels of dividend income, suggests that had stocks rallied instead of plunging in 2008, John McCain may have won key states like Florida and Ohio.

A Texas-wide initiative will bring 150 school district and campus leaders to Rice’s Jones Graduate School of Business for one weekend every month between now and March to advance the administrators’ and educators’ leadership skills.

A new study shows that two key factors can make freshly appointed CEOs more vulnerable and raise the odds they’ll get fired. The job security of a new CEO tends to suffer when the stock market reacts badly or when the previous CEO stays on as board chair, according to the study by Rice University and Peking University management experts. But the study found that the new CEO can overcome these challenges with what researchers call “social influence behaviors.”